This currency pair has gone back and forth during the trading session on Tuesday, as we have seen a lot of moves in the FX markets that probably took a lot of people by surprise. The US dollar against the Japanese yen is a very choppy pair at this moment, and it looks like we are going to continue to see more of the same. This is because both of these currencies tend to be thought of as “safety currencies”, so with that being the case, it is likely that we will continue to see this range respected.

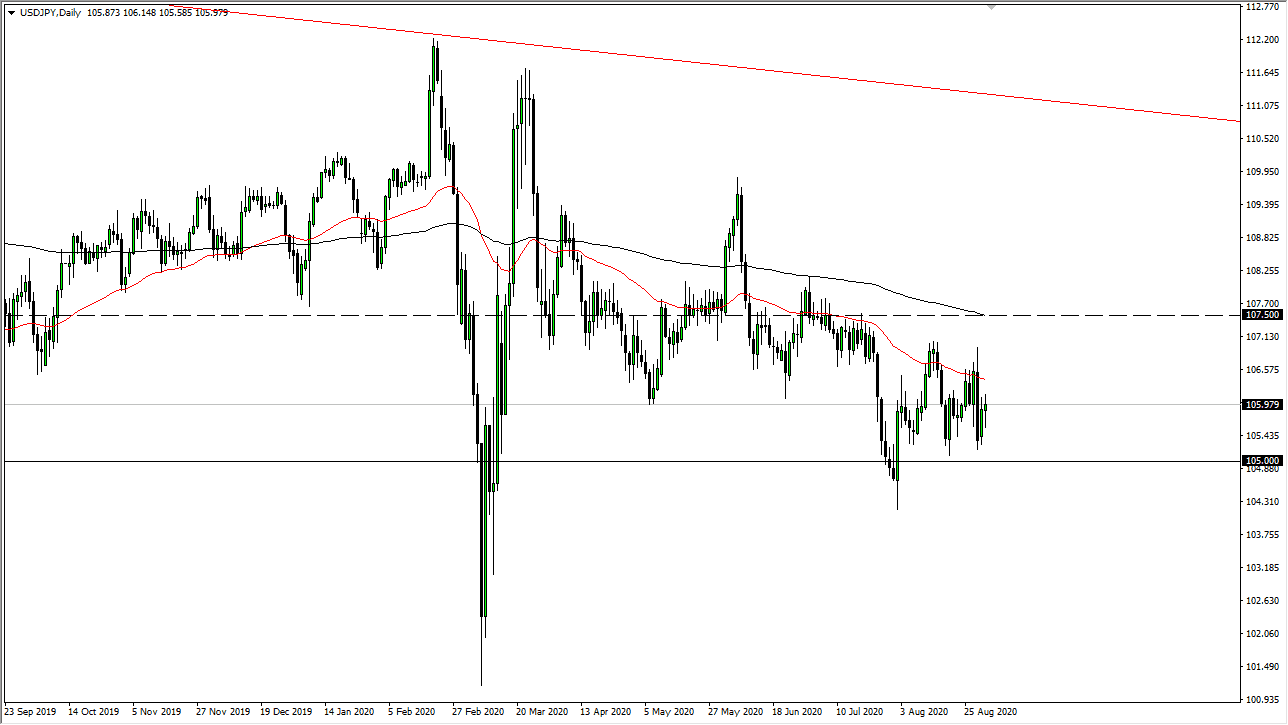

We have a significant amount of support just below at the ¥105 level, as we have bounced from just above that level multiple times. To the upside, the ¥107 level has offered enough resistance that it should continue to do so going forward. Furthermore, we also have the 50 day EMA between here and there, so I think that will also cause a bit of trouble. With all of that being said, the market is going to continue to be very noisy, to say the least, and therefore I like the idea of trading short-term, and perhaps in some type of range-bound trading system between these multiple levels.

If we were to break down below the ¥105 level, we would then go looking towards the ¥104.33 level. That is an area that had previously been supportive, so I do think that it is only a matter of time before buyers would jump back in, but if that level does give way to the selling pressure, then it opens up the possibility of a move down towards the ¥102 level underneath, which has historically been important as well. On the other hand, if we were to break above the ¥107 level, I think there is even more resistance at the ¥107.50 level, which is also the scene of the 200 day EMA, an important technical indicator that traders will continue to pay attention to. All things being equal, I think that it is better off for traders to focus on short-term charts, perhaps the 15-minute variety, than anything else. This is a market that I think is simply looking for some type of catalyst to move. Right now, we do not have any, but the one thing that is worth paying attention to is the fact that the Federal Reserve continues to be very loose with its monetary policy, but at the same time the bank of Japan does the same.