As I expected earlier, the bears have the opportunity to push the USD/JPY to stronger support areas, which happened in the beginning of this week’s trading, as the pair retreated to the 105.54 support before settling around 105.70 at the beginning of Tuesday’s trading. The Japanese currency's gains increased as political and economic data moved the currency. The latest data recorded a massive improvement in July, confirming that the world's third largest economy may be ready to recover from the financial crisis caused by the Coronavirus. But will the next Prime Minister be optimistic about the economy? Or could snap elections affect local markets?

On Sunday, the Liberal Democratic Party of Japan chose Yoshihide Suga to succeed Shinzo Abe as the new Japanese prime minister. A political action that could be a big deal for the forex currency markets, as Nikkei Asian Review points out, as he tried to control the appreciation of the Yen while he was cabinet minister. Early reports indicate that he will be less violent on the fiscal front while supporting a weaker Yen.

According to the latest government statistics, Japanese Industrial Production increased 8.7% in July, compared to a reading of 1.9% in June. In general, auto production, manufacturing and industrial metals have led to a revival of industrial data. Also, energy utilization increased by 9.6% in July, up from a 6.2% increase in the previous month. It was the second consecutive monthly increase, but it is much lower than the 90+ reading until the COVID-19 pandemic. In return, the indexes were hit hard. The tertiary industry activity index declined -0.5% to 93.70 in July, while the Reuters Tankan Index posted a reading of -29 in September.

On Monday, the July 2020 ETFGI Industry Outlook and ETPs report showed that the ETF and ETP market saw net flows of $6.58 billion in July, bringing the total to date to $51.54 billion. That's nearly double the $26.44 billion amount of the same time last year. This week, the Bank of Japan (BoJ) will hold its monetary policy meeting, and it is widely expected that they will keep interest rates unchanged and keep pushing bond purchases to support the recovery. The Bank of England (BoE) and the US Federal Reserve will also meet this week.

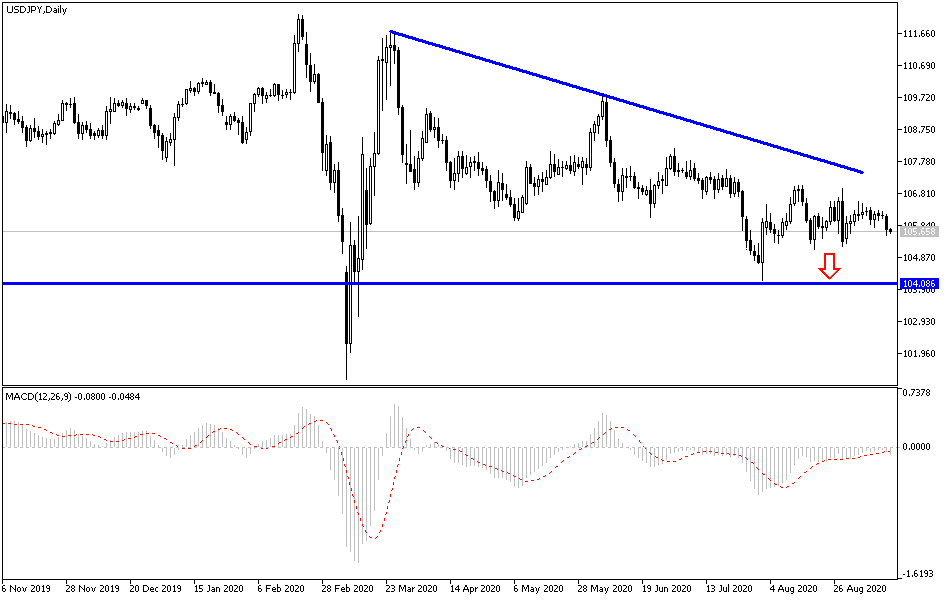

According to the technical analysis of the pair: The strength of the bears 'control over the USD/JPY performance has increased, and the bears may targets support levels, at 105.40, 104.80 and 104.00, which are the closest to the current downward trend. And as I expected in the past, there will be no opportunity for the pair to reverse the current bearish outlook without crossing the 108 resistance line. Despite this performance, I still prefer buying the pair from every lower level. Technical indicators are still confirming that the pair has reached strong oversold areas, but with increasing global geopolitical tensions and continuing losses from the COVID-19 epidemic, the Japanese yen will remain a preferred safe haven for investors. The yen will react to the release of Chinese economic data, and later, the US industrial production rate and the Empire State Industry Index.