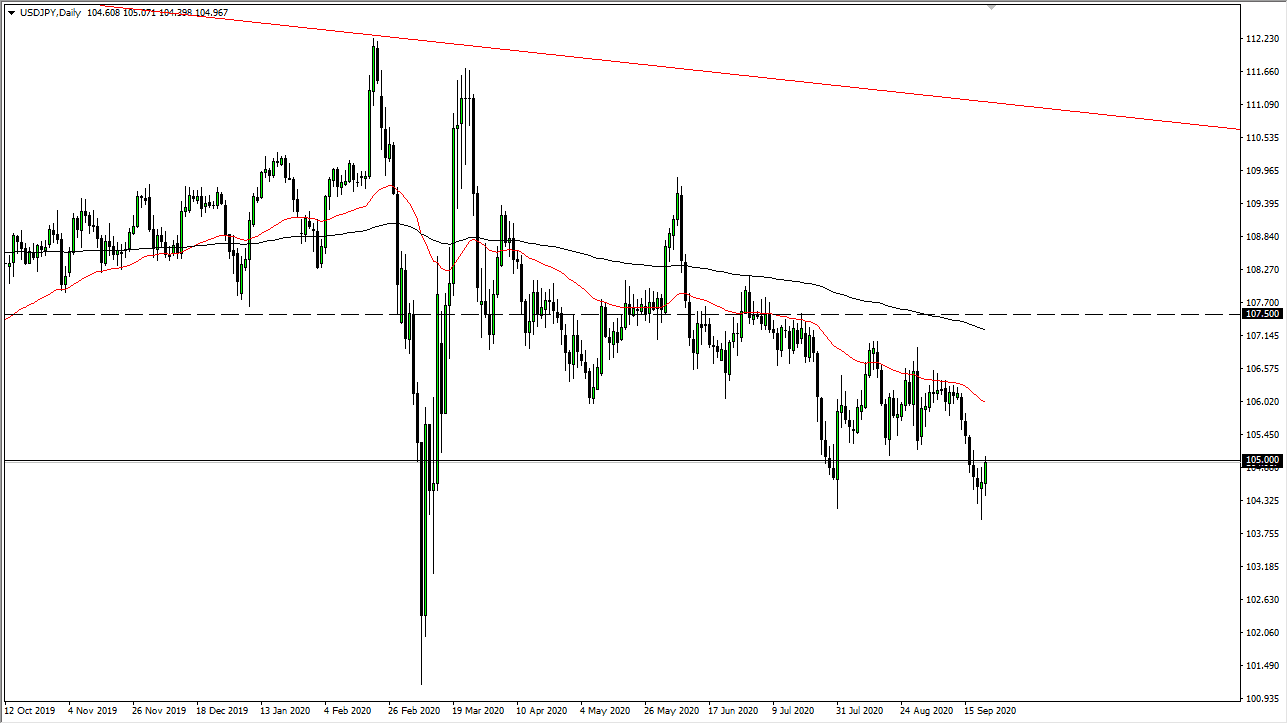

The US dollar has rallied significantly during the trading session on Tuesday to show signs of resiliency. We have crashed into the ¥105 level, an area that is a large, round, psychologically significant figure and if we can break above the top of the candlestick for the trading session on Tuesday, then it is likely that we could go to the ¥106 level. Just above there, the 50 day EMA is sitting on the chart, and drafting lower. That should cause a certain amount of psychological and structural resistance, so it will be interesting to see how the market reacts to it.

The pair has been decidedly negative for some time, but it is getting a bit of a boost due to the fact that the US dollar got a bit of a bid. On the other hand, if we were to turn around and a breakdown below the hammer from the previous session, then we will go looking towards the ¥102 level. I believe that fading rallies will probably continue to be the best way to trade this market, so looking at the shorter-term charts is probably going to be the way we need to go forward.

Even if we break above the 50 day EMA, I find it difficult to imagine that we are simply going to take off to the upside, rather it is more likely that we will fade those rallies as well for a longer-term move. The market is not one that I feel comfortable buying until we clear the 200 day EMA above, which is basically at the ¥107.50 level. All things being equal, I am looking to jump on weakness when I see it and more importantly signs of exhaustion that can offer value in the Japanese yen.

All things being equal, I think that this is a pair that is going to be very choppy as we have seen multiple times over the last couple of weeks. It is interesting that we have pulled back a bit from the ¥105 level, so that shows you just how much trouble each round figure will probably be in this currency pair. Short-term traders will continue to jump back and forth in what is obviously a very volatile market. If we get some type of “risk-off move”, that could also favor the Japanese yen.