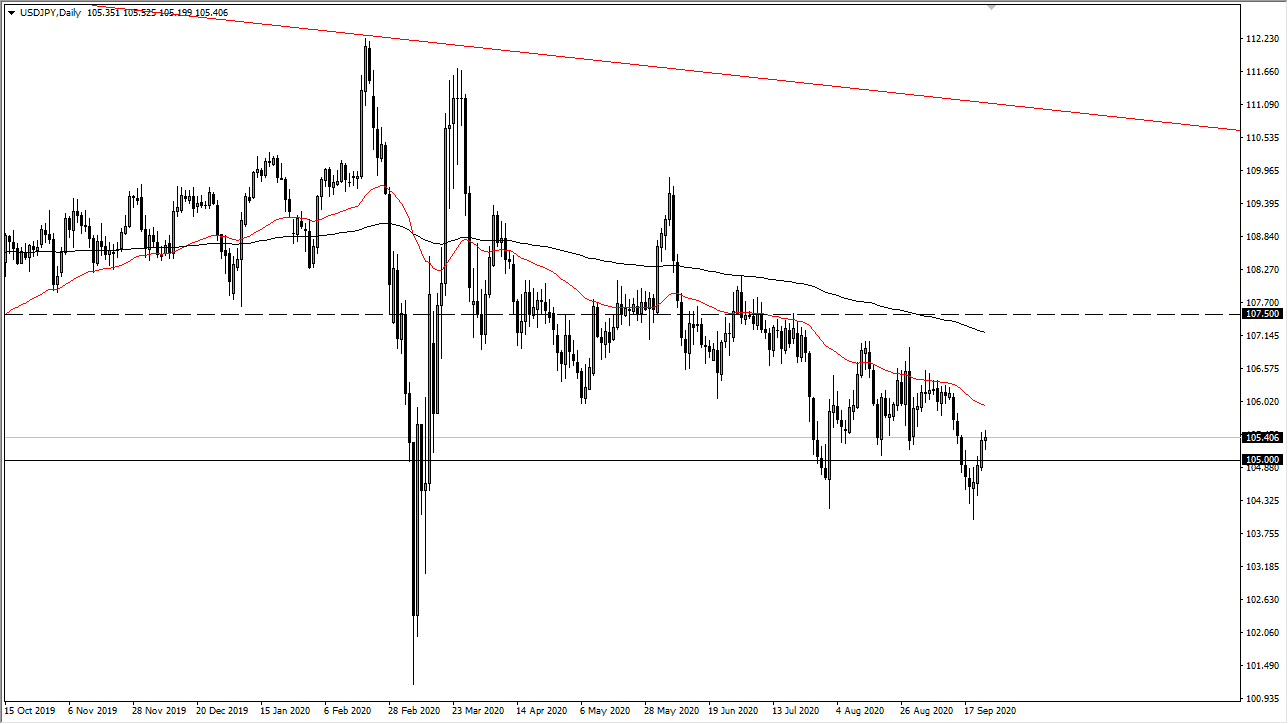

The US dollar has gotten a bit over bought so it does make sense that we are struggling to bit to continue to the upside. Nonetheless, I do believe that selling this pair is probably the best way to go, although I do like the US dollar in general. The 50 day EMA above is starting to slope lower, and it does in fact suggest that there is resistance there as we have seen over the last couple of months.

While the US dollar is probably going to strengthen going forward, it will react to bit differently over here as the Japanese yen is considered to be a major “safety currency.” Ultimately, if we turn around a break down below the ¥105 level it is likely that we will make yet another “lower low.” The market rallying from here will clearly run into a lot of trouble at the 50 day EMA but we should also point out that the ¥106 level is where we can see a lot of resistance there based upon structure as well. Even if we were to break above there, then I think there is a lot of resistance extending all the way towards the ¥107.50 level. We also have the 200 day EMA, so I guess essentially what I am telling you is I am “short only” when it comes to this pair.

The candlestick for the trading session on Thursday with someone neutral, so if we break down below the bottom of that I anticipate that we will see more selling. If we break above the top of it, then I will simply look for signs of exhaustion that I can jump on. At that point, you can then start to take advantage of what I believe is going to be Japanese yen strength longer term. In general, it is not until we break above the ¥107.50 level that I would be a massive buyer, because that would be such a huge turnaround. It is not likely that we are going to see that anytime soon, so I simply have to wait for an opportunity to pick up “cheap yen.”