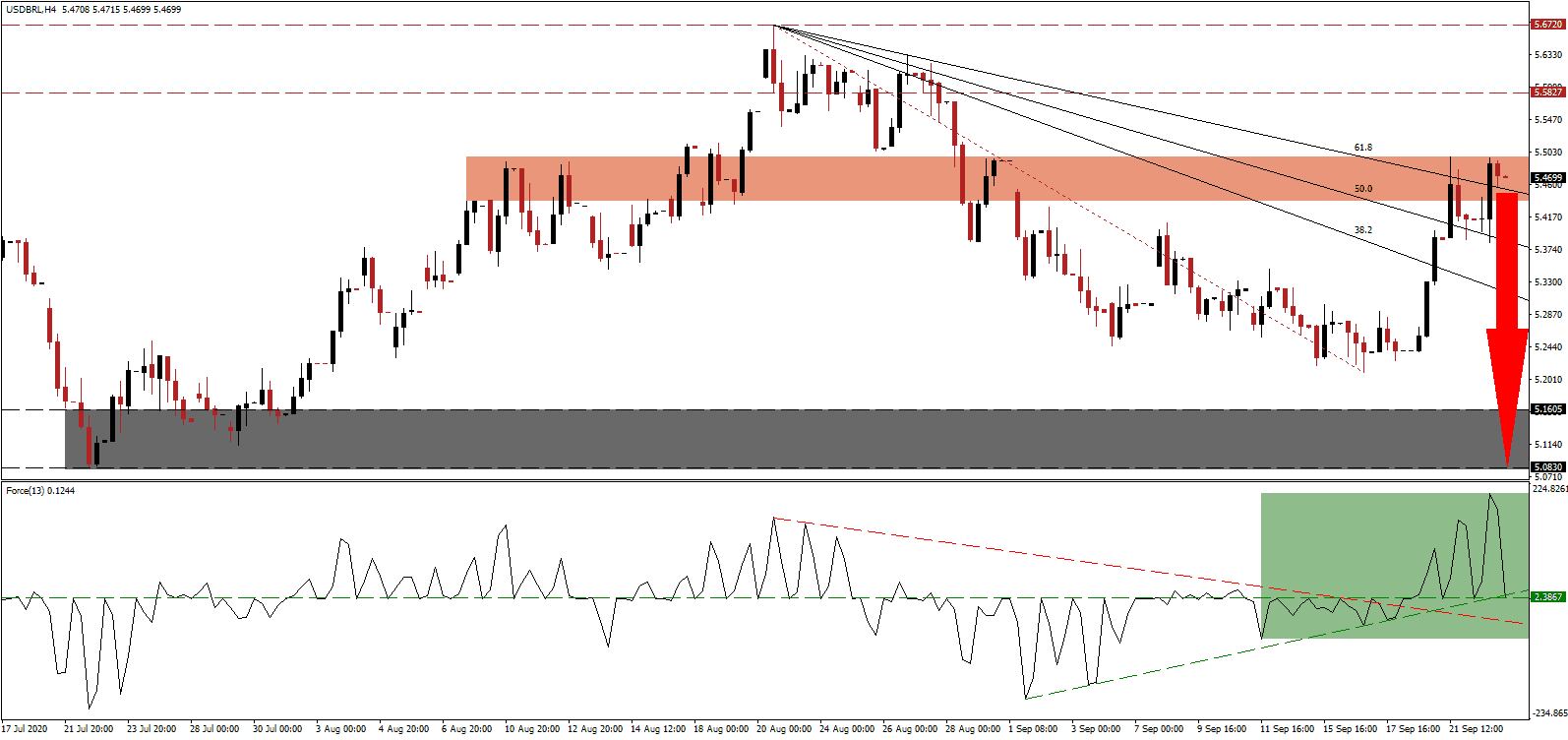

Brazil continues to report an increased number of new Covid-19 infections, while the number is forecast to rise. São Paulo eased lockdown restrictions healthcare experts labeled ill-timed. While a secondary wave of infections emerged globally, many developing countries struggle to contain the first one. The seasonal influenza season is forecast to pressure healthcare systems further, adding to an uncertain economic outlook with a bearish bias. The USD/BRL faced a counter-trend short-covering rally but has now reached its resistance zone from where bullish momentum collapsed.

The Force Index, a next-generation technical indicator, conformed the short-term advance and accelerated to a new multi-week peak before collapsing. It now challenges its horizontal support level, as marked by the green rectangle. Adding to bearish pressures is the move below its ascending support level, favored to extend the reversal through its descending resistance level. This technical indicator is on track to cross below the 0 center-line, tilting control over the USD/BRL to bears.

President Jair Bolsonaro used his pre-recorded speech to a remote session opening the UN General Assembly to attack the media over politicizing the Covid-19 pandemic and causing social chaos. He also blamed indigenous people for the wildfires burning in the Amazon and the Pantanal, the world’s largest rainforest and largest wetland. Pressures are mounting to address the environmental disasters, vital for a sustained recovery for Brazil. After the USD/BRL reached its short-term resistance zone located between 5.4379 and 5.4974, as identified by the red rectangle, bullish momentum swiftly collapsed.

Per an assessment by the World Resources Institute, a green economy could add millions of jobs and R$2.8 trillion to the GDP of Brazil. The Covid-19 pandemic and associated government spending may provide the platform for a recalibration of existing policies. Another development to monitor is the worsening relationship between President Bolsonaro and Paulo Guedes, the Minister of the Economy. A breakdown in the USD/BRL below its descending 61.8 Fibonacci Retracement Fan Resistance Level will position it for an accelerated sell-off into its support zone located between 5.0803 and 5.1605, as marked by the grey rectangle.

USD/BRL Technical Trading Set-Up - Breakdown Scenario

Short Entry @ 5.4700

Take Profit @ 5.0800

Stop Loss @ 5.5600

Downside Potential: 3,900 pips

Upside Risk: 800pips

Risk/Reward Ratio: 4.88

In case the Force Index reclaims its ascending support level, serving as resistance, the USD/BRL may attempt another breakout. Forex traders should sell any advance from present levels amid a worsening outlook for the US Dollar, with the Federal Reserve pledging zero-bound interest rates, as debt continues to decrease economic potential. The upside potential remains reduced to its resistance zone between 5.5827 and 5.6720.

USD/BRL Technical Trading Set-Up - Reduced Breakout Scenario

Long Entry @ 5.5900

Take Profit @ 5.6400

Stop Loss @ 5.5600

Upside Potential: 500 pips

Downside Risk: 300 pips

Risk/Reward Ratio: 1.67