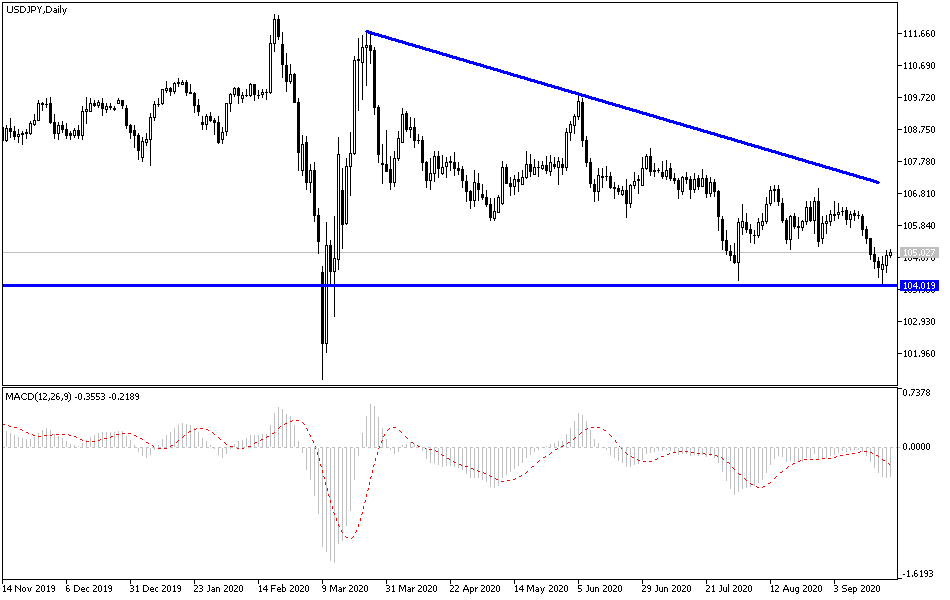

For the third day in a row, the price USD/JPY is trying to correct upwards, but gains of the bounce did not exceed the 105.07 resistance. Its recent losses pushed the pair to the 104.00 support at the beginning of this week's trading, the pair’s lowest level since last March. The bears’ control over performance despite the strength of the US currency against the rest of the other major currencies, is because the Japanese yen is still the preferred safe haven for investors more than the dollar in times of uncertainty, as is the case recently in global financial markets. The strength of the second Coronavirus wave will give the Japanese yen more momentum. The dollar got new support from the cautious optimism on the part of US Federal Reserve Governor Jerome Powell, who confirmed that the US economy is recovering from the recession caused by the pandemic with federal support, but it is likely that more help from the government will be needed.

Some Republican lawmakers have complained that House Democrats have been blocking approval of more relief because of their insistence on achieving a larger package than Republican lawmakers would like to support. In this regard, Mnuchin said he was ready to resume negotiations and said that the US administration would be ready to support stand-alone legislation to enhance support through the Pay-check Protection Program, which has greatly benefited small businesses.

“We are in a very different situation than we were last time,” Mnuchin added when Congress approved nearly $3 trillion in emergency financial aid. "At that time, the entire economy was shut down." Mnuchin also said that more federal aid should be focused on the hardest-hit sectors of the economy, such as restaurants and the travel industry.

"This time, you should be targeting the most affected industries," the US Treasury secretary told lawmakers.

US existing home sales rose 2.4% in August to their highest level since 2006 as the housing market recovers from a widespread shut down in the spring due to the coronavirus outbreak. In this regard, the National Association of Realtors said that sales rose to an annual rate of 6 million homes sold last month. Sales are up 10.5% from last year and are back to pre-COVID-19 levels in early 2020.

Although the pace of sales has slowed significantly after months of consecutive gains of more than 20%, it is the third consecutive monthly gain after large and consecutive declines in March, April, and May. The average price of the current single-family home was $315,000 in August, up 11.7% from August 2019. Last month was the first time that the median home price crossed $300,000.

Despite the high prices, the lack of available homes made buyers snatch them from the market at a faster rate every month, especially with interest rates stabilizing at their historic lows of less than 3%. The NAR report indicated that real estate remained in the market for 22 days in August, down from 31 days in August last year. It said 69 percent of homes sold in August 2020 had been on the market for less than a month. The lack of available homes had been a problem for years, long before the outbreak of the virus that scared many homeowners to stay put. The number of properties offered for sale in August reached 1.49 million, down 18.6% over the same period last year.

Accordingly, many economists fear that a lack of inventory will continue to fuel high prices, forcing many potential first-time buyers to exit the market. First-time buyers accounted for about a third of the purchases in August, roughly the same as the total purchases for 2019, according to a report released by NAR that year. Historically, Realtor Group says, first-time buyers made up about 40% of primary home buyers in the market.

According to the technical analysis of the pair: Despite the recent USD/JPY rebound attempts, the general trend is still down, and the bulls will not succeed in changing the direction without moving towards the 108.00 resistance. The bear’s control on the trend is still the strongest, and despite the arrival of the technical indicators, it may return to the support levels at 104.55 and 103.90 at any time. From there, we prefer to buy, waiting for the moment to rebound higher. The performance of the pair will interact with the announcement of the PMI reading for services and manufacturing in the United States, and then the content of the second testimony of Federal Reserve Governor Jerome Powell.