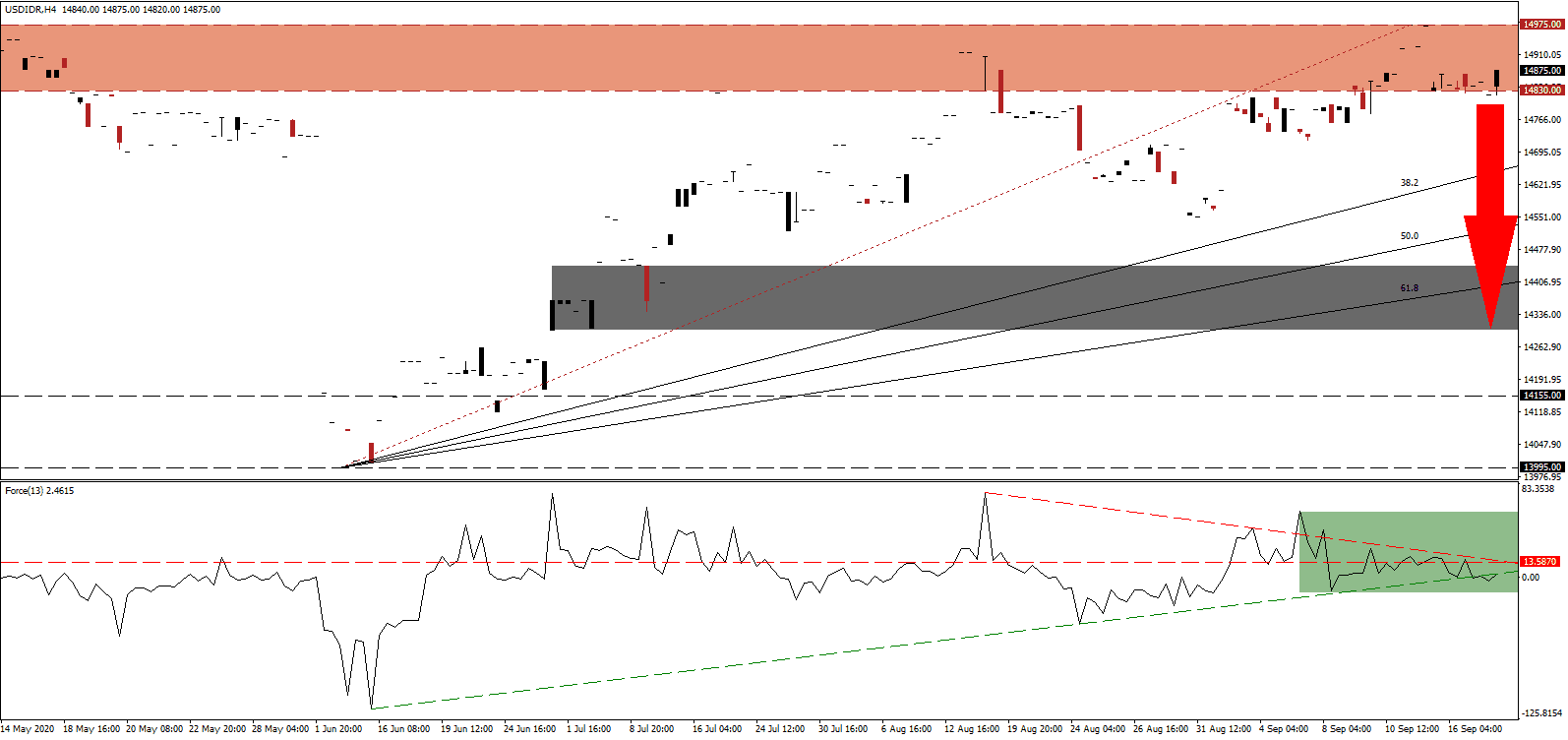

Indonesia returned to partial, localized lockdowns amid a surge in Covid-19 infections. While the country of nearly 275,000,000 fares comparably well against many others, with over 232,000 confirmed cases, it has the highest death toll in Southeast Asia above 9,200. The economy has taken a toll in this emerging market, and the Director of the Ministry of Health, Abdul Kadir, cautioned against renewed restrictions, fearing more health-related issues from the lack of income, particularly in the informal job sector and the poor, than the virus. The USD/IDR advanced into its resistance zone from were a profit-taking sell-off may merge.

The Force Index, a next-generation technical indicator, offered an initial warning that the advance is vulnerable to a reversal. It retreated from a peak while price action advanced, resulting in a negative divergence. After the descending resistance level initiated the conversion of its horizontal support level into resistance, as marked by the green rectangle, it pressured it below its ascending support level. Bears wait for this technical indicator to correct below the 0 center-line to regain complete control over the USD/IDR.

Herawati Sudoyo, a senior research fellow at the Eijkman Institute for Molecular Biology in Jakarta, cautioned that Indonesia had not recorded its peak. The economy also entered its first recession since the 1997 Asian financial crisis. A controversial bill aimed at labor market reforms to attract foreign investments remains a primary focus of the government of President Joko Widodo. The USD/IDR is well-positioned for a breakdown below its resistance zone located between 14,830 and 14,975, as identified by the red rectangle.

While the government unveiled a total stimulus of Rp695.2 trillion, Airlangga Hartarto, the Coordinating Minister for Economic Affairs, confirmed that only about one-third of the capital was deployed to date. Indonesia presently explores opportunities in Italy to unlock a new export market. A collapse in the USD/IDR below its ascending 38.2 Fibonacci Retracement Fan Support level will clear the path for an extended sell-off. Price action will challenge its short-term support zone located between 14,300 and 14,442, as marked by the grey rectangle. More downside cannot be excluded.

USD/IDR Technical Trading Set-Up - Profit-Taking Scenario

- Short Entry @ 14,875

- Take Profit @ 14,300

- Stop Loss @ 15,000

- Downside Potential: 575 pips

- Upside Risk: 125 pips

- Risk/Reward Ratio: 4.60

Should the Force Index push through its descending resistance level, the USD/IDR may attempt a breakout. Forex traders should consider any advance as a secondary selling opportunity, amid intensifying US Dollar weakness. Yesterday’s initial jobless claims were worse than forecast for a second week, with upward revisions to the previous one. The upside potential remains confined to its intra-day high of 15,220, the bottom range of a preceding price gap to the upside.

USD/IDR Technical Trading Set-Up - Confined Breakout Scenario

- Long Entry @ 15,080

- Take Profit @ 15,220

- Stop Loss @ 15,000

- Upside Potential: 140 pips

- Downside Risk: 80 pips

- Risk/Reward Ratio: 1.75