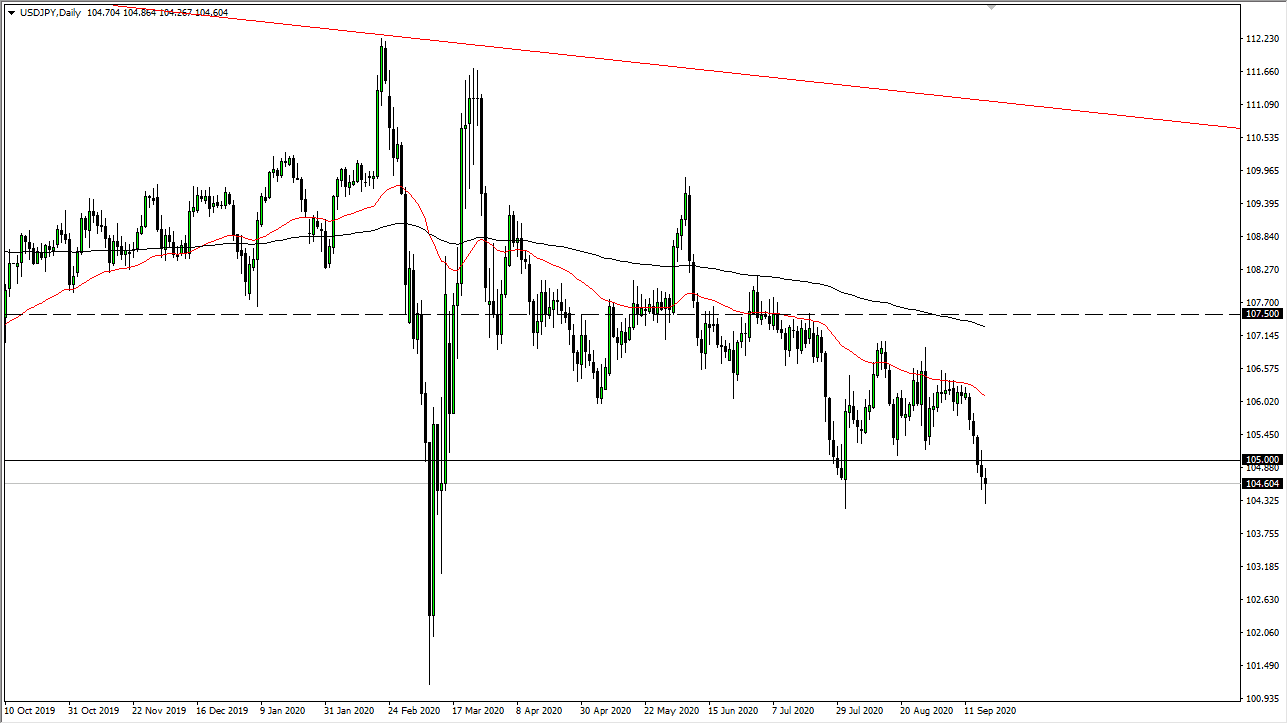

The US dollar has gone back and forth during the trading session on Friday but overall has seen more negativity than anything else. That being the case, the market is likely to face significant pressure, and I think this is a market that is looking to go lower. Having said all of that, I think that it is only a matter of time before we get a bit of a bounce and I anticipate that might be what happens in the short term.

On a break above the ¥105 level, I will be looking for an opportunity to short the US dollar against the Japanese yen. There are a couple of places that I will be interested in shorting, most specifically the ¥106 level, but would be very aggressive near the ¥106.50 level. Both of these areas on shorter-term charts have shown themselves to be important, so it is worth paying attention to. After all, the US dollar is a bit oversold against the yen, so it is worth taking profits on any shorts that you have, recognizing that we are still very much in a downtrend and you can take advantage of the same trade later.

The alternate scenario is that we simply break down below the candlestick for the trading session, sending this market towards the ¥104 level, possibly even the ¥102 level. This pair tends to be very choppy though, so keep in mind that the market will go back and forth quite a bit. Ultimately, this is a market that I have no interest in buying, at least not anytime soon. The 50 day EMA above being broken would be a huge sign of strength, but I do not think that happens in the near term. Currently, that moving average is closer to the ¥106.50 level, which is part of why I would be so bearish at that level considering how reliable it has been. As the world continues to have a lot of concerns about global growth, it does make sense that the Japanese yen should strengthen a bit, as it tends to be more of a safety currency than anything else. If this pair does start following again, you will probably have more movement in other pairs like the GBP/JPY pair, NZD/JPY pair, and so on.