India continues to lead the world in new Covid-19 infections, slowly closing the gap to the US. It poses a troublesome combination of a health and economic crisis, and while Prime Minister Narendra Modi pushed Made in India, one burden to his economic revival remains an excessive tax code. Toyota represents the latest example, reluctant to invest in India, the fourth largest car market globally, where luxury taxes on some cars are as high as 50%. The Covid-19 pandemic may deliver much-needed reforms. After being rejected by its short-term resistance zone, the USD/INR is well-positioned to accelerate its correction.

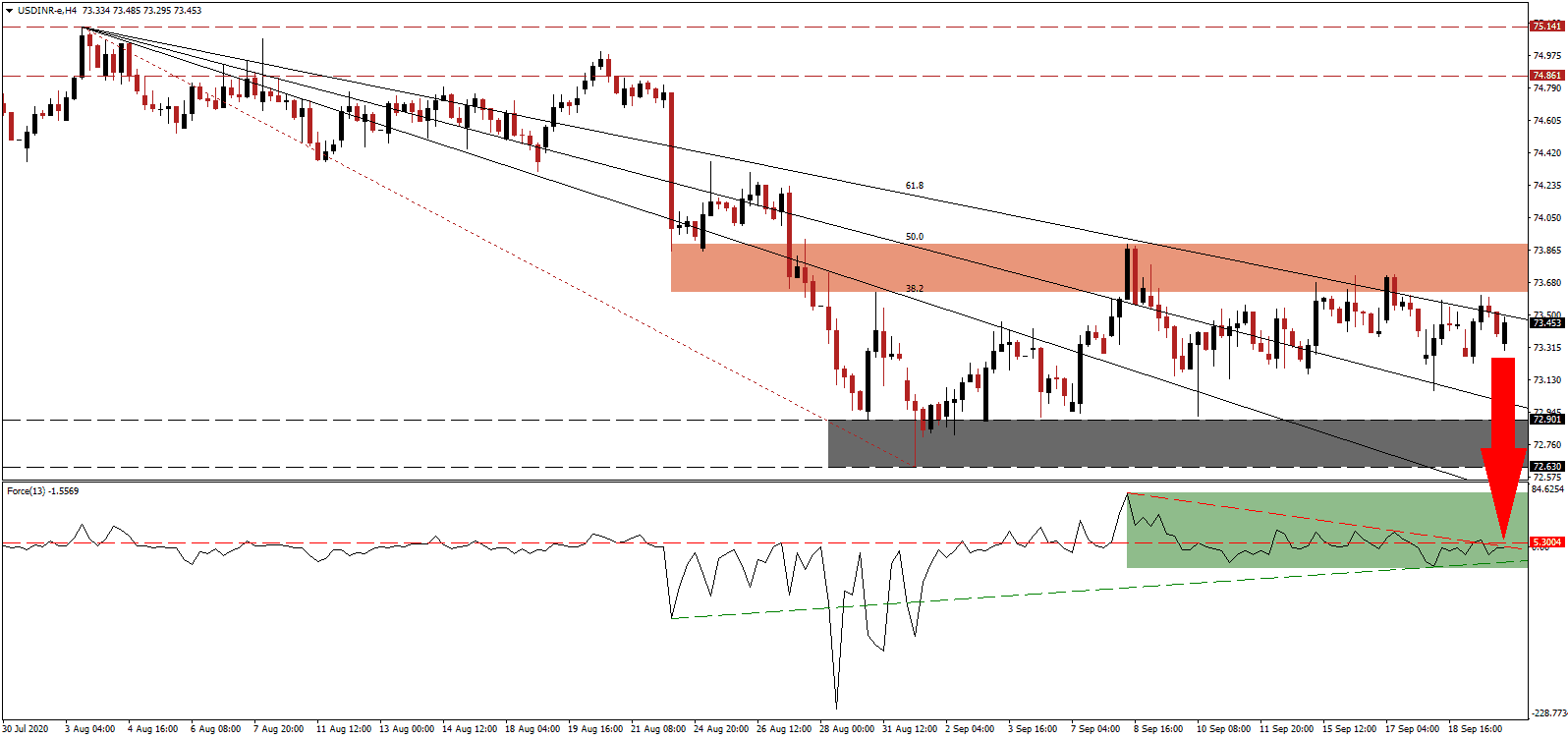

The Force Index, a next-generation technical indicator, remains below its horizontal resistance level, confirming the dominance of bearish momentum. Magnifying breakdown pressures is the descending resistance level, as marked by the green rectangle, expected to push this technical indicator below its ascending support level and farther into negative territory, placing bears in complete control over the USD/INR.

Per an analysis from McKinsey Partner Shirish Sankhe, India needs to create over ninety million jobs this decade and achieve a GDP growth rate of 8.5% to achieve a healthy economy. By comparison, over the past six years, job growth averaged just four million. Agriculture was outlined as one essential driver for job creation, with a tripling in exports from $30 billion to $100 billion as the base-case scenario together with massive infrastructure programs. Bearish pressures continue to accumulate on the USD/INR after the breakdown below its resistance zone located between 73.625 and 73.899, as identified by the red rectangle.

Without tax reforms, India will be unable to recover from the Covid-19 pandemic, while the economy was slowing before the virus emerged. Until the government of Prime Minister Modi addresses the heavy tax burden, his Made in India campaign will not yield results. Economist Rathin Roy, Managing Director of Research and Policy at ODI, noted Indian clothes are more expensive than imports from Bangladesh and Vietnam. It adds pressure for a complete overhaul of a dysfunctional system. The descending Fibonacci Retracement Fan sequence is favored to pressure the USD/INR into its support zone located between 72.630 and 72.901, as marked by the grey rectangle. A breakdown into its next support zone between 71.419 and 71.710 is likely.

USD/INR Technical Trading Set-Up - Breakdown Extension Scenario

Short Entry @ 73.450

Take Profit @ 71.420

Stop Loss @ 73.900

Downside Potential: 20,300 pips

Upside Risk: 4,500 pips

Risk/Reward Ratio: 4.51

Should the Force Index eclipse its descending resistance level, the USD/INR may attempt a reversal. With the outlook for the US economy increasingly bearish, and downside pressure on the US Dollar rising, Forex traders should sell any advance from present levels. The upside potential remains confined to its intra-day high of 74.370, a previous peak from where the most recent correction emerged.

USD/INR Technical Trading Set-Up - Limited Reversal Scenario

Long Entry @ 74.100

Take Profit @ 74.350

Stop Loss @ 73.900

Upside Potential: 2,500 pips

Downside Risk: 2,000 pips

Risk/Reward Ratio: 1.25