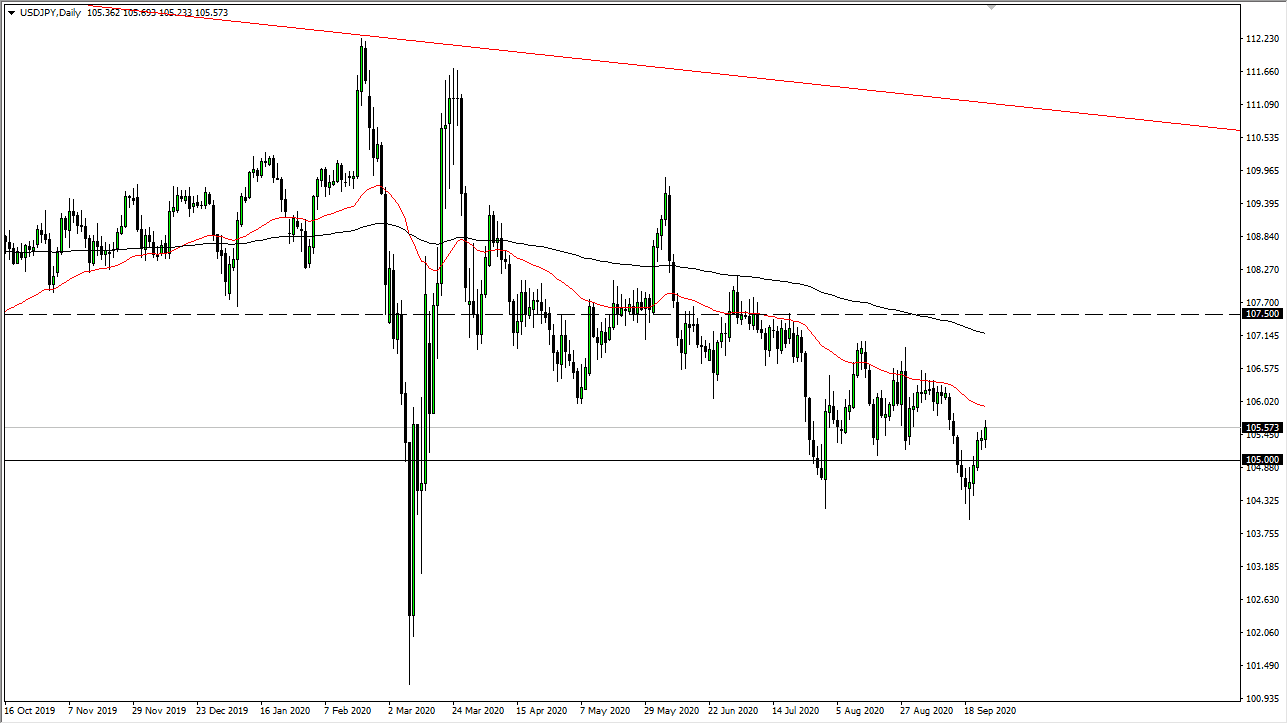

The US dollar initially pulled back a bit against the Japanese yen during the trading session on Friday, but then shot higher. At this point, the market then started looking towards the ¥105.75 level. I do believe that there is plenty of resistance above though, so it is worth paying attention to. I looking to short this market if we get an opportunity to do so near the 50 day EMA, an area that has been important more than once. The 50 day EMA is close to the ¥106 level, so I think it is only a matter of time before we see that come back into play.

Signs of exhaustion will be jumped on, and it does look like we may have had an overbought condition recently, and therefore think it is only a matter of time before we have to go back to where we were. Keep in mind that the US dollar does behave a bit differently against the Japanese yen that it does other markets, so do not necessarily think that the US dollar has to go in the same direction here as it would against the Euro, Pound, New Zealand dollar, etc.

The ¥105 level is a large number that a lot of people will pay attention to, so if we can break down below there it is likely that we go much lower. At that point, the market is likely to go looking towards the ¥104 level initially, perhaps even down to the ¥102 level. Looking at this chart, if the market rallies, then I will proceed to sell every time it shows signs of exhaustion on shorter-term charts. I think we will continue to see a lot of volatility, and therefore I am ignoring all buy signals in this pair, and therefore I am simply looking towards opportunities.

Keep in mind that this pair is highly sensitive to risk appetite, and if that falls down the drain, that could probably send this market lower as well. All things being equal, I do think that we will see an opportunity to short this market than the next couple of days, perhaps for a reach back down to the lows again, and beyond. It is not until we break above the 200 day EMA, painted in black on the chart, that I would be thinking about trading in the other direction.