Ahead of this week’s important US Federal Reserve announcement of its monetary policy decisions and the statements of its Governor Jerome Powell, the USD/JPY was subject to selling operations that pushed it towards the 105.30 support, its lowest level in two weeks, and stabilized near it at the time of writing. The current meeting is the first for the US central bank since they conducted a major revision of the Federal Reserve’s framework in ways that would likely keep short-term interest rates near zero for years to come. This caused a sharp setback for the dollar against the rest of the other major currencies. As a result, analysts expect the US Federal Reserve to keep the benchmark interest rate unchanged after its two-day meeting ending on Wednesday. It has been pegged at nearly zero since March after the pandemic and measures taken to contain it, which have essentially shut down the largest economy in the world.

The statement issued by US monetary policymakers is expected to contain revisions reflecting the sweeping changes that Fed Chairman Jerome Powell announced late last month about how the central bank should operate. The Fed will also release its quarterly economic forecasts, which for the first time will include estimates of growth, unemployment, and the Fed's benchmark interest rate for 2023.

The Fed has also made a critical change to its 2% inflation target, which is formally set in 2012. The US central bank is now seeking inflation averaging 2% over a period of time, instead of a steady 2% target that ignores previous deficiencies. This change reflects the bank's growing concern that in recessions, inflation often falls below 2%, but it does not necessarily reach 2% when the economy grows and rarely tops it. Over time, this means that inflation on average falls more than the target. As businesses and consumers expect increasingly less inflation, they act in ways that entrench lower rates, making it difficult for the bank to reach its target.

US industrial production slowed to a modest 0.4% increase in August, which is much weaker than the strong rebound recorded in previous months when factories came back to life. The slight rise came on the heels of gains of 3.5% in July and 6.1% in June when the industrial sector began to recover due to the epidemic. In August, manufacturing rose 1% but mining, which includes oil and gas exploration, fell 2.5%, the Federal Reserve said yesterday. Production at public facilities in the country has decreased by 0.4%.

The result is the fourth consecutive monthly increase after COVID-19 caused production to decline in March and April. But even with gains made over the summer, industrial production is still 7.3% lower than it was in February before the economic activity was disrupted in light of the pandemic. Manufacturing was cut last month by a 3.7% drop in production at auto factories, although there have been widespread increases in industries that make other types of durable goods.

Production at airlines increased by 4.2% but remained well below the pre-pandemic level. Commenting on the findings, Paul Ashworth, chief US economist at Capital Economics, said this reflected persistent troubles at Boeing and the collapse of the global travel industry. Economists also said that the industrial sector should improve further, but that there are still a number of risks.

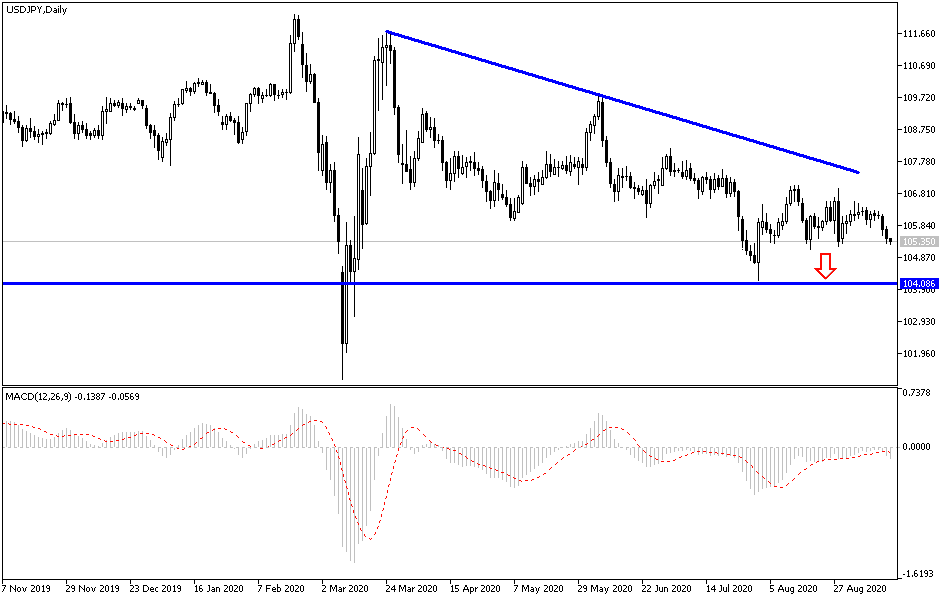

According to the technical analysis of the pair: By reviewing the recent technical analysis of the USD/JPY pair, it seems clear that expectations are correct, and that the downward pressure on the pair is still stronger despite attempts to stabilize with a slightly higher correction over the past two weeks. According to our view, a retreat below the 106.00 support will increase the selling operations to move the pair towards stronger support levels, the closest to which is currently 105.45, 104.80, and 103.90, respectively. Despite this pessimism, I still prefer to buy the pair from every lower level, especially from the last two levels I mentioned.

On the upside, the first opportunity to break the current trend will not materialize without surpassing the 108.00 resistance. The pair will be greatly affected by the US retail sales figures, the interest decision from the Federal Reserve and its policy statement, and then the statements of Bank Governor Jerome Powell.