The bulls failed to push the USD/JPY higher than the 106.55 resistance, and with the renewed global geopolitical tensions and the investors’ appetite for safe havens, the Japanese yen was more popular. Therefore, the pair moved towards the 105.78 support at the time of writing, and as we expected previously, a move below the 106.00 support will be important for bears to dominate and push the pair towards new buying levels, which we will define in the last lines of the analysis. In general, the US currency has been buying strongly since yesterday, as stock markets and commodity prices have resumed their decline last week in earnest after the return of North American investors from the May Day holiday that saw US President Donald Trump promote the possibility of a permanent "separation" from relations with China.

Investors have ignored the influx of headwind news related to China for months, with the US dollar index DXY declining by nearly 10% between mid-May and early September and the future of the US presidential election, that is highly and strongly expected to have an effect on the performance of the forex currency trading market in general. Commenting on the latest performance, Bipan Rai, head of foreign exchange strategist at CIBC Capital Markets, said: “Over the weekend, Trump threatened local companies wanting to do business with China, causing a massive beta selloff. Accordingly, the United States may target cotton grown in China, and thus the markets are exposed to major risks. Therefore, we expect a short hedge in the US dollar in the short term, to dissipate in the end.”

As for the situation in Japan after the resignation of Prime Minister Abe. Suga, the Japanese cabinet minister, gave his first speech, the first time he has done so since announcing his candidacy as leader of the LPD. The first candidate indicated that early elections may be imminent for Japan. Japanese elections are scheduled for next October, and Suga has pledged to continue Abenomics, followed by advanced reforms, so the top candidate may choose a call for elections to strengthen the situation.

With SUGA looking to follow the Abenomics approach, the JPY may continue to struggle to break through the last ranges from 105 to 107 in the near term. Notably, Abenomics' fundamentals have remained bearish on the Japanese Yen, and the effect has not been serious over the past few weeks. On the other hand, the dynamics of the US dollar may determine the outlook for the USD/JPY, the most important of which is the US presidential election in November.

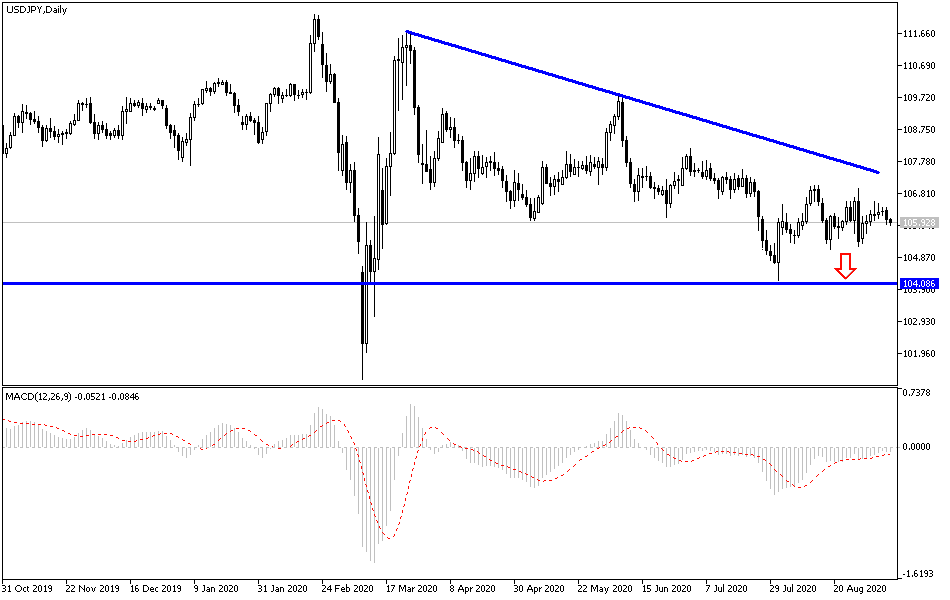

According to the technical analysis of the pair: The bears are still dominating the USD/JPY performance, especially by moving below the 106.00 support. On the upside, as we expected before, we confirm now that there will be no real opportunity to reverse the trend without crossing the 108.00 resistance. We expect calm movements for the pair today in light of the absence of any important and influential data from Japan or the United States in the economic calendar. The pair will be affected more by the extent of investors’ risk appetite, especially with the renewed global geopolitical tensions and the continuing human and economic losses from the COVID-19 epidemic.