The USD/JPY pair is still suffering from the bears' control over performance despite the dollar's recovery against the rest of other major currencies. It appears that investors prefer the Japanese currency as a safe haven in light of the continuing global geopolitical tensions along with the devastating impact of the Coronavirus outbreak on the future of the global economy. The pair is stabilizing around the 106.06 support at the time of writing, in a boring range of performance since the beginning of this week’s trading and prior to the announcement of the first important US data for this week. The buying of the yen increased after the heavy selling of technology stocks in the US stock markets, along with concerns about Britain's exit from the European Union and AstraZeneca halting a trial of the Coronavirus vaccine, which contributed to the decline in risk sentiment.

AstraZeneca has halted the last phase of its COVID-19 vaccine trial due to a possible unexplained illness in a volunteer from the UK, according to reports citing an email statement issued by a company’s spokesperson. The potential vaccine is being developed by the pharmaceutical giant in partnership with the University of Oxford. It is being studied on thousands of patients in the United States and the United Kingdom. The company has reportedly said that it has stopped the vaccination voluntarily to allow a review of safety data by an independent panel.

The news dampened hopes for a speedy recovery from the pandemic and exacerbated risk aversion in financial markets.

According to the results of economic data today, the Japanese Cabinet Office said the total value of basic machinery orders in Japan rose by a seasonally adjusted 6.3 percent in July - to 751.3 billion yen. That exceeded expectations for an increase of 1.9% after a decrease of 7.6% in June. On an annual basis, orders of basic machinery decreased by 16.2 percent - also beating expectations for a decline of 18.3 percent after declining 22.5 percent in the previous month.

For the third quarter of 2020, core machinery orders are expected to decline 1.9 percent quarter-on-quarter and 15.5 percent year-on-year.

From the United States, senior Republican senators made pessimistic expectations on Wednesday about securing a bipartisan coronavirus relief package ahead of the November elections, indicating instead that they would only try to pass legislation that would avoid a federal shutdown. So Senate Majority Leader Mitch McConnell, a Republican from Kentucky, said he was "optimistic" that Republicans would provide strong support for a diluted $500 billion COVID-19 rescue package in the Republican Party in a test vote Thursday. But he refused to say whether his majority would participate in full. Democrats indicated that they would dismiss the Republican measure as insufficient, leaving lawmakers' negotiations in a dead end.

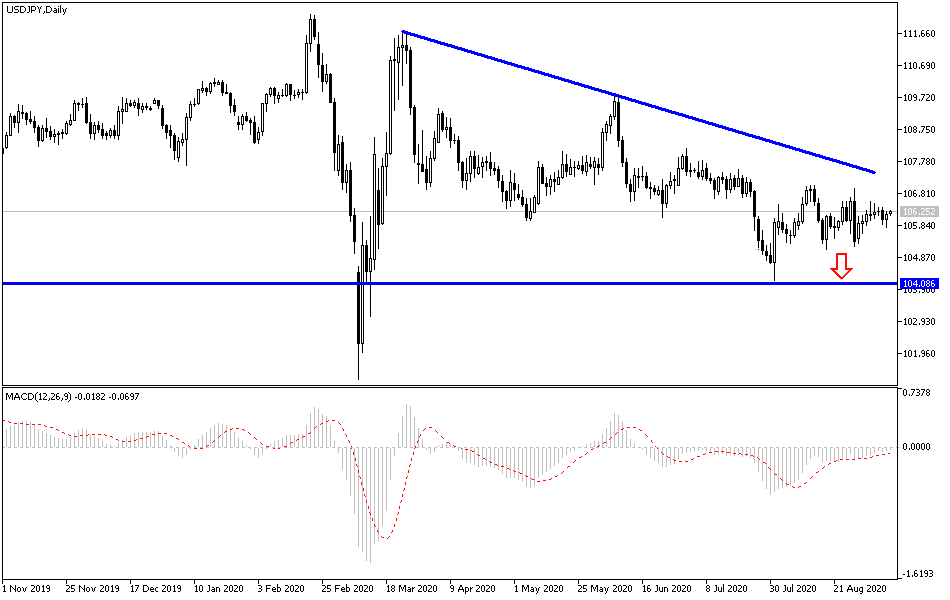

According to the technical analysis of the pair: On the daily chart, the USD/JPY pair is still under downward pressure, and stability below the 106.00 support increases the bearish momentum to test lower levels, and the closest levels are currently at 105.55, 104.90, and 104.00, respectively, and despite the recent performance, I would still prefer buying the pair on every downside. As I mentioned before, there will be no beginning of bulls controlling the performance without the pair crossing the resistance barrier at 108.00. Otherwise, the general trend will remain to the downside, as is the case now.

Regarding today's economic calendar data: Focus will be on the results of US economic releases, as the number of jobless claims will and the producer price index reading will be announced.