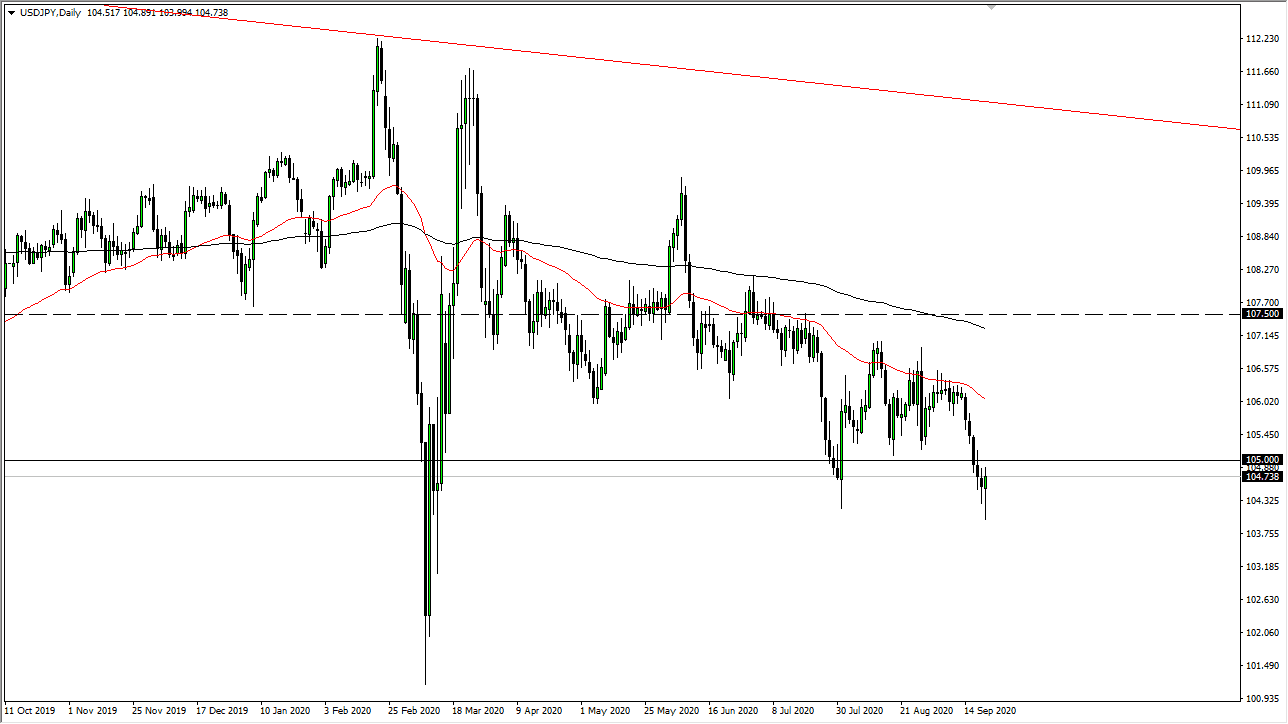

The US dollar has gone back and forth during the trading session on Thursday, initially trying to rally towards the ¥105 level, but then fell hard to reach towards the ¥104 level before bouncing yet again. Ultimately, the market ended up forming a bit of a hammer that is a bullish candlestick. At this point, if we were to turn around and break above the ¥105 level, we probably go looking towards the 50 day EMA above, which is an area that will attract a certain amount of technical selling.

Furthermore, the ¥106 level is roughly where the 50 day EMA is reaching towards and should be interesting to pay attention to. I am looking for signs of exhaustion to get short of this pair because the Japanese yen will pick up a bit of strength when there is more of a “risk-off” attitude around the world. I think there is going to be plenty of that, so it is only a matter of time before we have that happen.

The candlestick being broken to the downside opens up a bigger “flush lower”, but it does seem to be a little less likely at least immediately. If we were to break down below there, the market then goes down to the ¥102 level, perhaps even lower than that. I think that the selling has become much more aggressive over the last several months, so it makes sense that we would continue to see more of a “fade the rallies” type of scenario.

The 50 day EMA and the 200 day EMA are separated quite drastically, and that suggests that the momentum is still very strong. The Japanese yen will continue to attract a certain amount of attention, and if we continue to see a lot of fear out there, I think we will see a huge run lower. However, if we were to reach down towards the ¥100 level, the market is likely to see the Bank of Japan get involved, even if they are only jawboning the market. They typically do not like to see the yen appreciate like that, so that could become an issue down the road. Nonetheless, the downward pressure is something that I fully anticipate returning periodically.