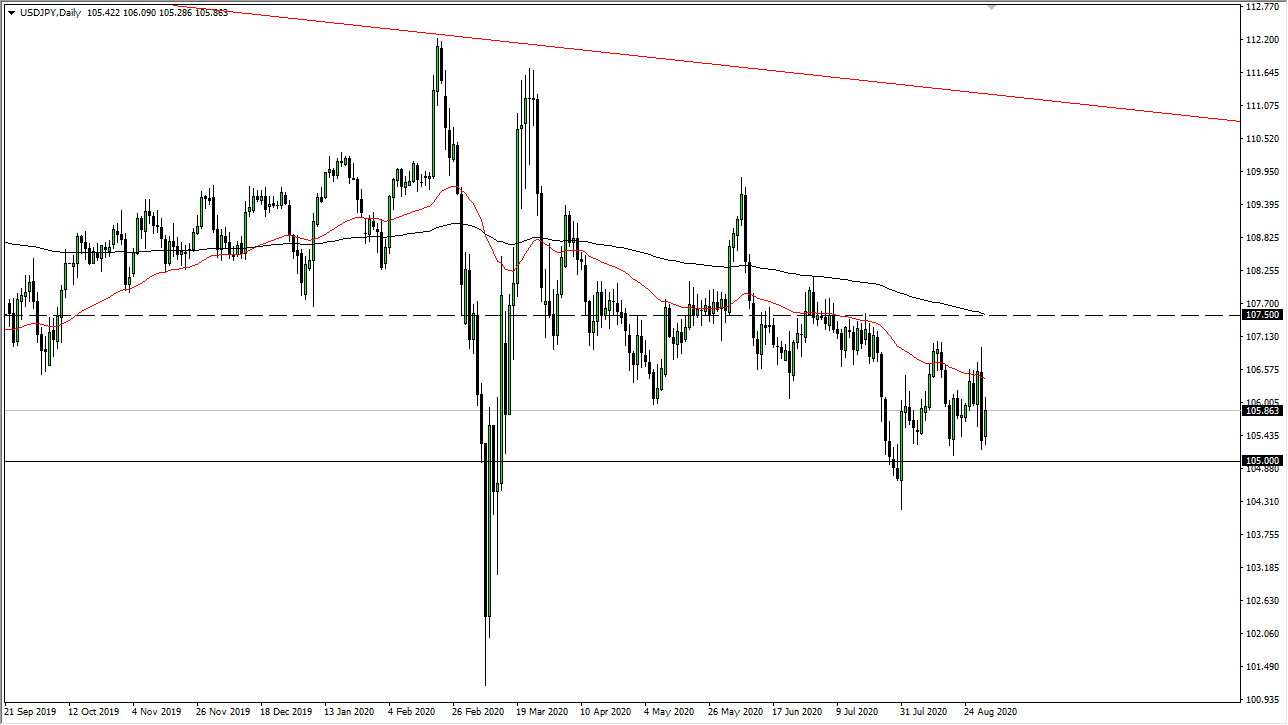

The US dollar has rallied quite nicely during the trading session on Monday but has given back quite a bit of the gains late in the day as it shows the ¥106 level to be resistive. Even if we break above there, then the 50 day EMA and the ¥107 level should both offer selling opportunities. In other words, no matter what happens in this pair, I am looking for selling opportunities currently. Having said that, this is not a huge range that we are trading in, but it is well defined. If you understand that, then you have the ability to trade back and forth between those levels and the ¥105 level underneath which looks to be so massively supportive.

If we can break down below the ¥105 level, then it is likely that we go looking towards the ¥104.25 level, which was the recent low. The question is not necessarily whether or not we can get down there, but whether or not the Japanese yen can pick up enough momentum to make that happen. After all, the Bank of Japan is also extraordinarily loose with its monetary policy, so we could see the US dollar gained a bit against the yen, at least in the short term. However, I do not think that we can break above the 200 day EMA above, which is at the structurally and historically important ¥107.50 level. If we were to break above there, that would obviously change a lot but right now I think that is what it takes to get me to start buying this pair as it has been so reliably negative over the last couple of months.

If you are more aggressive, then obviously you can play this market from both sides, but for myself, I do not like the idea of buying the US dollar because of what the Federal Reserve is doing and the fact that it is negative against most other currencies. As long as that is going to be the case, then it makes quite a bit of sense that you should simply trade to the downside, even in this pair. Looking at the candlestick, it is somewhat impressive, but it is worth noticing that the ¥106 level has stopped the market dead in its tracks, which could be a little bit of heads up as to what could happen next.