Ahead of anticipated and important statements by US Federal Reserve Governor Jerome Powell and the US Treasury Secretary, and for four trading sessions in a row, the price of the USD/JPY continues to correct upwards. Gains did not exceed the 105.50 resistance before stabilizing around 105.25 at the time of writing. Markets are still interacting with the statements of monetary and fiscal policy officials of the United States of America, waiting for the announcement of more stimulus plans for the US economy, especially with the approaching of the second wave of the Corona epidemic with the winter season. Before that, the United States of America is still leading global figures of infections and deaths from the COVID-19 epidemic. This winter will be more exciting as the market is waiting to know who will win the US presidential elections, which will be held early next November. Coronavirus has put Trump's future on the line.

Yesterday, Federal Reserve Board Chairman Jerome Powell defended the US central bank’s efforts to support the economy during the recession caused by the epidemic from claims that its programs had corrupted aspects of its response. A subcommittee in the House of Representatives released an employee analysis that found that the program in which the bank bought corporate bonds to try to support companies struggling under the pandemic involved buying bonds from companies that have laid off more than a million workers since March.

The report from the Coronavirus Crisis Selection Subcommittee concluded that 383 companies whose bonds were bought by the Fed continued to pay dividends to shareholders, with 95 of those companies also laying off workers. The report also said that fossil fuel companies accounted for 10% of federal bond purchases even though they only employ 2% of workers in larger companies.

"Several large layoffs have occurred among companies whose bonds have been purchased by the Federal Reserve, indicating that the primary beneficiaries of the program are corporate managers and investors, not workers," the report added.

In his testimony on the second of the three days before Congress about government rescue assistance, Powell objected to the report's findings. Where he said that the bank has organized its purchases of corporate bonds and distributed them in relatively small sums and covered more than 800 companies, to ensure that it does not favour any specific companies. He pointed out that the corporate bond purchases were made in the secondary market and not directly from companies.

"We did not want to identify the companies that we would help," Powell added. He also said that the primary objective of this program is to provide support at a time of turmoil in the bond markets, noting that this and other Federal Reserve programs have succeeded in stabilizing the markets.

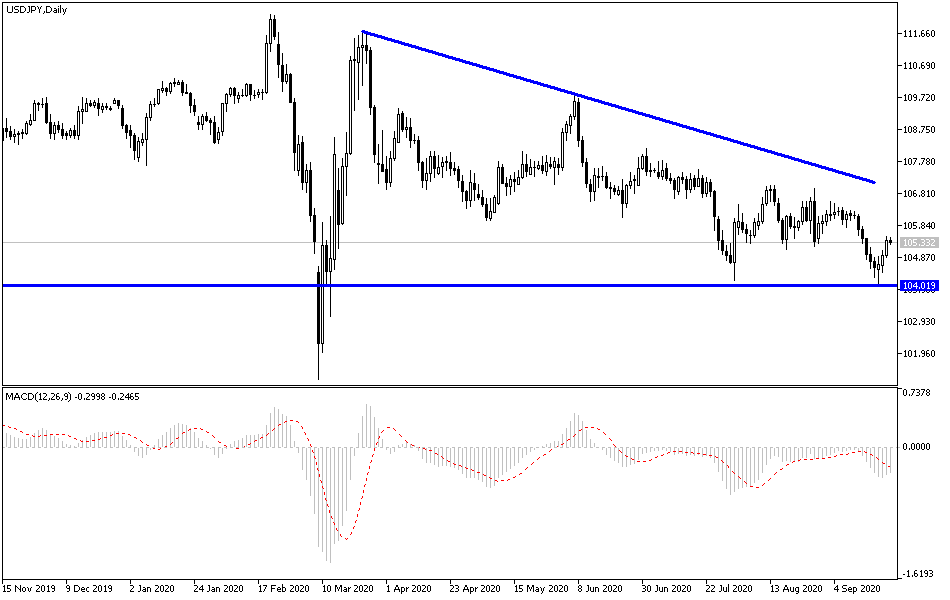

According to the technical analysis of the pair: Despite the USD/JPY recent attempts to rebound, the pair’s general trend is still bearish, and as I mentioned before, there will be no real break of the bearish outlook without the pair crossing the 108.00 resistance. On the other hand, approaching the 105.00 support and moving below it will spark selling again. Support levels at 104.90, 104.20 and 103.55 are still important targets for bears to dominate the performance for a longer period. In my opinion, the last two levels of the mentioned support are the most suitable for buying at the present time. Do not forget that the technical indicators have reached oversold areas.

As for the economic calendar data today: From Japan, there is the announcement of the consumer price index and the monetary policy report of the Bank of Japan. From the United States, there will be the jobless claims and new US home sales, followed by statements by US Federal Reserve Governor Jerome Powell and US Treasury Secretary.