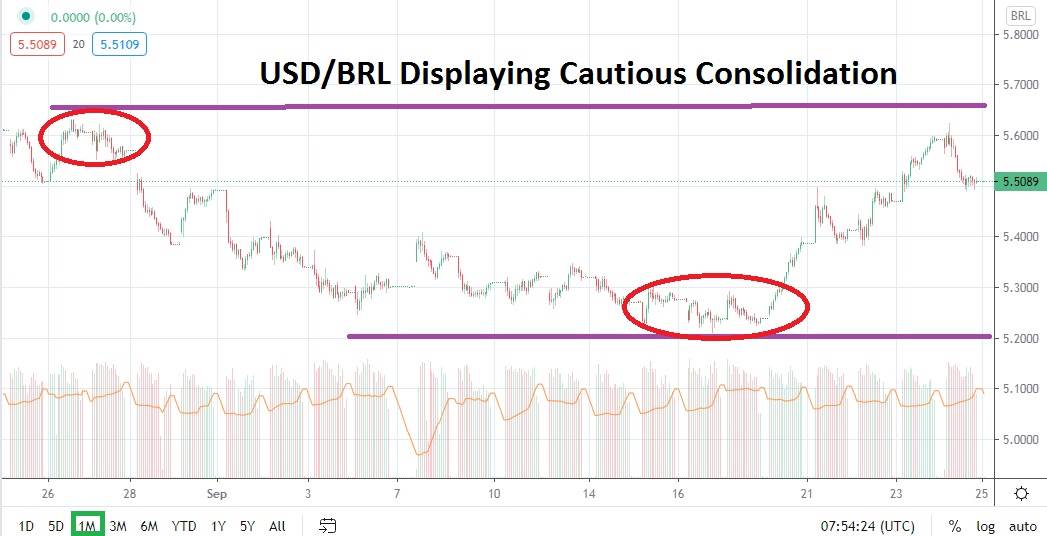

The USD/BRL has proven a consolidated forex pair the past three months. With a low of nearly 5.0900 in late July and a high of 5.6700 in late August the USD/BRL has delivered a fairly consistent range for speculators to test. Short term technical traders may find their results have been hard fought because of the ability of the forex pair to change direction abruptly, but if limit orders are used and trends are followed carefully the USD/BRL does offer traders the ability to pursue mid-term value momentum and solid opportunities.

The consolidated range of the USD/BRL has been rather strong and while daily value changes may look big on the surface, the forex pair has actually produced a comfortable range. What should intrigue speculators heading into October is the notion that the USD/BRL is trading within the upper regions of its range and has seen a rather strong bullish run higher develop the past week and a half. However, it should be noted that the 5.6000 resistance level has proven capable again and has produced a reversal lower.

The question speculators should consider is what are the capabilities of the 5.5000 value to sustain its strength? If trading continues to see the 5.5000 juncture work like a magnate, some speculators may believe the USD/BRL has the capability to traverse higher and potentially trade above the 5.6000 level. However, the 5.7000 level has not been traded since May of this year when coronavirus implications regarding the Brazilian economy reached a hyperbole of media frenzy.

If global risk sentiment struggles and pain is felt on US equity indices it is conceivable the USD/BRL could challenge the upper reaches of its resistance junctures. But if optimism continues to make itself known and a steady dose of positive or mixed trading remains abundant it is more likely the USD/BRL will continue to see a test of the rather consolidated range it has traversed the past three months.

Speculators may want to wait for a couple of positive days of trading within global equity indices to sell the USD/BRL, but the current value of the forex pair does look like it is technically high and may demonstrate a reversal lower. Traders within the USD/BRL should practice patience and use limit orders when trading to take advantage of momentum which frequently develops within the pair. Selling the USD/BRL within a price range of 5.5200 to 5.6000 and using a conservative stop loss will allow speculators to look for downside action.

If support levels come into target, traders may want to swiftly alter their trading perspectives and look for upside momentum. The price range of the USD/BRL has been rather consistent and until proven otherwise speculators may have the ability to take advantage of support and resistance signposts which have dominated the forex pair’s trading landscape the past three months.

If a breakout suddenly emerges within the USD/BRL in October it will likely be because of a sudden change in risk appetite globally which has effected global risk appetite. However, if current trading conditions remain as they are going into the month, the rather tight consolidated range of the USD/BRL will likely remain an efficient avenue to pursue trends.

Brazilian Real Outlook for October:

Speculative price range for USD/BRL is 5.1000 to 5.7000

Support at 5.3000 appears important but if broken lower could test the 5.2000 to 5.1000 levels.

Resistance at 5.6000 seems adequate, but if proven vulnerable the 5.7000 mark could be tested.