Brazil continues to report a high daily new Covid-19 infection count, but the spending spree by President Jair Bolsonaro to support the poor and focus on economic activity, rather than lockdowns to prevent the pandemic from spreading, has scored him political points. His approval rating, presently at 37%, are the highest since he took office. His small Aliança pelo Brasil (ALIANÇA) party teamed up with a dominant bloc of center-right parties, refereed to as centrão, which allows him to pass reforms and block impeachment notions, currently numbering 49. It adds to a growing bullish outlook for the economy, and the USD/BRL is well-positioned to extend its correction with a breakdown below its resistance zone.

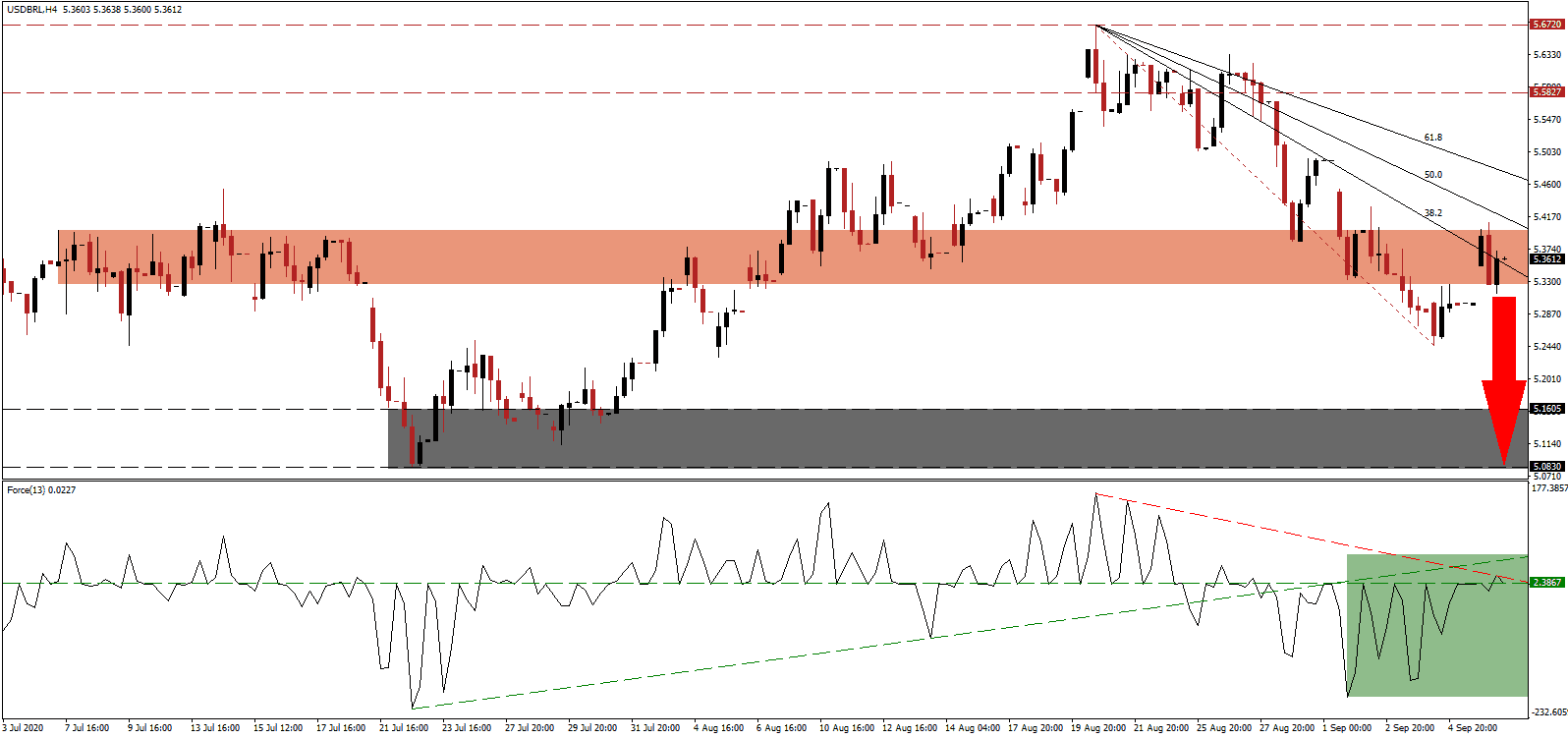

The Force Index, a next-generation technical indicator, recovered from a recent multi-month low but now faces rejection by its descending resistance level. It remains below its ascending support level and is in the process of converting its horizontal support level into resistance, as marked by the green rectangle. Bears wait for this technical indicator to cross below the 0 center-line to regain complete control over the USD/BRL.

With his popularity and approval across Brazil on the rise, the relationship between President Bolsonaro and Paulo Guedes, the Minister of the Economy, maintains a challenging dynamic. Guedes opposes the massive spending but is favored by markets due to his nature as a reformer. The two appear to have reached a compromise. One example is the reduction in the monthly payment to poor Brazilians from R$600 to R$300 until the end of December. The USD/BRL reversed a breakdown below its short-term resistance zone located between 5.3269 and 5.3982, as marked by the red rectangle while selling pressure remains elevated, favored to extend the correction.

Another bullish catalyst emerged from the role reversal between Brazil and Mexico. Right-wing Brazilian President Bolsonaro promised to reign in debt and reform the economy, while left-wing Mexican President López Obrador campaigned to tackle poverty through state-funded spending programs. During the Covid-19 pandemic, the former unleashed massive spending plans, while the latter reigned in expenses. The descending Fibonacci Retracement Fan sequence is likely to pressure the USD/BRL into its support zone located between 5.0830 and 5.1605, as identified by the grey rectangle.

USD/BRL Technical Trading Set-Up - Breakdown Scenario

- Short Entry @ 5.3600

- Take Profit @ 5.0900

- Stop Loss @ 5.4400

- Downside Potential: 2,700 pips

- Upside Risk: 800 pips

- Risk/Reward Ratio: 3.38

A breakout in the Force Index above its ascending support level may inspire the USD/BRL to follow suit. The upside potential remains confined to its long-term resistance zone located between 5.5827 and 5.6720, amid exhaustion in the post-lockdown recovery in the US. Adding to the bearish outlook are conditions for a double-dip recession and the weak US Dollar policy outlined by the US Federal Reserve.

USD/BRL Technical Trading Set-Up - Confined Breakout Scenario

- Long Entry @ 5.5200

- Take Profit @ 5.6300

- Stop Loss @ 5.4400

- Upside Potential: 1,100 pips

- Downside Risk: 800 pips

- Risk/Reward Ratio: 1.38