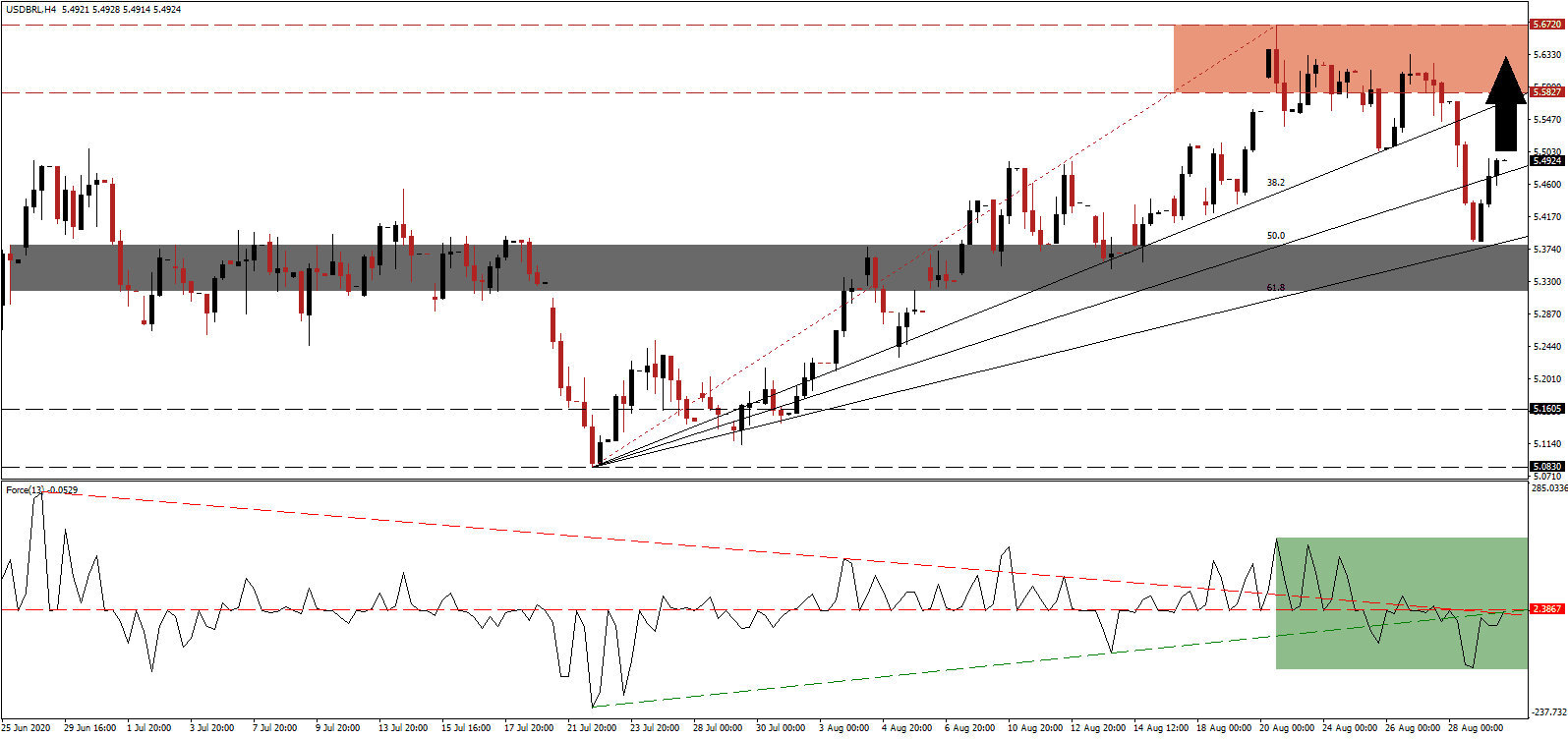

Brazil remains under the ongoing stress of the Covid-19 pandemic and will likely cross the 4,000,000 infection level this week. While early indicators suggested the economy bottomed out and a recovery is in its initial phase, the risk of a secondary wave of infection remains elevated. The Treasury Department increased the debt ceiling for 2020 from between R$4.5 trillion and R$4.75 trillion to between R$4.6 trillion and R$4.9 trillion, to reflect emergency spending related to the pandemic. The USD/BRL entered a counter-trend advance on the news and reclaimed its ascending 50.0 Fibonacci Retracement Fan Support Level.

The Force Index, a next-generation technical indicator, confirms the temporary rise in bullish pressures by eclipsing its descending resistance level. It is now pressuring its ascending support level, serving as resistance, as marked by the green rectangle, from where a conversion of its horizontal resistance level into support is favored. Once this technical indicator crosses above the 0 center-line, bulls will be in control of the USD/BRL.

Concerns over debt maturing over the next twelve months, which is expected to account for nearly 30% of total outstanding debt, add to short-term bearish pressures on the Brazilian Real. Jose Franco, the Sub-Secretary for Public Debt at the Treasury, confirmed liquidity is sufficient, but investors shy away from longer-term maturities. The Banco Central do Brasil received official approval for the transfer of R$325 billion to the Treasury. The short-term support zone located between 5.3192 and 5.3791, as marked by the grey rectangle, assisted the USD/BRL in its present reversal.

Government data revealed the July budget deficit was significantly lower than forecast, clocking in at R$86.9 billion versus the R$109.9 expected. The total federal debt decreased by 1.0% in July, and domestic one by 0.8%, but the debt-to-GDP ratio rose to 60.2%. By comparison, the US debt-to-GDP ratio crossed above 100.0% and is positioned to exceed 120.0%. The USD/BRL possesses upside momentum to extend its advance into its resistance zone located between 5.5827 and 5.6720, as identified by the red rectangle, from where a breakout is unlikely, due to excessive long-term bearishness in the US Dollar.

USD/BRL Technical Trading Set-Up - Confined Breakout Extension Scenario

Long Entry @ 5.4925

Take Profit @ 5.6325

Stop Loss @ 5.4325

Upside Potential: 1,400 pips

Downside Risk: 600 pips

Risk/Reward Ratio: 2.33

Rejection in the Force Index by its ascending support level will invalidate an extension in the counter-trend advance in the USD/BRL. It will allow the established bearish chart pattern to resume, potentially clearing the path for an accelerated correction into its long-term support zone between 5.0830 and 5.1605. The outlook for the Brazilian economy remains bullish, amid a pending surge in domestic manufacturing, coupled with export demand from China.

USD/BRL Technical Trading Set-Up - Breakdown Scenario

Short Entry @ 5.3500

Take Profit @ 5.0900

Stop Loss @ 5.4325

Downside Potential: 2,600 pips

Upside Risk: 825 pips

Risk/Reward Ratio: 3.15