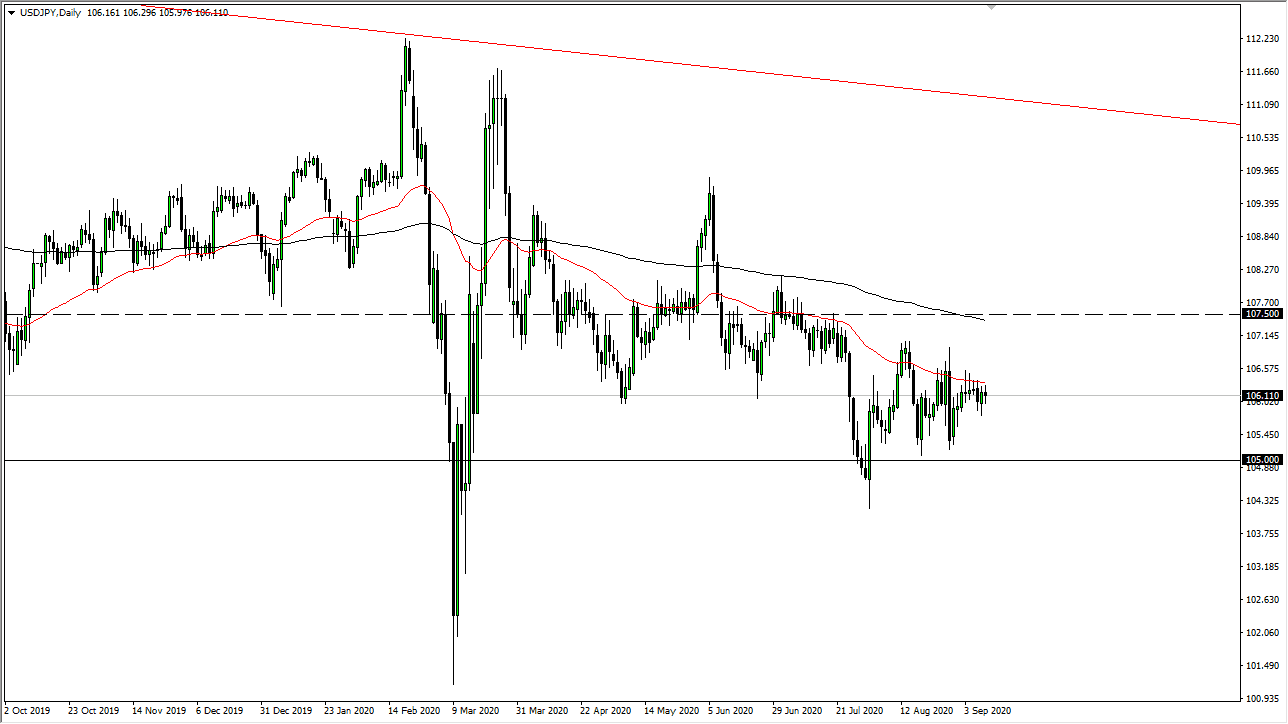

The US dollar has gone back and forth during the trading session on Thursday again, as we tread water against the Japanese yen just below the 50 day EMA. The 50 day EMA of course is a technical area that a lot of traders will pay attention to, due to the fact that it is such a commonly used trend measuring indicator. Looking back at the last week or so, you can see that clearly every time we try to break above it, sellers come in to push this market back down.

Short-term traders continue to make bets in both directions, as we do not have clarity for a bigger move quite yet. That being said though, it is likely that we still favor the downside, mainly because we have seen so much in the way of volatility in the markets, and of course the Japanese yen is considered to be a safety currency. Yes, I am aware the fact that the US dollar most certainly is as well, but the Japanese yen is more traditionally bought than the US dollar.

If we do break above the 50 day EMA, I think there are plenty of reasons to think that the market only has somewhat of a limited uptrend available to it. The ¥107 level will be resistance, just as the ¥107.50 level will be. That is an area where we see the 200 day EMA, which obviously attracts a lot of attention. Because of this, I am simply waiting for an opportunity to short the market on signs of exhaustion just above, for short-term trades. I am not looking to put a ton of money into this market, unless of course we see some type of massive and impulsive candlestick that closes with a large range. Until then, it is difficult to imagine risking a whole lot going into the weekend. Short-term traders continue to do quite well though, so keep that in mind and look towards those charts to play the best trades and take quick profits. As far as bigger moves are concerned, we need some type of catalyst to make that happen. Right now, we simply do not have it, so at this point it is likely we will continue this type of behavior over the next 24 hours, if not the next couple of weeks. I think as volatility continues to climb in other markets, it is likely that the USD/JPY pair will remain very choppy.