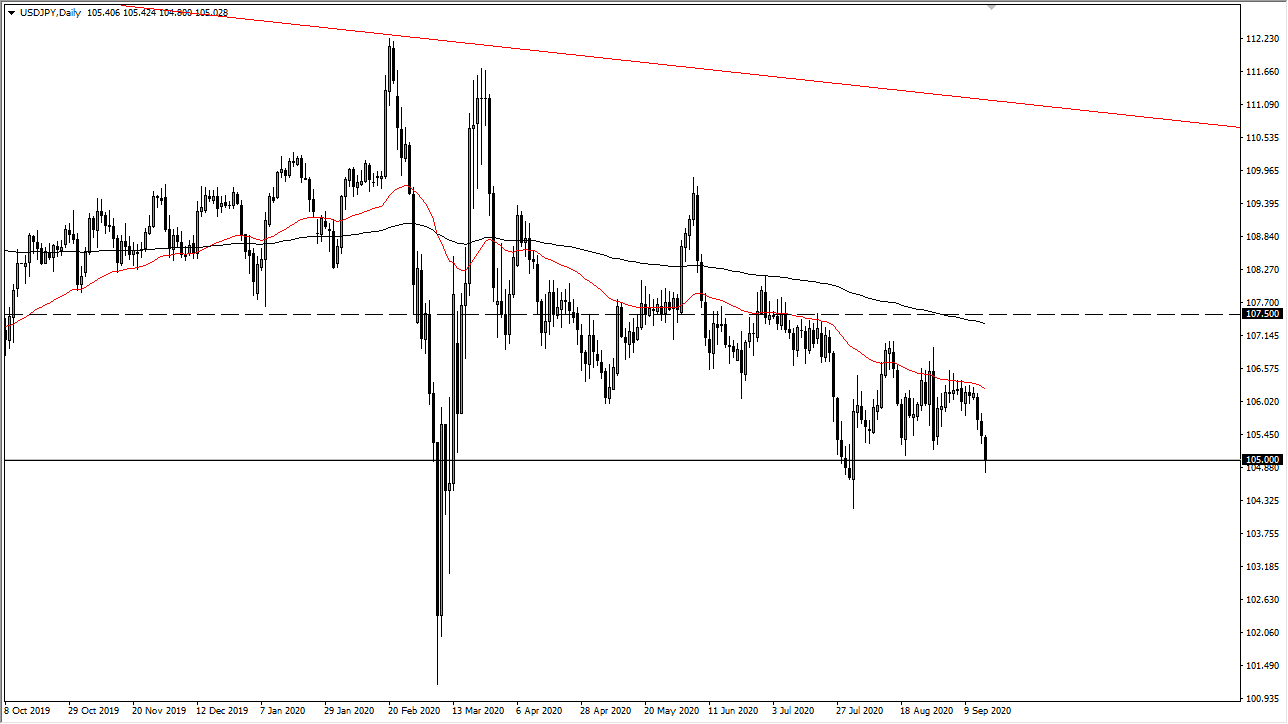

The US dollar has broken down significantly during the trading session on Wednesday, slicing through the ¥105 level, but is closing right around that level. At this point, it is very possible that the market could bounce, but it is obvious that rallies continue to get sold into, and I think that the ¥106 level will offer resistance, just as the 50 day EMA is right above there and it has been drifted lower. It is an area that has been resistant previously, and therefore it is likely that the market will continue to fade the rallies as they come.

Keep in mind that this pair is also sensitive to the risk appetite of traders around the world. Typically, people will buy the Japanese yen, especially Japanese traders as they repatriate money. Ultimately, if we break down below the ¥105 level again, I think we probably will go looking towards the ¥104.33 level, and below there we could be looking at the ¥102 level. This is probably the one place where I see the US dollar’s weakness, so that makes it a bit of an outlier. If this pair falls apart and we continue to see the US dollar strengthen against other currencies overall, it might be better off to shore something like the EUR/JPY and the GBP/JPY pairs. After all, if the Japanese yen is starting to strengthen in general, then it is worth noting that and looking for other weak currencies to trade against.

I believe that this will probably be settled during the European session, and with a major lack of large announcements during the week, it will be interesting to see how this plays out. This market looks likely to see quite a bit of pressure, and therefore unless we see some type of major selloff in the US dollar overall, this is a one-way trade, to the downside only. The market will more than likely attract the attention of the Bank of Japan if we do break down towards the ¥102 level, but that is something to worry about another day. This is a market that looks likely to continue to be noisy but negative overall. It is not until we break above the 50 day EMA on a daily close that I would even entertain the idea of possibly going long.