The US currency gained after Jerome Powell's historic statements about updating the foundations and rules of the bank in the performance of the US monetary policy in line with the developments on the ground imposed by the Corona virus on the US and global economies.

In the era of COVID-19, the Congressional Budget Office said that the federal budget deficit is expected to reach $3.3 trillion, as massive government expenditures to combat the Coronavirus and support the economy have added more than $2 trillion to the federal spending book. The sudden rise in the deficit means that federal debt will exceed annual GDP next year - a milestone that will put the United States in the place it was in the aftermath of World War II, when the accumulated debt exceeded the size of the US economy.

The $3.3 trillion figure released yesterday is more than three times the 2019 deficit and more than twice the levels seen after the market crash and the Great Recession of 2008-2009. Therefore, government spending, fuelled by four measures to confront the Coronavirus, is expected to record $6.6 trillion, an increase of $2 trillion over 2019.

The recession has caused tax revenues to drop, but the changes have not been as dramatic as seen from the spending side, with individual income tax collection being delayed by 11% last year. Corporate tax collection was down 34%.

The US economy stalled in the spring due to people being forced to stay at home in a failed national attempt to defeat the epidemic. The shutdown prompted lawmakers and US President Donald Trump to pour money into business support, greater unemployment benefits, $1,200 direct payments and other stimulus steps that helped the economy survive on the short term. In general, most economists are not alarmed by this massive borrowing when the economy is in danger, and debt was barely a concern when a $2 trillion coronavirus relief bill was passed almost unanimously in March.

By the end of the year, the total national debt owned by the public will reach 98% of the GDP of the United States, which is the total output of goods and services. This compares to 79% of GDP at the end of 2019 and 35% in 2007. Amid pessimistic expectations that debt will exceed 100% of GDP in 2021 and set a new record of 107% in 2021.

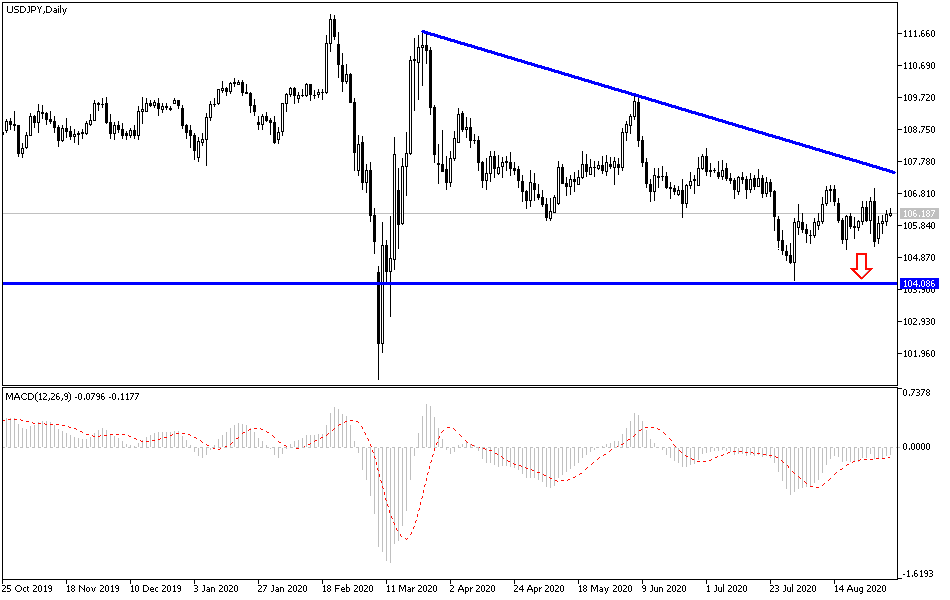

According to the technical analysis of the pair: On the daily chart, the USD/JPY still faces more difficulties to confirm the reversal of the general trend, which is still bearish so far, as the pair is still unable to overcome the 108.00 resistance, which may motivate it to move towards the 110.00 psychological resistance. In return, stability below the 106.00 support will continue to confirm the bears’ strength and control on performance. Today, the pair will interact with the jobless claims announcement, the trade balance and non-agricultural productivity, then the ISM services PMI reading.

In addition to the extent of investor’s risk appetite, amid monitoring global geopolitical tensions and the strength of the second wave of the COVID-19 outbreak.