Resistance levels in the USD/BRL have experienced increased pressure and higher values for the forex pair appear to be attainable. Vulnerable resistance has been demonstrated the past week as support levels do appear to be rising incrementally. Speculators who have been chasing bearish moves because they believe the USD/BRL needed to step in line with other forex pairs have been treated rudely the past ten days as the buying has increased.

Importantly, the USD/BRL is now testing August high watermarks and if these resistance levels falter it could set off fireworks as the forex pair then begins to test highs not seen since May. Brazil is suffering from perception problems that may not subside quickly, its political environment remains supercharged with accusations of corruption, and unfortunately, coronavirus continues to make nasty statistical headlines. This combination is not going to help investor sentiment short term.

Brazil however remains an important economic engine in South America and the world as a trading partner. Its importance will remain strong long term and speculators must acknowledge that while the USD/BRL has been put to the test regarding resistance levels the past week and a half of trading, that there is the potential for reversals of sentiment and bearish moves to occur.

The actual price range of the USD/BRL has been rather comfortable when taking into consideration volatility which has been experienced within other emerging market currencies. The recent bullish momentum for the USD/BRL must be taken seriously, and it may in fact continue to test higher resistance levels until equilibrium is restored. However, trading of the USD/BRL is also affected by global risk sentiment and the recent fatigue experienced in equity indices has not helped the Brazilian Real either.

As the USD/BRL tests short term resistance, speculators need to ask how much room is left for bullish momentum to be sustained. Standing in front of an existing trend can be dangerous and costly, so speculators who believe the USD/BRL will eventually show an ability to reignite a bearish trend should be patient. In the meantime, speculators may want to buy the USD/BRL using limit orders and see if higher resistance levels are targeted. Support levels below may prove to be worthwhile stop-loss ratios as short term bullish momentum is chased.

Brazilian Real Short Term Outlook:

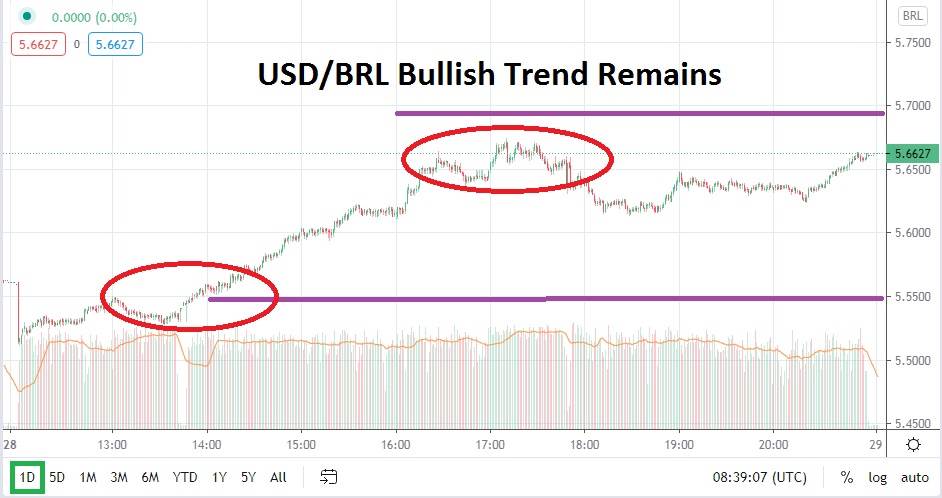

Current Resistance: 5.6900

Current Support: 5.6100

High Target: 5.7500

Low Target: 5.5200