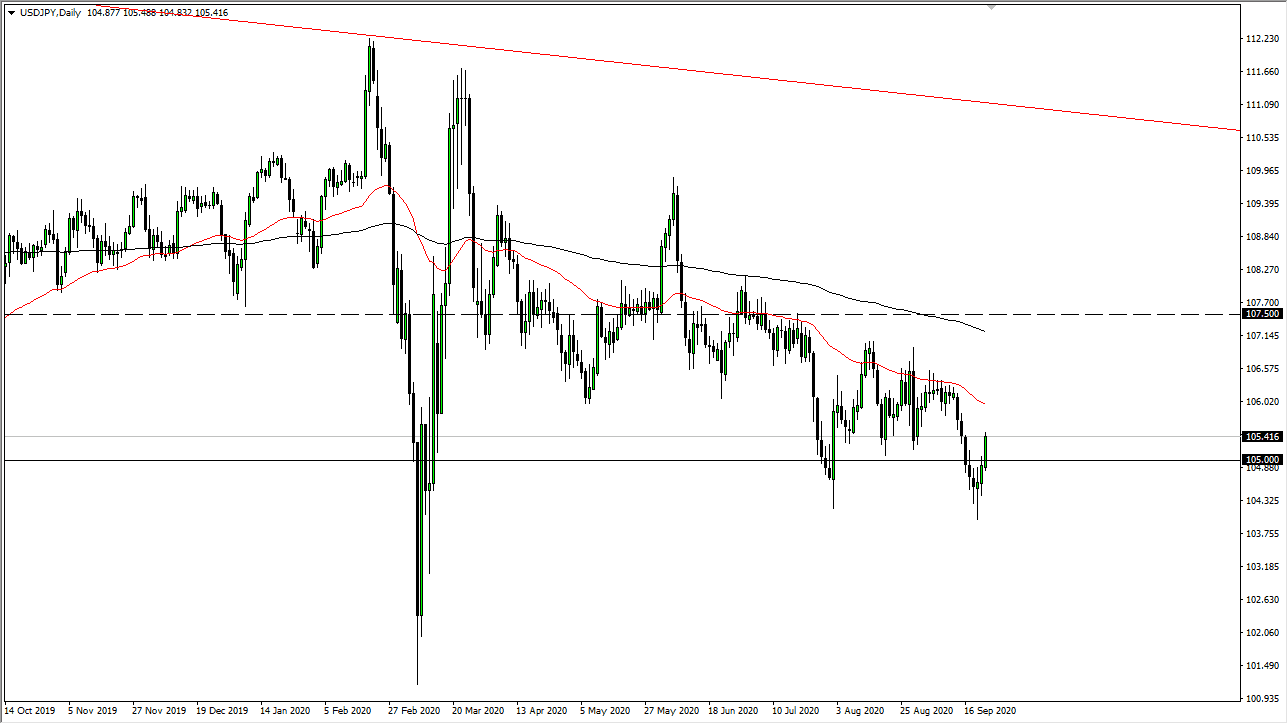

The US dollar has broken higher during the trading session on Wednesday, slicing through the ¥105 level. After doing so, the market is likely to continue to see a lot of noise above, and I think at this point in time the market is likely to see selling pressure above, especially near the 50 day EMA. The 50 day EMA is right around the ¥106 level, so given enough time I would anticipate that people will come back in to push this market lower.

The US dollar has risen everywhere, including against the Japanese yen but given enough time it is likely that the “risk off attitude” will overtake this market and send this market lower. I suspect that the 50 day EMA is as good of a place as anywhere else and it is an area that we have seen act as resistance more than once, so having said that I like the idea of fading rallies and signs of exhaustion will be what I am looking forward to start buying the Japanese yen. However, the US dollar is so strong that I find it difficult to short this pair, but would use a breakdown in this market in order to short NZD/JPY, CAD/JPY, etc.

The size of the candlestick is somewhat important, as it does suggest that perhaps we have further upside but I also recognize that we are in a downtrend and have recently made a “lower low” in this market, and we have not made a “higher high”, signifying that we are still very much in a downtrend. I think given enough time the market probably goes looking towards the ¥102 level, perhaps even lower than that. Having said all of that, even if we do break above the 50 day EMA, I think there is plenty of resistance between there and the 200 day EMA to continue to look for signs of selling pressure to get involved with as well. If the US dollar continues to strengthen against most currencies, we could very well see a turnaround here but I think it is easier to short the EUR/USD pair if you want to buy the US dollar than it is to try to go long in a market that features two safety currencies at the same time. Because of this, we may have a bit of choppy behavior, but I clearly favor the downside in general.