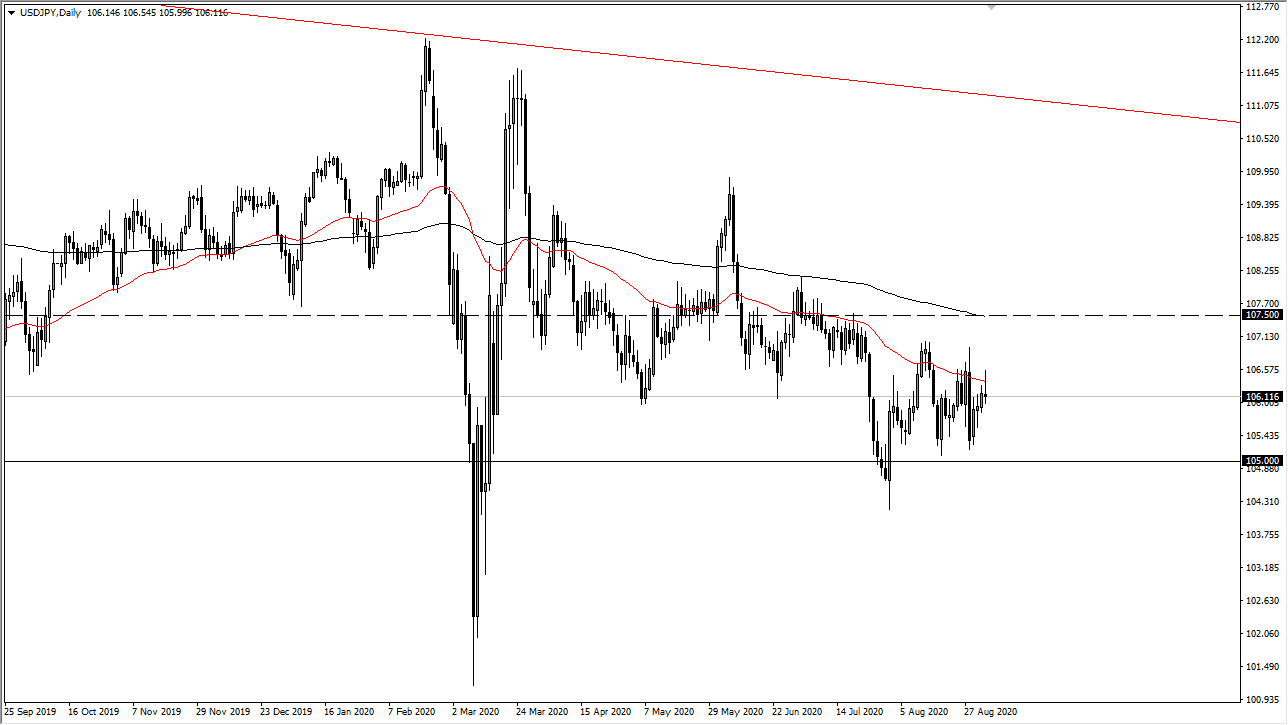

This suggests that we will probably fall from here, and that makes quite a bit of sense considering that the US dollar is under significant pressure due to the Federal Reserve and its antics. That being said, it is likely that we will continue to see this market hang out in the same general consolidation area, meaning that the ¥105 level underneath will be very significant. I like selling short-term rallies as I have been doing for some time, paying close attention to every 50 pips or so.

Keep in mind that the Friday session of course is highly anticipated, as it is the Non-Farm Payrolls announcement, at 830 in the morning New York time. That tends to have a major influence on the US dollar, and of course this pair as a result. That being said, I like the idea of fading any kind of rally that shows up, just as I would be a seller of a breakdown below the ¥105 level. I have no interest in buying this pair for anything more than a short-term trade, something that is possible to do but also a bit more dangerous.

Looking at this chart, I think that we will continue to see a lot of choppiness but given enough time we should see a bigger move, as pairs cannot sit like this forever. Both of the central banks are working against the value of their currencies, so it makes quite a bit of sense that we stay in a relatively tight range. By the time we get some type of move, it will more than likely be a massive one. Although the Federal Reserve is working feverishly against the US dollar, the Bank of Japan should not be doubted and its ability to crush the yen. This is like a fight between two lightweights but with the entire world shorting the US dollar, I feel it is probably only a matter of time before we see some type of bigger move. For what it is worth, the highs continue to get slightly lower. If you are a short-term trader though, this is been a great pair as of late.