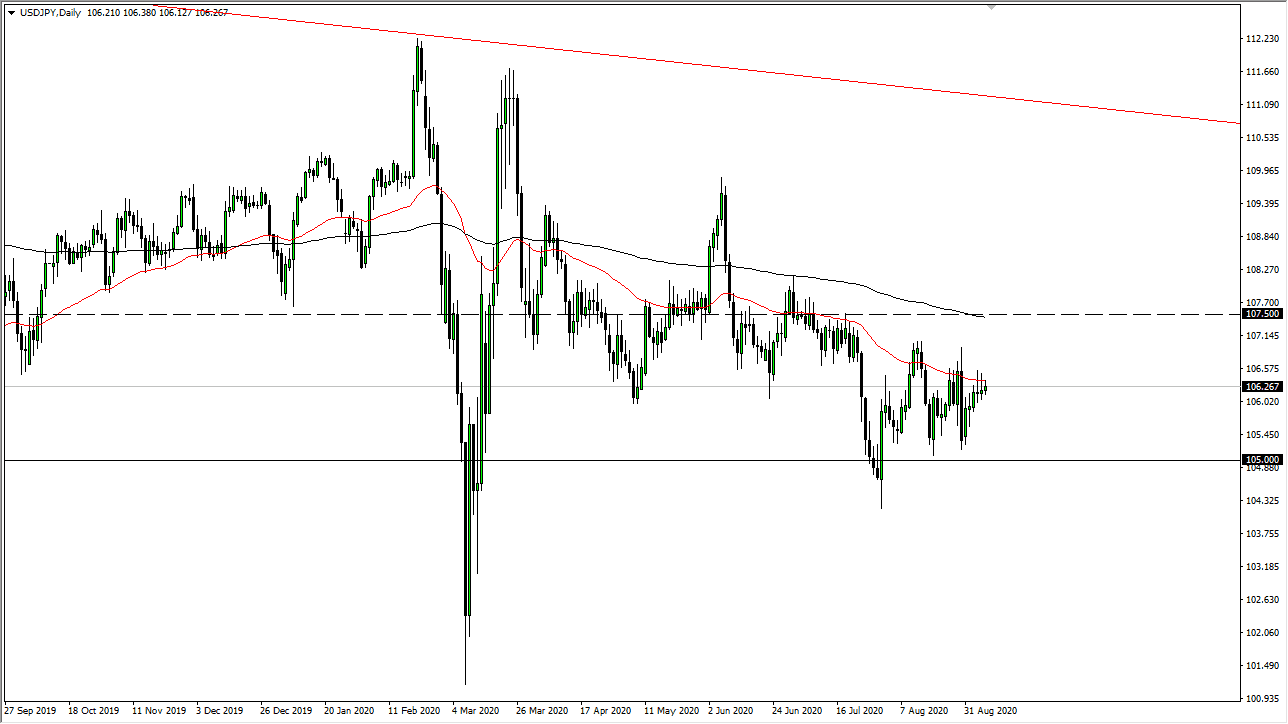

The US dollar has rallied a bit during the trading session on Monday, as we were trading in thin volume during the Labor Day holiday in the United States. Ultimately, this is a market that continues to see a lot of resistance near the 50 day EMA, as we have pulled back from there a couple of times now. Looking at this chart, you can see that the highs keep getting lower, but the support underneath continues to hold rather significantly. The breaking below the ¥105 level it is likely that we could go much lower.

By breaking below the ¥105 level, it would bust through a significant amount of support, and then the market will go looking towards the ¥104.33 level, the area where we had bounced from previously. If we break down below that level, then it is likely that the market will unwind down towards the ¥102 level, an area that has previously been supportive as well. The market is likely to continue to respect the 50 day EMA in general, and if you look at the 50 day EMA and the 200 day EMA, you can see there is a buffer of resistance that the market cannot seem to overcome and therefore it is likely that the sellers will continue to jump into the game.

If we do break to the upside, it is not until we clear the ¥107.50 level that I would consider buying this pair. Furthermore, the 200 day EMA is right around the same area, so I think overall breaking above the structural resistance would be a massive turn of events. I highly doubt it happens, at least as long as the Federal Reserve is out there looking to loosen monetary policy, which works against the value of the greenback in general. With this being the case, I am looking at the possibility of a descending triangle that is forming on the chart, signifying that we are in fact going to break down eventually. There are a lot of concerns out there when it comes to risk appetite, so beyond that, we also have to think about the correlation of the Japanese yen being a major safety currency. With this, I expect a lot of volatility but more negativity than anything else. Choppiness will continue to be the most predominant feature of this market.