Continuous pressures on the US currency are still present, which explains the continued downward performance of the USD/JPY in the recent trading sessions. The pair is holding around the 105.70 support at the time of writing, after yesterday's losses around the support level of 105.28. Changing the monetary policy settings of the Federal Reserve was a good reason for the dollar's collapse. The new policy framework aims to help keep real returns well low in the economic recovery by easing expectations of raising interest rates until the labor market shrinks significantly, and by encouraging higher inflation expectations by showing greater willingness to accept going beyond target in the future. Analysts argue that the more the Fed succeeds in raising inflation without tightening policy, the worse the outcome will be for the US dollar, as recent history since the global financial crisis shows that raising inflation will be more difficult in reality.

Strong economic data and a strong recovery should cause more stable inflation pressures. With the Fed announcing its intention to keep interest rates low for an extended period and allow inflation to rise above the target for some time, the stronger data indicates that “real returns” will fall at least for a while, it is not clear that the dollar will benefit from the positive data this week. The DXY dollar index was on track for its biggest loss since its collapse in May as the US earnings outlook worsened after the Fed's change of strategy.

The sell-off in the US dollar increased dramatically after the Fed said at the end of last week that it would intentionally boost inflation above target and that interest rates would remain at record low as price pressures rose. The policy points to further declines in "real" bond yields, which represent the inflation-adjusted returns that investors receive. The above-target inflation was likely to raise interest rates, but now the Fed says it will use its monetary policy to boost the inflation target above target in order to improve past and current periods in which it has fallen below the 2% price growth target.

As for the course of the war between the United States and China, on Friday, China imposed restrictions on the export of AI technology, apparently including the kind that TikTok uses to select which videos to store for its users. This means that TikTok's Chinese owner, ByteDance, will need to obtain a license to export any restricted technologies to a foreign company. Prior to that, the Trump administration threatened to block TikTok by mid-September and ordered ByteDance to sell its US business, citing national security risks caused by that Chinese ownership. The government fears that user data will be transferred to the Chinese authorities. TikTok denies it poses a national security risk and has sued to stop the administration from threatening a ban.

Potential buyers of US TikTok assets include Microsoft, Walmart, and, reportedly, Oracle. Oracle declined to comment.

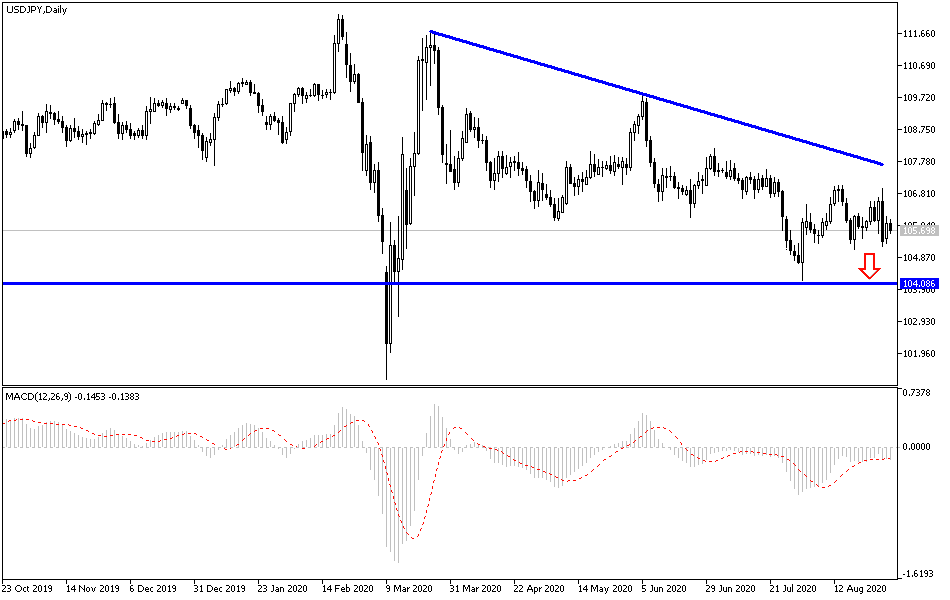

According to the technical analysis of the pair: I do not see any change in my technical view towards the performance of the USD/JPY pair, as the stronger bears’ domination and stability below the 106.00 level increases the chances of moving towards lower levels, and currently, the closer ones are 105.45, 104.80, and 104.00 in a row, I see the last two levels as good buying areas at the moment. There will be no real shift of the current downtrend without breaching the 108.00 resistance. After the release of Japanese morning data, including the unemployment rate and the manufacturing PMI, the pair will interact with the announcement of the US ISM manufacturing PMI reading as well as the announcement of the rate of construction spending.