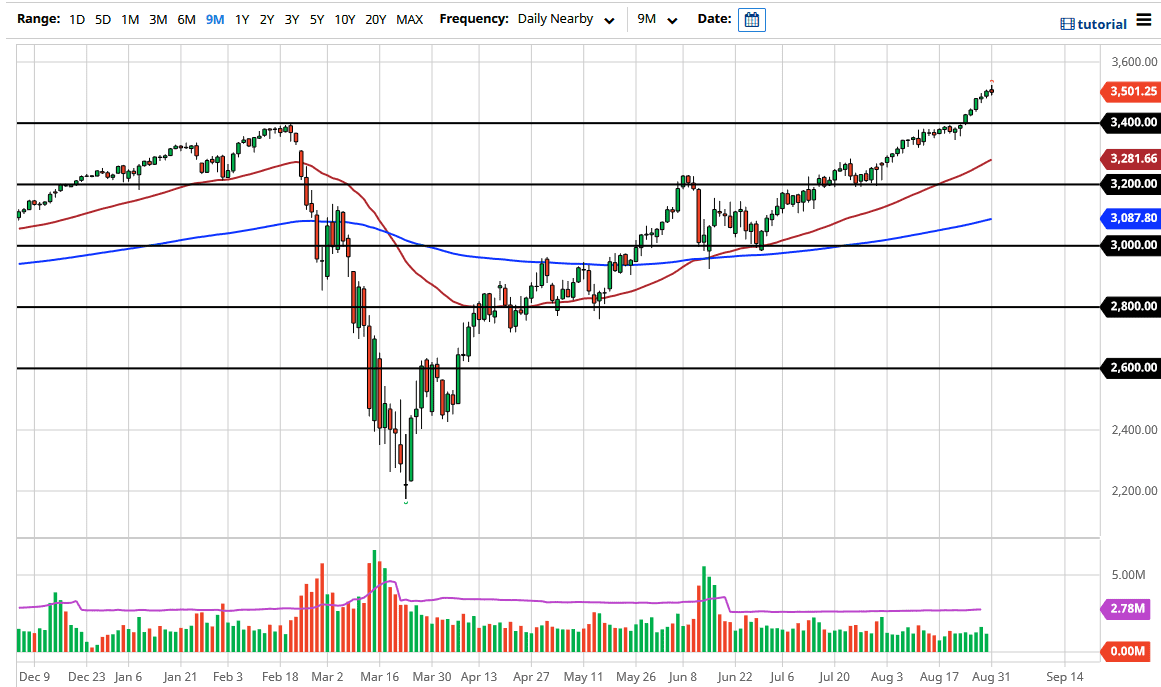

The S&P 500 has rallied a bit during the trading session on Monday but has given back a bit of the gains in order to form a less than enthusiastic candlestick. What is interesting is that we are at the 3500 level, an area that a lot of pundits have been looking at as a potential target. Ultimately, the fact that it is a large, round, psychologically significant figure will attract a lot of attention as well, so I think a pullback makes quite a bit of sense. This pullback could be in preparation for the jobs number coming on Friday, but I have no interest in shorting this market due to the fact that it has been so bullish for so long. The breaking above 3400 once a major push higher for this market, but ultimately it can only go so far in a certain amount of time.

I believe that there is a massive amount of support just underneath the 3400 level, so I would be very interested in buying down there. This is not to say that we are definitely going to reach down towards that area, just that it is a potential target. There are a lot of things out there that are moving the markets around, not the least of which is the fact that there was a reshuffling of the Down Jones 30, and a stock split from a couple of the world’s largest followed stocks. Ultimately, this will cause a bit of volatility, and people trying to close out positions ahead of the figures coming out on Friday will do the same.

Looking at this chart, the 50 day EMA is currently approaching the 3300 level, so it is not until we break down below there that I would be concerned. I think we may have a pullback or two ahead of us in the next few days, waiting for the jobs figure when we can continue to perhaps go higher. After all, the Federal Reserve is lifting this market as obviously it has become one of their major mandates. Ultimately, if we break above the top of the candlestick for the trading session on Monday, then it opens up an impulsive move towards the 3600 level above, which if you look at the chart you can clearly see that the S&P 500 tends to move in 200 point increments.