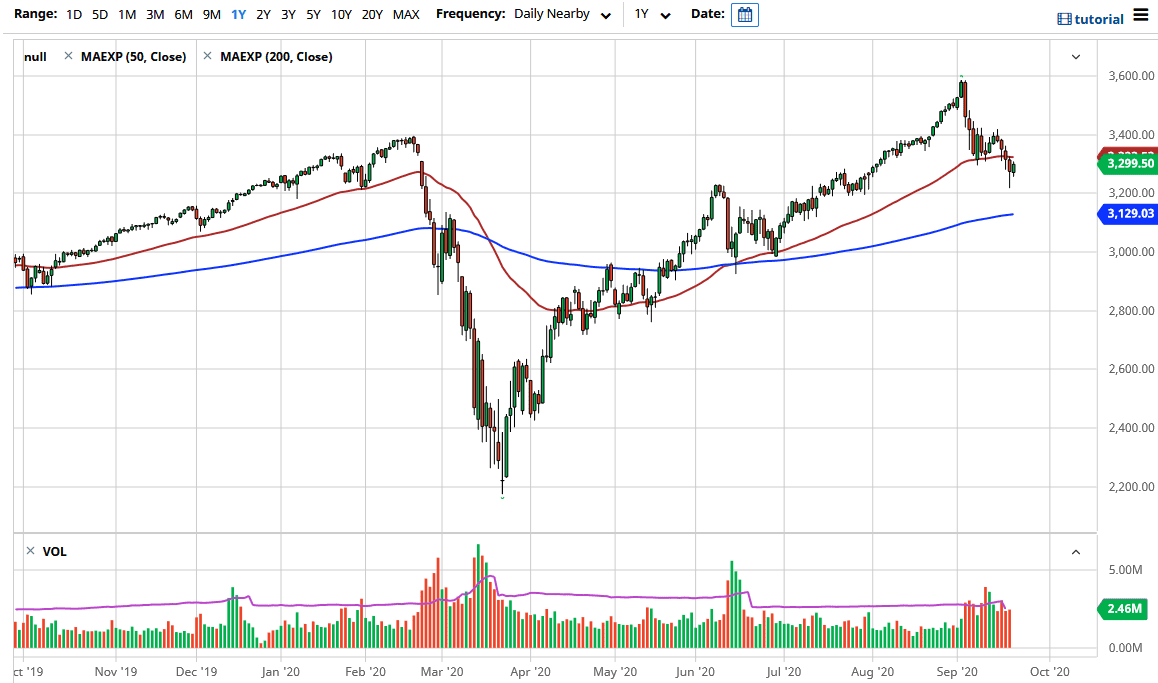

The S&P 500 has pulled back a bit during the trading session on Tuesday but then turned around to show a certain amount of resiliency. After the Jerome Powell speech in front of Congress, it has seemed to take away from that situation that the “Powell put” is still in effect. The 3200 level underneath continues to be an area that a lot of people that will be paying attention to, due to the fact that it was previous support. The candlestick from the Monday session was a hammer so that does give us an idea that perhaps there are plenty of buyers underneath.

If we break above the 50 day EMA, then it is likely that the market could go towards the 3400 level. That is an area that is important based upon the fact that we have broken down from there. If we were to clear the 3400 level, then it is likely that we go much higher. That would be a complete recapturing of the major breakdown, and that has people taking a look at going back towards the highs. Keep in mind that if the Federal Reserve is out there looking to flood the market with liquidity, it should continue to help this overall outlook.

If we were to break down below the 3200 level, then the market is likely to go looking towards the 200 day EMA which is currently at the 3129 handle. That is massive support from a technical analysis standpoint, so if we were to break down through there, it is likely that we would go down towards the 3000 handle. That is a large, round, psychologically significant figure that a lot of people have been paying attention to since the last leg higher, and therefore one would have to think that there is a lot of liquidity down there looking to get into the market. One thing I think you can count on is a lot of choppy volatility, and there are a lot of concerns out there as to whether or not stimulus is coming from the U.S. Congress, which has been hampered due to the fact that we now have an argument over appointing a Supreme Court justice, further exacerbating the friction between the Republicans and the Democrats. At this point, volatility is going to pick up, not drop.