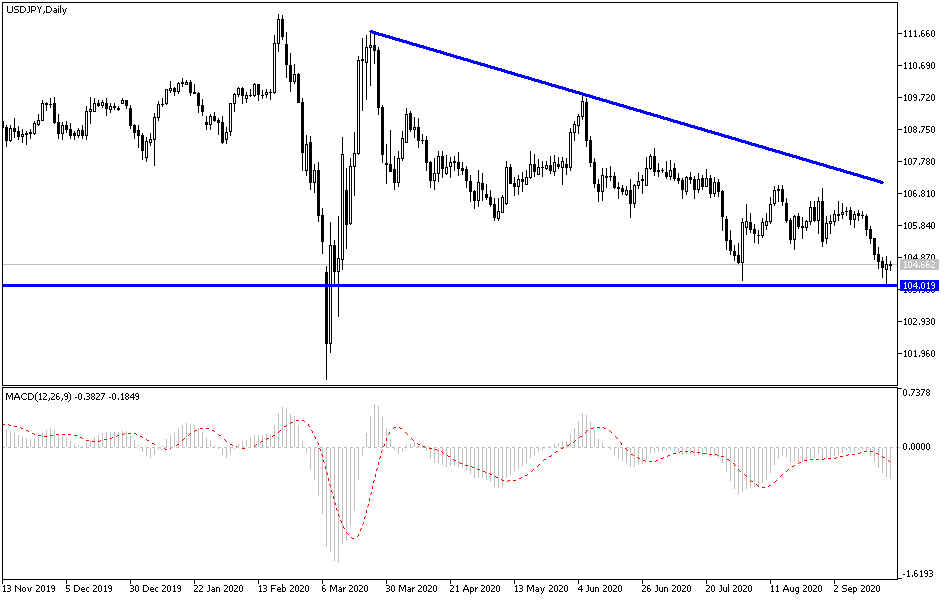

The USD/JPY pair plummeted to the 104.00 support at the beginning of this week’s trading, which is the pair's lowest level in six months. The Japanese currency is still reaping gains from the continued turnout by investors and amid rapid buying operations after the pair collapsed. As I mentioned before, the pair reached strong oversold levels and returned to correcting higher, reaching the 104.75 resistance before the most important event for this week, which is the testimony of the Federal Reserve Governor Jerome Powell. Powell and Treasury Secretary Stephen Mnuchin will speak before the House Financial Services Committee on the CARES Act on Tuesday. Speeches by Fed members Lyle Brainard, Charles Evans, Raphael Bostic, James Pollard, Mary Daly, and John Williams are also due to be delivered this week.

On the economic front, a report on the US existing home sales is due to be released on Tuesday, and home price data is due out on Wednesday. Later in the week, the new home sales data and durable goods orders data will be released.

Despite the strongest global economic recession since World War II, which was caused by the Coronavirus, American household wealth recovered in the last quarter to a record high, as the stock market quickly recovered from the downturn caused by the pandemic in March. Nevertheless, gains flowed mainly to the wealthiest households even as tens of millions of people face job losses and incomes shrink. In this regard, the Fed said yesterday that the net wealth of American households jumped by 7% in the April-June quarter to $119 trillion. That number dropped to $111.3 trillion in the first quarter, when the coronavirus hit the economy and caused stock prices to fall sharply.

Since then, the S&P 500 stock index has recovered to its highest level before losing some of its gains this month. It is up 2.8% for the year through Friday. The Nasdaq index of technology stocks has risen more than 20% this year. Family wealth reflects the value of Americans' homes, as well as bank accounts, stocks, bonds, and other assets minus mortgage debt, auto loans, credit card debt, and other loans.

Americans also increased their savings sharply in the last quarter, likely reflecting a squeeze in spending by wealthier consumers worried about the virus threat to the economy. It's also possible that the federal government's financial aid in the form of $1,200 checks and $600 in weekly unemployment benefits will allow some low-income families to save more. That government aid has since expired.

The amount of money in checking accounts jumped 33% to $1.8 trillion. Savings accounts rose 6.1% to $11.2 trillion. On his part, Fed Chairman Jerome Powell has repeatedly expressed concern about widespread inequality in the US economy and said last week that it is likely to impede growth.

According to the technical analysis of the pair: The recent collapse of the USD/JPY pair pushed the technical indicators to strong oversold areas, and forex currency traders are considering buying to gain from the expected rebound. The closest support levels best suited to do so are 104.35, 103.90, and 103.00 respectively. As I mentioned before, I confirm now that the bulls will control the performance. You expect the pair to surpass the resistance level at 108.00. Otherwise, the general trend will remain to the downside. Today the pair will interact a lot with the content of US Federal Reserve Governor Jerome Powell's testimony.