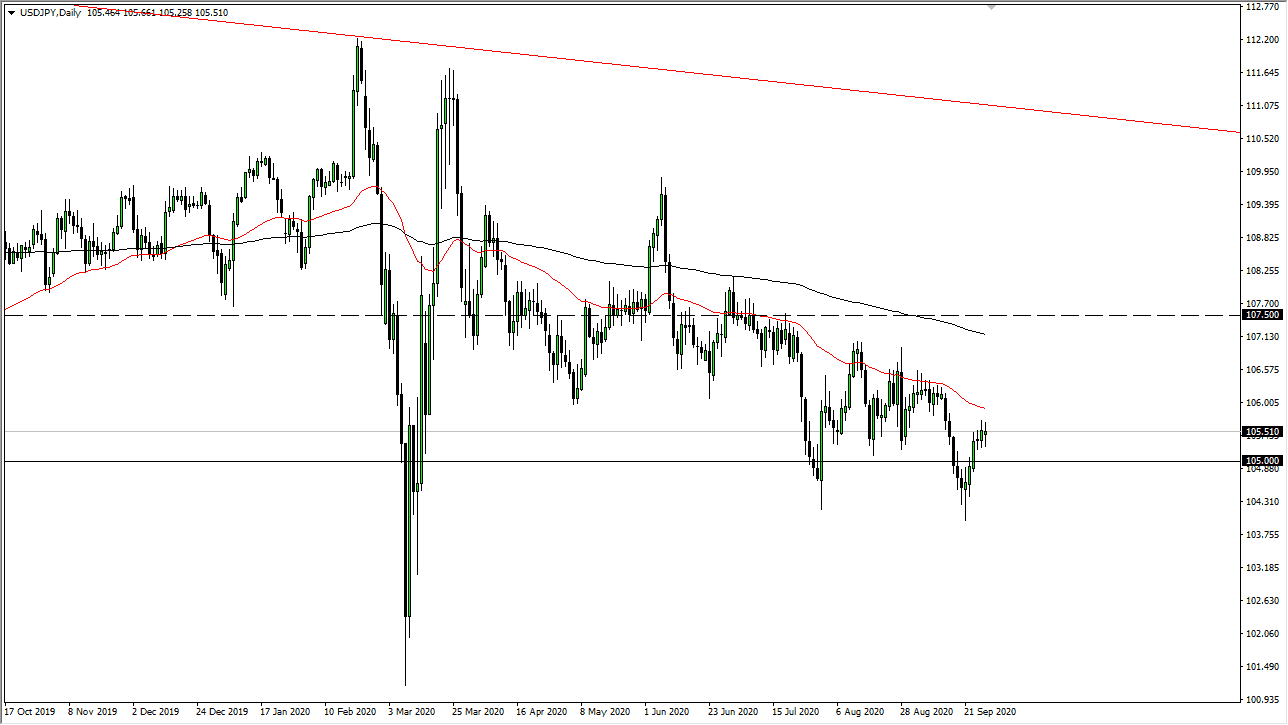

The US dollar has gone back and forth during the trading session on Monday as traders came back to work. The market has bounced quite nicely from the bottom, but we are in a downtrend, so it is difficult to get overly excited about buying this pair. I do think that we are eventually going to have selling pressure, therefore I like fading rallies on short-term charts. In fact, you had a nice opportunity to do it during the day on Monday, so if you are paying attention to short-term charts you certainly had an opportunity to get involved. Regardless, the market is likely to see a lot of noise and continue to fade US dollar strength, at least against the Japanese yen.

Keep in mind that this pair is highly sensitive to risk appetite, so if there is a lot of concern out there and quite frankly let us expect that there will be, it could make sense that this pair falls. The pair falling towards the ¥105 level makes quite a bit of sense, just as the pair falling below there it makes sense. I think there are a lot of things out there that could cause issues so it is very possible that we will see a sudden move lower. Furthermore, if you look at the chart you can see that the 50 day EMA has been rather resistive from a dynamic standpoint so I would not be surprised at all to see sellers in that area as well.

In fact, I do not have any interest in buying this pair, because if I am going to buy the US dollar I will do it against other currencies such as the Euro and the Pound, not a safety currency like the Japanese yen. The biggest problem of course is that this pair can “but the trend” when it comes the US dollar strength or weakness, based upon the fact that it is the Japanese yen we are talking about. Fading short-term rallies should continue to work, but I would not necessarily look for some type of major meltdown. If we make a “lower low”, I think it opens up the door down to the ¥102 region given enough time, possibly even down to the ¥101 level. Expect choppy volatility as we head into more and more headline risk.