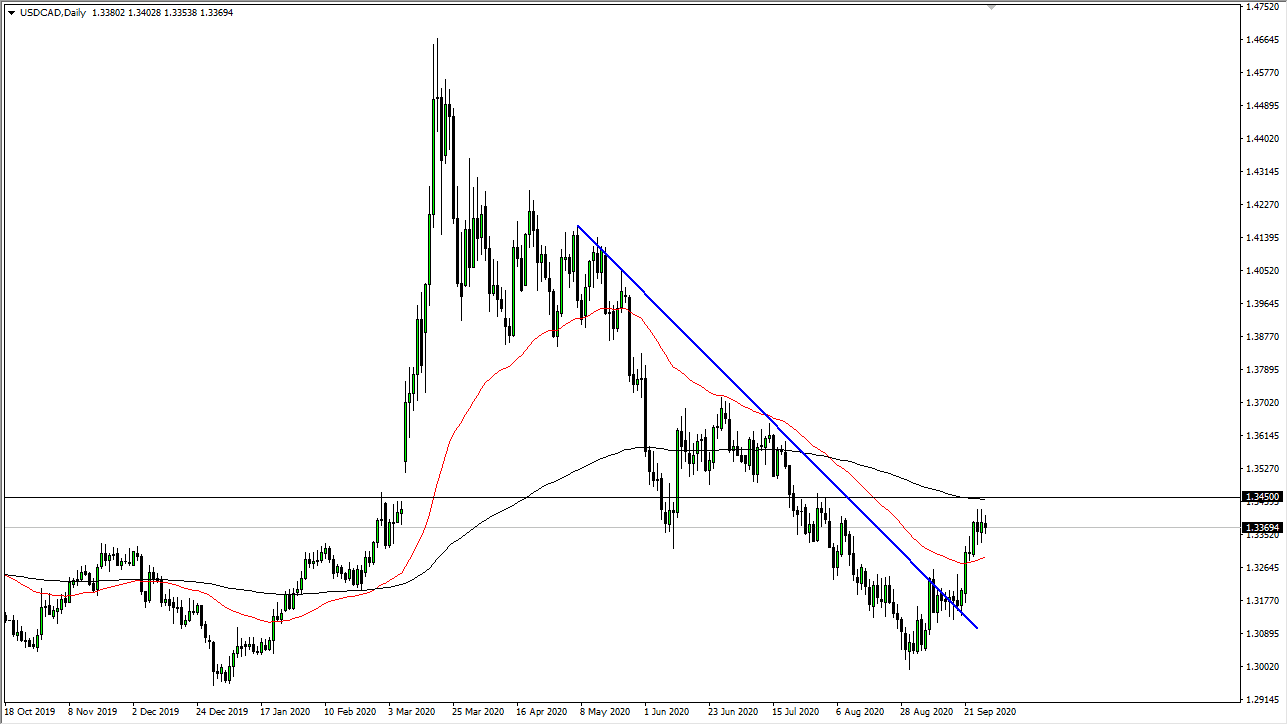

The US dollar has gone back and forth against the Canadian dollar for the last several sessions, as we are reaching towards a significant level in the form of 1.3450 just above. This was where we had seen a major gap form in the past, and now that we have flown through that gap in the opposite direction, it will still have a little bit of memory built into it, but it may not be as stringent of resistance as it should have been supported.

The crude oil markets are essentially doing nothing, but at the same time the US dollar continues to gain against the Canadian dollar, at least overall. This is a very interesting situation, because the Canadian dollar typically is used as a proxy for the crude oil market, and if the greenback can continue to rally against the Loonie, it is very likely that a little bit of disruption in the crude oil market might be all it takes to send this market much higher. Beyond that, coronavirus numbers in Ontario are starting to climb again, which of course is Canada’s most populous province. There are even rumblings of the Ontario government shutting things back down.

Beyond all of that, the Canadian housing market is still something that is a festering sore just waiting to cause issues, so we could see a little bit of flight out of Canadian assets. Beyond that though, we also have to pay attention to the technical analysis, which is starting to at least try to turn the corner to the upside. After all, we had recently broken through a major downtrend line, and we are now above the 50 day EMA. It is worth noting that the 200 day EMA is sitting just at the 1.3450 level that I mentioned previously, so that could come into play also. Regardless, if we can break above that 200 day EMA I think it opens up a move towards the 1.3550 level and breaking that will almost certainly accelerate the upside. Keep in mind that the Canadian dollar is considered to be a commodity currency, so if there is a major concern around the world when it comes to risk appetite, the US dollar will almost certainly rally against it. Furthermore, demand for crude oil is certainly sluggish at best, so I think this continues to put upward pressure on this pair given enough time. Pullbacks towards the 50 day EMA will probably find people looking to get long.