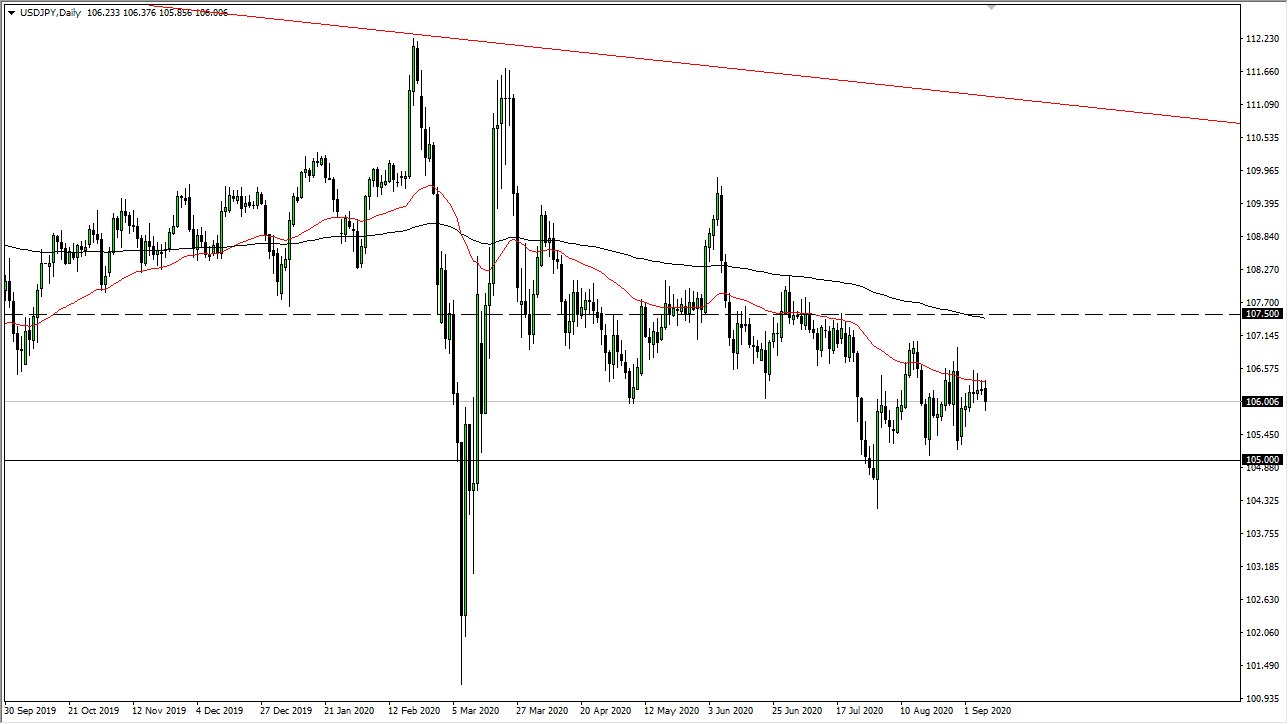

The US dollar has initially tried to rally against the Japanese yen but fell rather hard to slice through the ¥106 level before turning right back around. This is a market that continues to be very noisy, but it most certainly seems to favor the downside more than anything else. We have seen a lot of noise when it comes to the greenback as of late, as the Federal Reserve is doing everything it can to loosen monetary policy. This even translates into the buying of Japanese yen, although this will be much messier than many other markets due to the fact that both of these are very loose central banks and safety currencies.

To the upside, we still have the 50 day EMA offering resistance, so I think it is still is easier to fade rallies that get close to that indicator, as we have done over the last couple of days. Given enough time, I think the market will go looking towards the ¥105 level, although it may take it is time getting down there. That being said, this could also break down significantly in more of a “risk-off” type of move, as the Japanese yen is the natural safety currency for a lot of trades. The candlestick did bounce a bit towards the end of the day, so it does suggest that it is going to take some time to get down there, but ultimately, I do think that we will head down to the ¥105 level. In fact, I have no interest in buying this pair until we clear the 200 day EMA above which is closer to the ¥107.50 level, due to the indicator and the structural resistance in that area as well.

I think that we are more than likely going to see a lot of back and forth in this choppiness, but eventually, the market should adhere to the “lower high” scenario that we have been in for some time. We certainly are grinding to the downside, so it makes quite a bit of sense that eventually, the dam will break. Until then, I can trade this from a short-term standpoint, recognizing that the downward momentum is the best way to go on short-term charts taken advantage of the longer-term move. It is very difficult to imagine that we break above the 200 day EMA to start buying.