Throughout last week’s trading, the USD/JPY was in a limited upward correction range despite the US currency’s strength against the rest of the other major currencies. Rebound gains reached the 106.55 resistance, starting from the 105.20 support, and the pair is stabilizing around 106.25 at the beginning of this week's trading, which confirmed the bears' control on performance. The pair continued trading inside a compact triangle formation with no clear directional momentum. The pair's performance has stabilized above the 100-hour and 200-hour SMA lines on the hourly time frame chart.

The Japanese yen interacted a lot with the recent and surprising announcement of the Japanese Prime Minister Abe’s resignation, and as a result, the Yen’s strength increased the political uncertainty as the markets watched cautiously. The question of who would be Abe’s successor and expectations strongly point to Suga Yoshihide, Abe’s right hand, who gets about seventy Percent of the vote within the Liberal Democratic Party.

Political and economic analysts are biased towards the possible alternative because of his high knowledge, familiarity, and experience with current policies that provide him with the skills necessary for this task, especially during the coronavirus era.

On the economic front, Japan's seasonally adjusted retail sales for July missed expectations (MoM) at 8% with sales at -3.3%. General retail sales missed expectations (YoY) at 2.4% with a -2.8% decline while major retail sales exceeded expectations by -10.5% with an improvement of -4.2%. On the other hand, primary industrial production for July declined to -16.1%, and expectations were for a decline of -15.7%. The unemployment rate for July beat expectations of 3%, up by 2.9% from 2.8% in the previous period.

From the United States, the most prominent details of the US Labour Department report, as the US economy and in the non-agricultural sector, added a total of 1.37 million jobs, while expectations were for 1.4 million jobs to be added. Average hourly wage growth for the month beat expectations of 4.5% at 4.7% (YoY) while the US unemployment rate was affected by 8.4% compared to the expected rate of 9.8%. The labor force participation rate for the month slightly exceeded the projected rate of 61.4% with a participation rate of 61.7%. Prior to that, the ISM US Services PMI for August came below expectations of 57, with a reading of 56.7, while the ISM manufacturing index beat expectations of 54.5 with a reading of 56.

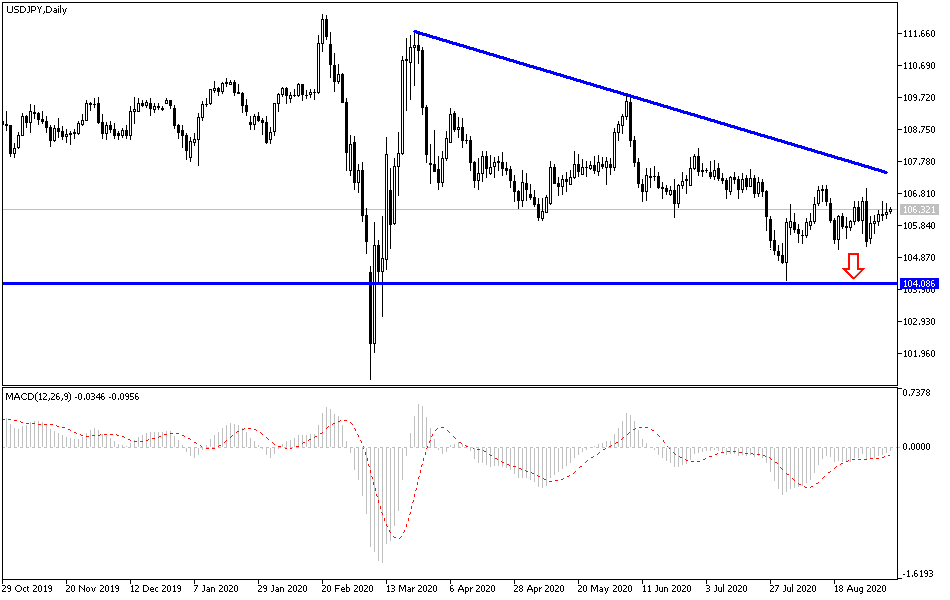

Technical Outlook For USD/JPY: In the near term, and according to the hourly timeframe performance, it appears that the currency pair is trading within a coherent triangle formation, and this indicates that there is no clear directional bias in market sentiment. Accordingly, bulls will target short-term gains around 106.54 resistance or higher at 107.06. On the one hand, the bears will be looking for profits at around the 105.62 support or below at 105.18.

In the long term, and based on the daily chart performance, it appears that the USD/JPY is trading within a downward channel. This indicates significant long-term downward pressure in market sentiment. Therefore, bears will look to maintain control of the pair by targeting profits around the 104.08 support or below at 101.96. On the one hand, the bulls will be looking to pounce around 107.81 resistance or higher at 109.67 resistance.

In light of an American holiday, the pair does not expect any important, influential data, whether from the United States or even Japan.