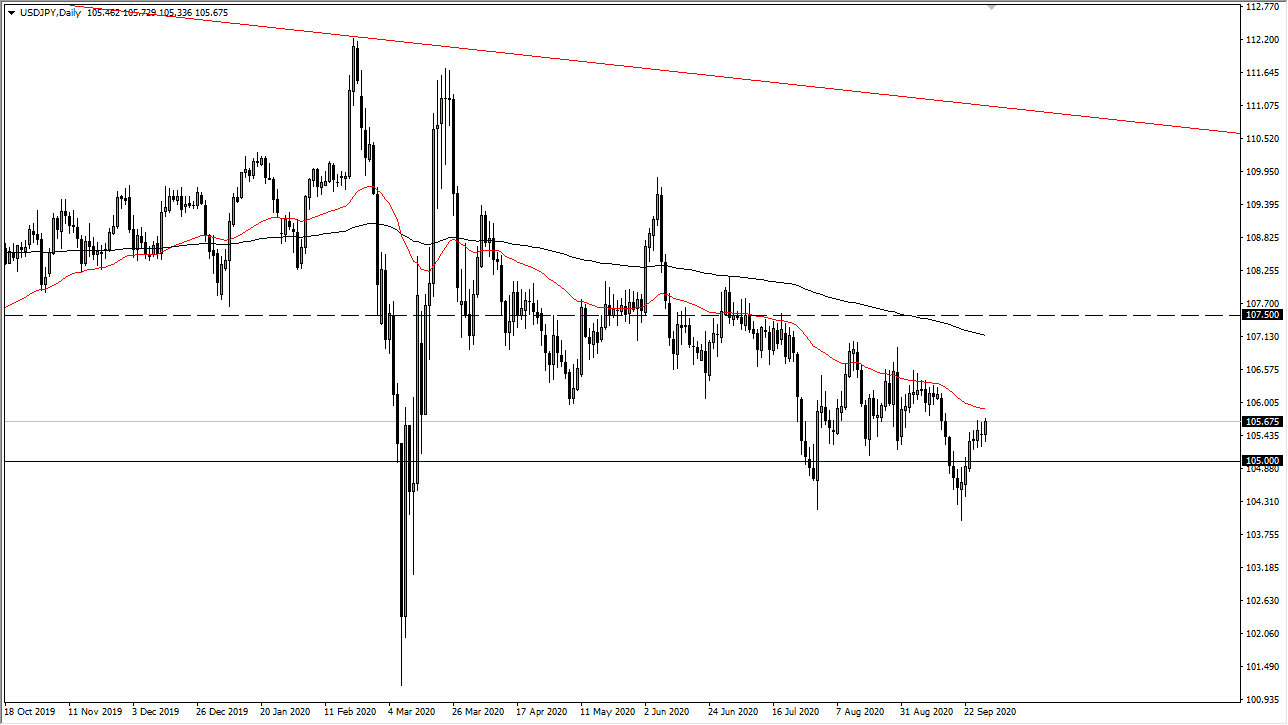

The US dollar initially pulled back a bit during the trading session on Tuesday, but then rallied significantly to reach towards the ¥105.70 level. All things being equal, the market is likely to continue finding resistance at the 50 day EMA just above, which is drifting lower and is a nice technical indicator that a lot of people will pay attention to, and trade from.

There is also a lot of resistance between the 50 day EMA and the 200 day EMA as you can see on the chart, and as a result, you can see that we have failed to break higher. That being said, I do think that fading short-term rallies will continue to work, because not only is the US dollar under some pressure, but it does get sold off against the Japanese yen even in a major “risk-off” move. Beyond that, the trend is most decidedly negative, so if you are patient enough you should see plenty of opportunities to short this market off of short time frames.

To the downside, the ¥105 level is more than likely the most obvious target, as it is a large, round, psychologically significant figure and an area that will attract a certain amount of attention. Having said that, the market is likely to break down through there and go looking towards the lows that we had seen previously. The ¥104 level underneath is significant and if we were to break down below there it is likely that we continue to go much lower. The market is likely to continue to see a lot of volatility, but I think it is only a matter of time before we sell-off. I have no interest in buying this pair, at least not until we break above the 200 day EMA which is obviously a longer-term target that people will pay attention to. If we were to break above there, then it would obviously send this market much higher, perhaps reaching to brand-new highs. With all of this being said, this is a very noisy market that continues to be one that you should probably trade from short-term charts more than anything else. I think at this point, it is going to be a market that moves very quickly, so therefore you need to be very cautious with your position size.