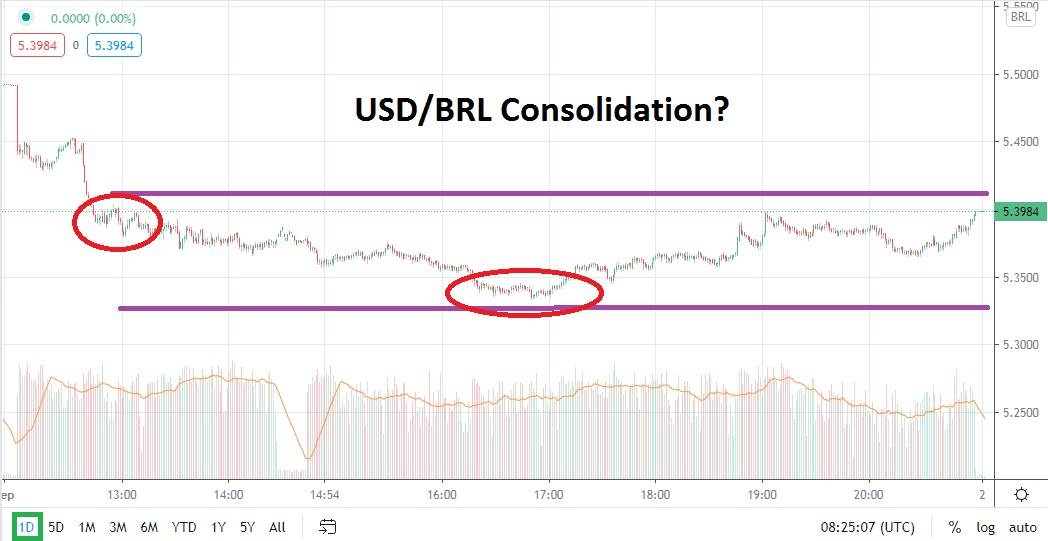

The USD/BRL has produced a bearish trend the past week of trading and yesterday’s rather consolidated trading without any sudden reversals higher may indicate the forex pair has more ammunition to fire regarding potential volatility. After hitting a low value of 5.3330 approximately yesterday, the USD/BRL has risen to its current price vicinity near 5.3900 as of this morning.

Short term resistance for the USD/BRL is 5.4300, which is definitely close to the immediate trading range of the forex pair. However, trading conditions have actually been quite stable and if the USD/BRL is able to maintain its current junctures, this may give speculators the impetus to believe its bearish trend will renew in the near term. The perception being that the USD/BRL may continue to build on its recent bearish momentum.

Global risk appetite has not subsided, US equity indices continue to barrel ahead higher. The Ibovespa of Brazil put in positive gains yesterday also, and today’s early calls from US equity futures suggest another day of optimism may be seen. The reason this should be of interest to USD/BRL speculators is because the Brazilian Real has seen plenty of choppy trading the past three months due to concerns regarding coronavirus and its impact on the nation’s domestic economy. It price range has been wide.

Certainly worries remain for Brazil and its projected financial outlook is challenging. However, the Brazilian government has also continued to fight to keep businesses open in many sectors which may lessen the long term economic hardships which shadow the country, although it also opens the door to criticism regarding its guardianship of its citizens’ health. Speculators who are looking at technical charts will see that the support level of 5.3400 is interesting and if this juncture is broken downwards it could translate into a more dynamic bearish run towards the lower values traded in late July and early August.

The consolidated range of the USD/BRL needs to be watched by speculators. Limit orders seeking to sell the forex pair near the 5.3300 level should be considered. If the forex pair can build downward momentum and break current support levels, traders who believe risk appetite globally will remain optimistic may also believe the USD/BRL can produce a stronger selling surge.

Brazilian Real Short Term Outlook:

Current Resistance: 5.4300

Current Support: 5.3400

High Target: 5.4600

Low Target: 5.2200