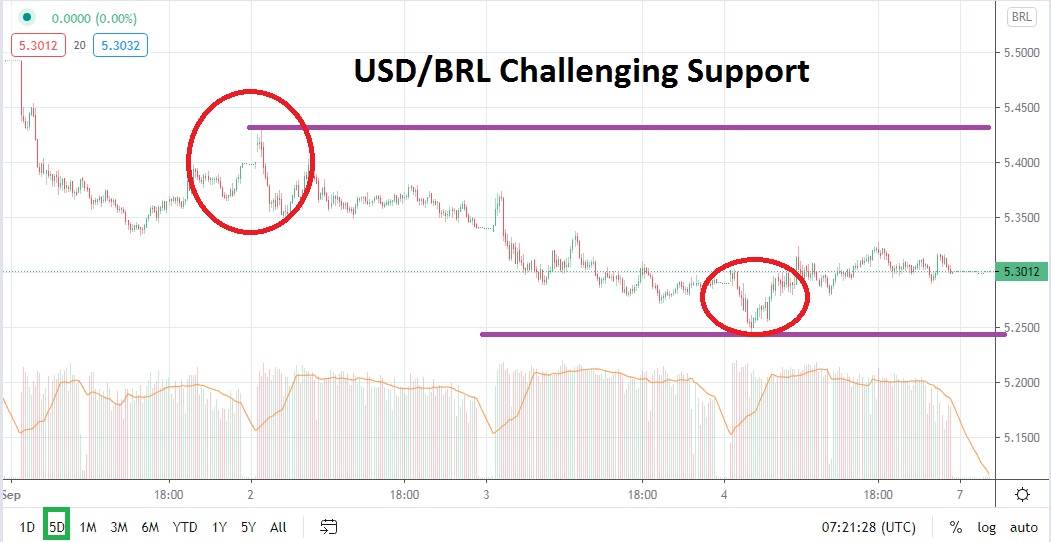

While the Brazilian Real continues to maintain a relatively stable price range and display rather narrow support and resistance levels, a bearish trend has also been maintained. The USD/BRL has demonstrated a price band of 5.2500 to 5.4300 fairly consistently the past week, but the past few days have seen consistent tests of support near the 5.2700 ratio too.

The USD/BRL will get plenty of attention because of its rather turbulent technical trading the past few months, but what should capture the imagination of speculators is the forex pair’s rather consistent value band. Resistance has certainly been tested during the mid-term, but it has also produced solid reversals downwards regularly.

Current resistance short term appears adequate near the 5.4000 juncture. Interestingly, the 5.5000 level above when tested has sparked several bearish reversals when it has been approached mid-term. Yes, on the 20th of August the USD/BRL did hit a high of 5.6720 but this peak resistance then produced the bearish trend the USD/BRL is still maintaining.

Global risk appetite remains a large factor within the Brazilian Real. Economic concerns about coronavirus certainly cast a shadow over Brazil, but its rather pro-business government attitude has also given investors and financial institutions reasons to suspect Brazil’s economy may be able to recover from the implication of coronavirus faster than many of its counterparts.

Whiles Brazil’s coronavirus policy has certainly had many critics, Brazil also remains a place in which international commerce is a necessity for countries that export products from the nation. The combination of criticism regarding coronavirus policy and the nation’s importance in global business has helped create rather choppy technical trading for the USD/BRL the past six months. Short term support for the USD/BRL is nearby at the 5.2700 level and critically the 5.2400 level appears to be an important inflection juncture mid-term.

If the USD/BRL can break the 5.2400 level lower it could produce a test of late July values. Speculators should watch the current price vicinity of the USD/BLR carefully because it will likely not stay consolidated. There is a reason to suspect a breakout may occur relatively soon. Risk appetite will play a critical factor in the trading of the Brazilian Real. Speculators who want to sell the USD/BRL may want to use limit orders and enter their short positions slightly above current price action.

Selling the USD/BRL within a range of 5.3200 to 5.3500 may allow traders to use tight stop losses above while targeting bearish momentum.

Brazilian Real Short Term Outlook:

Current Resistance: 5.4000

Current Support: 5.2700

High Target: 5.5000

Low Target: 5.2400