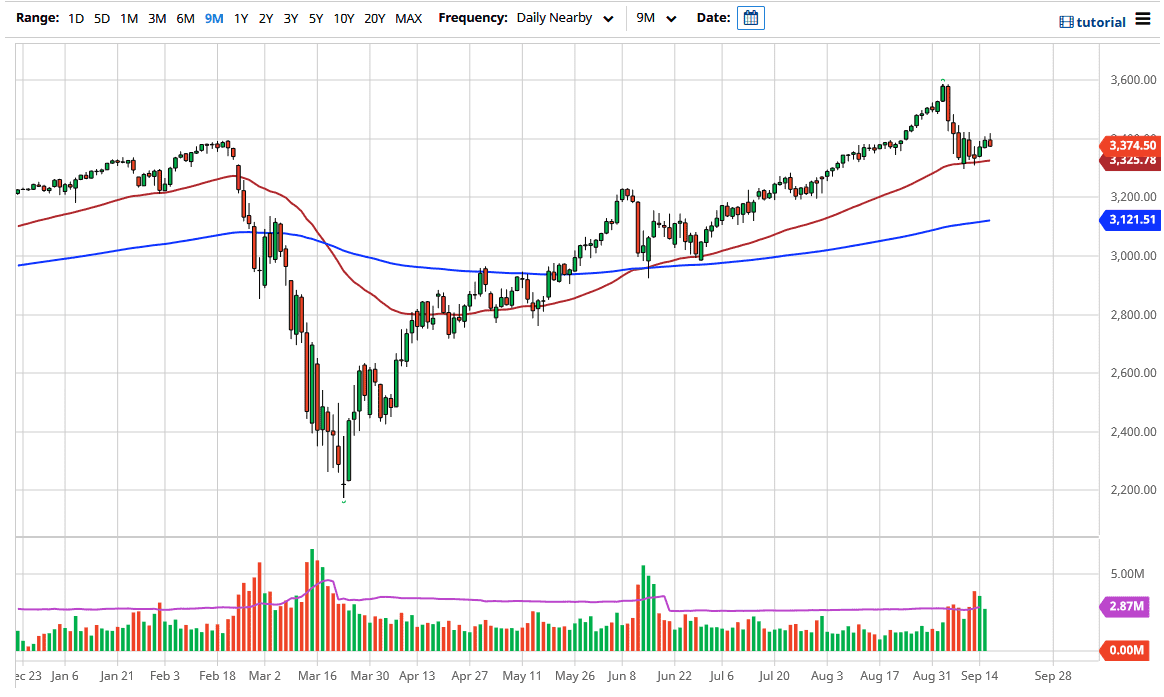

The S&P 500 has rallied a bit during the trading session on Wednesday but gave up the gains just above the 3400 level. The market obviously has a lot of resistance just above the 3400 level, specifically right around the 3420 level. If you been reading my analysis, you know that I have said that we need to see a daily close above the 3420 level to get bullish. At this point, it does not look like the market is ready to go higher, and you can see that the candlestick for the trading session ended up forming a bit of a shooting star. Ultimately, if we break above the top of the shooting star, it would be a very bullish sign.

To the downside, the 50 day EMA sits at the 3325 handle, and there will be a certain amount of support near the 3300 level. It appears that the market has not reacted very positively to the Jerome Powell question and answer part of the day. Ultimately, the markets look like they are trying to build some type of base, and quite obviously we are not ready to go higher. However, if we break down below the 3300 level, it is likely that we go down towards the 3200 level which is much more structurally important as it was an area that offered significant resistance in the past, as well as support.

The stock markets are a bit frothy, but if the US dollar continues to strengthen, then it is likely that the market will continue to see a lot of selling pressure. At this point, it is all about the greenback, and it should be noted that the Federal Reserve did not seem to settle nerves for Wall Street. Wall Street has learned to focus solely on cheap money, so at this point, it is not a huge surprise to see that this market fell apart. That being said, we should see plenty of support underneath, so I think we just go back and forth over the next couple of days. However, breaking below the 3300 level will clearly rattle quite a few traders out there. To the upside, a break above the 3420 level opens up the possibility of going right back to the highs.