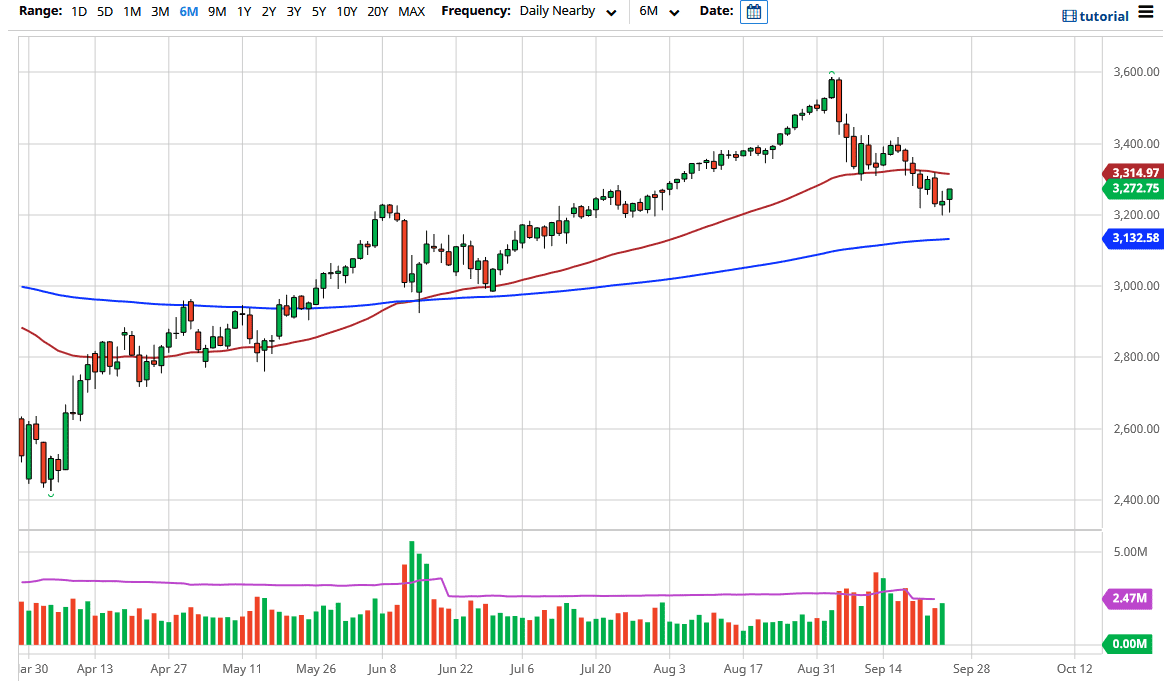

The S&P 500 initially fell rather hard during the trading session on Friday but has turned around at the 3200 level. That is a level that of course is very crucial as it is a large, round, psychologically significant figure and of course the 200 day EMA sits just below there. The shape of the candlestick is also very bullish, so that is worth paying attention to.

While I do not necessarily think that the market is suddenly going to take off to the upside, it certainly looks as if we are trying to find our footing. Furthermore, the VIX has calmed down quite a bit and that of course is a major advantage to the buyers as well. If the US dollar can calm down, that might be yet another reason for this market to rally. That being said, it is the US dollar that still looks like it could be a bit strong. At the very least, I believe that we may get a bit of a bounce in the short term. To the upside, I believe that the 50 day EMA is going to cause some resistance, just as the 3400 level well. I think we will see a lot of choppy behavior and therefore you need to be cautious about your position size.

A breakdown below the 3200 level could send this market down to the 200 day EMA, which is at the 3132 handle. Breaking down below that level opens up the possibility of a move towards the 3100 level, possibly even the 3000 level. All of that of course would be very bearish and could show quite a bit of negativity. The market is going to continue to be volatile and of course sensitive to headline risk, not the least of which would be the fact that we are getting close to the presidential election, which of course is relatively tight at the moment, and could have major implications as to what happens with the economy.

I do believe that the candlestick does suggest that we may have a day or two of positivity coming, so if you are a short-term trader that might be what you are looking for. However, longer-term traders are probably looking for a little bit more of a substantial solidifying candle, and therefore a bit of patience may be needed.