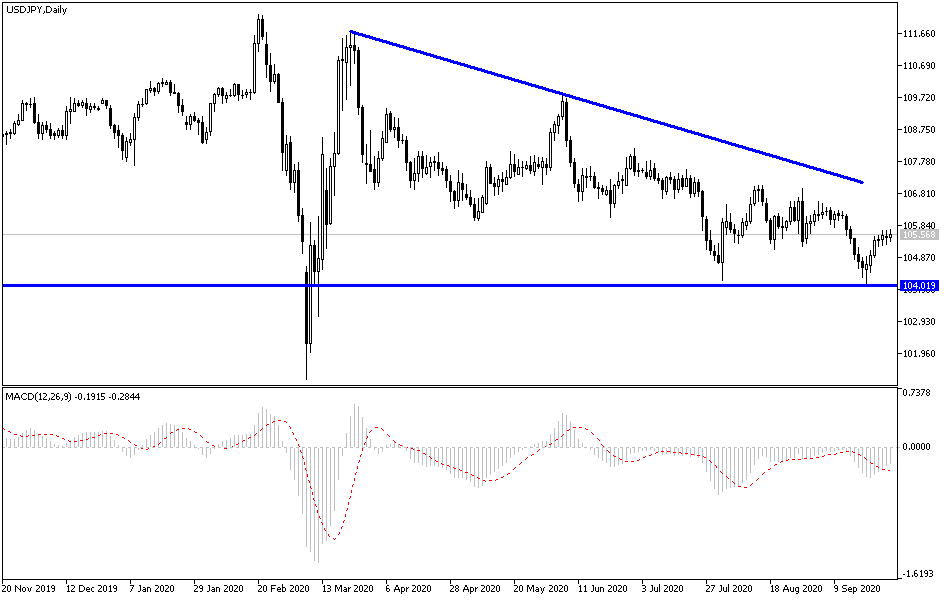

As can be seen on the USD/JPY daily chart, there are several attempts to breach the resistance level at 105.70 for three trading sessions in a row, but the pair lacks sufficient momentum to cause this to happen. The pair is waiting for risk appetite again in order to get stronger momentum. Commenting on the pair's recent boring performance, analyst Richard Berry of Hantec Markets says that the uptrend could continue if support holds in the 105.10/105.20 range. The recovery in the USD/JPY pushed the pause button as the market initially fell back. The bull's response to this may give insight into the psychology of the bulls early in this week's trading.

Over the course of the past week, weakness has been bought during the European session again and again while the US session consolidated. This leads the market to five consecutive positive closings. We had expected a bearish rebound over the three-month and the 55-day moving average (currently around 106.95), while the 106.00 level represents an old pivot level. The stability of support in the 105.10/105.20 region will help maintain the possibility of recovery.

However, if we start seeing early weakness confirmed at the end of yesterday's session that could indicate that the dollar's rebound is losing its way. Therefore, closing below 104.85 will confirm this. Initial resistance is now at Friday's high of 105.70. The rally through Friday's close helped a rally in Wall Street and continues to have a positive bias into the new trading week.

In general, the US Democrats are still trying to work on a financial support package that can be voted on this week. If so, this could indicate a sustainable shift in market sentiment with risk in mind. At the same time, the risks of the second COVID-19 wave increased at a time when the US Congress has failed to provide a financial support package in the United States. With the presidential election just five weeks away, political risk is an important factor as well, as Trump is already threatening to take the result to the Supreme Court if he loses.

Downside risks can be reduced if a financial package is agreed upon. The dollar will remain volatile until the improvement in sentiment appears, and this may depend on the progress of the financial support in Congress.

According to the technical analysis of the pair: There is no change to my technical view of the USD/JPY performance, as the bullish correction still needs more strong impetuses, and the bearish outlook will be broken if the bulls succeed in breaking the 108.00 resistance as a first stage before moving to the most important psychological resistance at 110.00, and up to the moment, this performance is still far-fetched, as the markets are still dominated by fears of the strength of the new Corona pandemic outbreak at a time when the global economy is trying to recover from the effects of the first wave. The dollar will continue to be troubled by the results of opinion polls on voters’ tendencies to choose the president of the United States. In general, the pair approaching the support levels at 105.15, 104.80, and 104.00 will re-strengthen the bears' control over the performance. The last level is ideal for buying pending the expected bounce.

The pair is awaiting the US Consumer Confidence announcement and the reaction to the comments of several monetary policy officials of the US Central Bank.