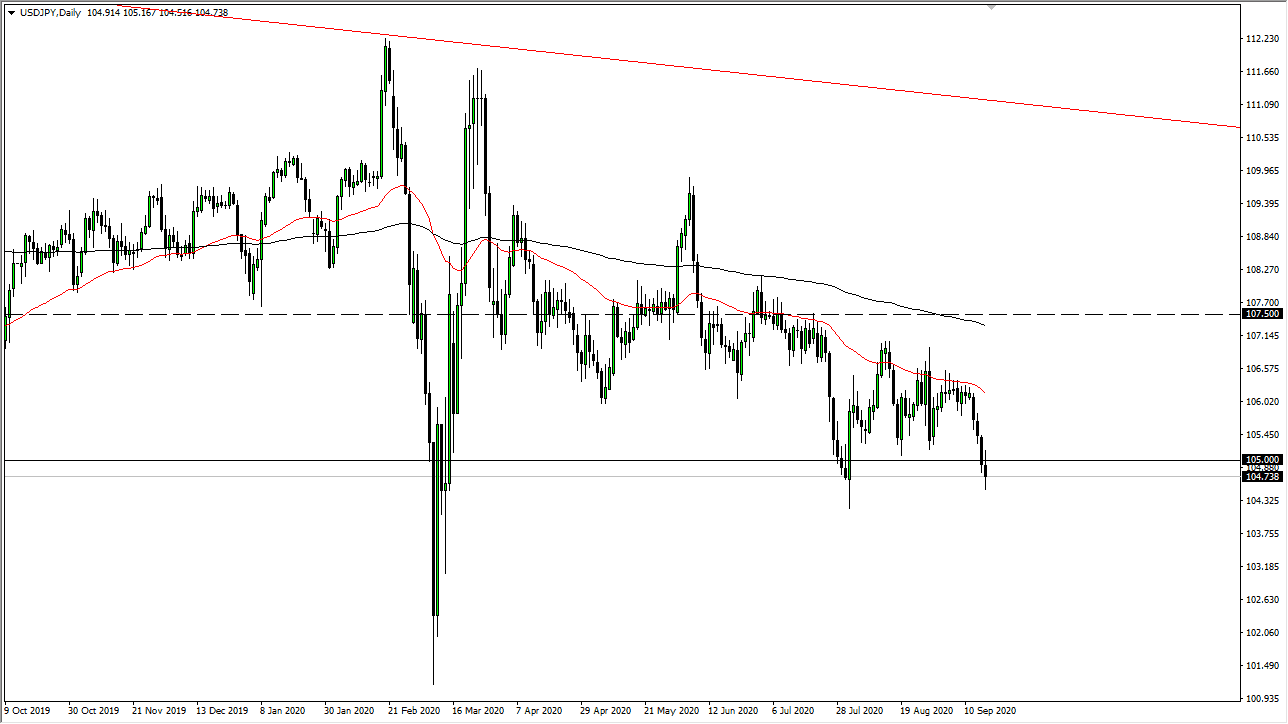

The fact that we broke back above it really in Asia and then fell from there again shows that there is going to be relentless pressure on the US dollar when it comes to the Japanese yen, and I think that any rally at this point you are looking at an opportunity to sell on signs of exhaustion.

The candlestick, although negative, is not necessarily convincing right away. We may try to rally into the weekend, but I suspect that the closer we get to the ¥106 level, the more the pressure would really come back into the mix. All things being equal, this is a pair that is sensitive to risk appetite as well, so we see some type of major flush when it comes to risk appetite, we may see this market fall. On the other hand, if we get massive US dollar strength across-the-board it can have an effect here, but typically it is a bit more muted than it is against other currencies such as the Australian dollar, New Zealand dollar, Canadian dollar, and so on.

To the downside, if we can break down below the ¥104.33 level, I think it is likely we go dropping down towards the ¥104 level, ¥102 level, and then possibly even the ¥100 level, an area that I think the Bank of Japan will jump in and make its presence known. At this point, I do not have any interest in buying this pair, because it looks so sad and sick.

It is not until we break above the 50 day EMA, pictured in red on the chart that I would be a buyer, and even then, I would need to see a daily close above there. All things being equal, I also think that there are plenty of selling at the 200 day EMA as well as the ¥107.50 level. Look at this chart, it seems like it is only a matter of time before we get a “lower low” on the longer-term chart. It has been a while since we have seen a “higher high” on the chart, so that right there tells you most of what you need to know.