New daily cases are on the rise globally, with warnings of a sharp increase in the weeks ahead, as the weather cools down, and the seasonal influenza virus adds another significant virus to the burdened healthcare system. Switzerland eased restrictions since June, but daily cases have steadily increased and could breach the 1,000 level in October. The USD/CHF rallied amid a combination of temporary US Dollar strength and Swiss National Bank (SNB) market manipulation, but its resistance zone rejected price action.

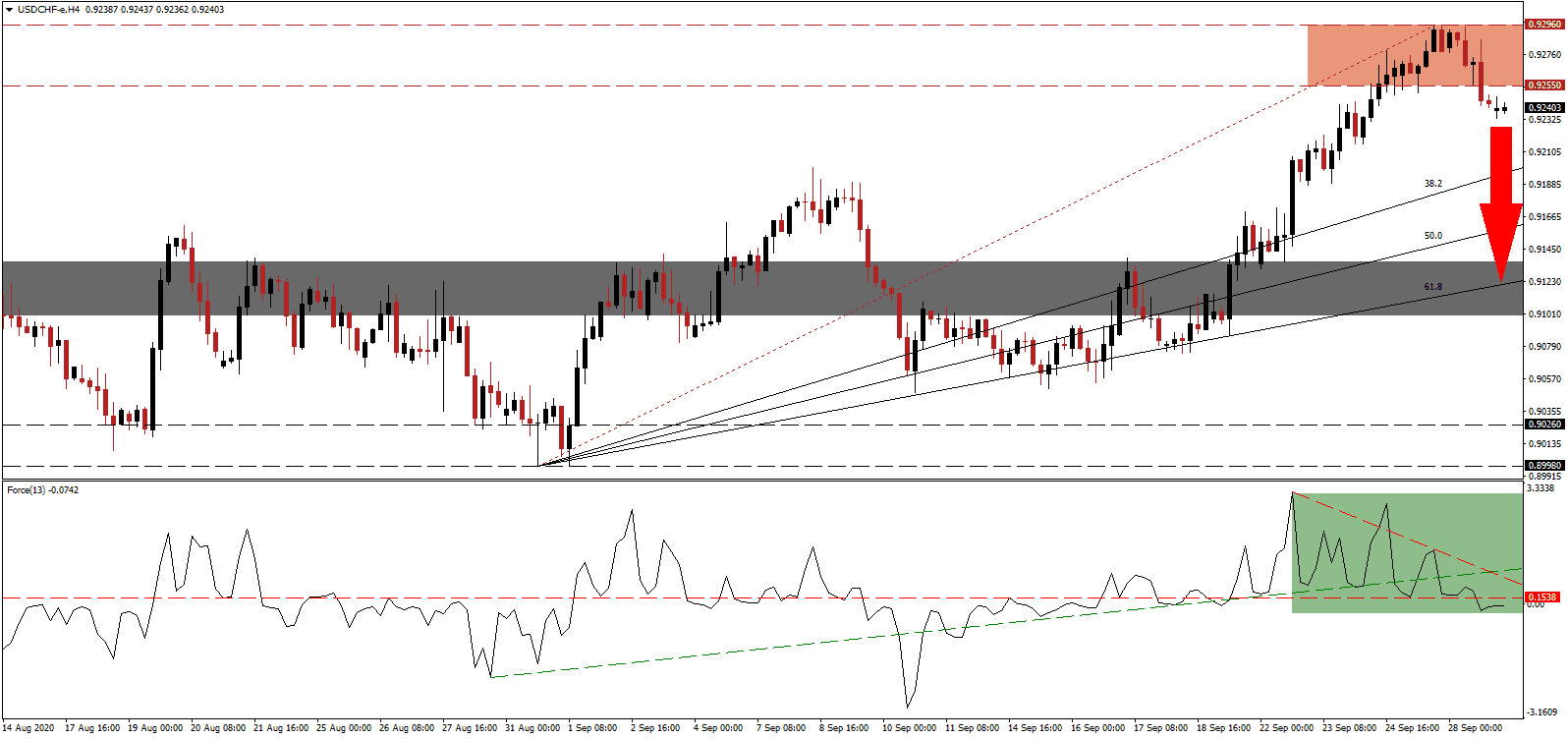

The Force Index, a next-generation technical indicator, offered an initial warning that the uptrend is vulnerable to a reversal amid a series of lower highs, as marked by the green rectangle, and a negative divergence formed. Following a collapse below its ascending support level, the Force Index corrected below its horizontal resistance level. The descending resistance level is favored to guide this technical indicator farther into negative territory with bears in control of the USD/CHF.

Swiss pharmaceutical giant Roche plans to release a Covid-19 test, which delivers results in 15 minutes. In the absence of a vaccine, Switzerland hopes it will allow efficient Covid-19 management. The test has a less than 0.5% chance to report a false positive, and 3.48% for a false negative. Swiss health authorities note that all tests will be confirmed via RT-PCR Technology (Polymerase Chain Reaction) tests and that the rapid tests will assist in targeted isolation rather than nationwide lockdowns to deal with the second wave of Covid-19 infections. After the USD/CHF completed a breakdown below its resistance zone located between 0.9255 and 0.9296, as marked by the red rectangle, more downside is likely.

Per the State Secretariat for Economic Affairs (SECO), the Swiss economy performed better than initially reported in the second quarter. GDP was revised up from a drop of 8.2% to 7.3%. SECO credited the industry mix for the upward revision, with chemical and pharmaceutical industries cushioning the contraction. The USD/CHF is positioned to correct into its short-term support zone located between 0.9100 and 0.9136, as identified by the grey rectangle, and presently enforced by its ascending 61.8 Fibonacci Retracement Fan Support Level.

USD/CHF Technical Trading Set-Up - Breakdown Extension Scenario

- Short Entry @ 0.9240

- Take Profit @ 0.9125

- Stop Loss @ 0.9270

- Downside Potential: 115 pips

- Upside Risk: 30 pips

- Risk/Reward Ratio: 3.83

Should the Force Index reclaim its ascending support level, serving as temporary resistance, the USD/CHF may attempt a second breakout. One significant factor to monitor is the US Dollar weakness and how it will impact the well-know market manipulation by the SNB, which will make monetary policy more expensive and could result in less short-term interventions. Any upside from present levels will grant Forex traders a secondary selling opportunity. The upside potential remains reduced to its intra-day low of 0.9375.

USD/CHF Technical Trading Set-Up - Reduced Breakout Scenario

- Long Entry @ 0.9310

- Take Profit @ 0.9370

- Stop Loss @ 0.9270

- Upside Potential: 60 pips

- Downside Risk: 40 pips

- Risk/Reward Ratio: 1.50