There is no significant change in the USD/JPY for the fourth consecutive day. It is moving in a range between the 105.24 support and the 105.73 resistance and is stabilized around 105.60 at the beginning of Wednesday's trading, which contains a number of important economic releases affecting Forex traders’ sentiment. Shortly before the US presidential elections, which usually affect investor sentiment towards the US currency, many reports appear that may shake confidence in Trump. Recently, we noticed the emergence of reports of tax evasion for the president of the largest economy in the world.

Another report states that President Donald Trump will have to repay more than $300 million in loans over the next four years, which increases the likelihood that his lenders will face an unprecedented situation if he wins a second term and is unable to raise the funds. Financial experts say the idea of a Trump exit anytime soon is out of reach.

Even with a total debt burden across his entire business empire estimated at more than $1 billion, they note that he still has plenty of assets to leverage, ranging from a portfolio that includes office towers, apartments, golf courses, and $2.5 billion in brand deals. Trump's true financial picture has come under more scrutiny following a New York Times report this week declaring hundreds of millions in losses in recent years, allowing him to pay only $750 in taxes the year he won the presidency and none for the 10 - 15 years before that.

As for economic news, US consumer confidence increased more quickly in September than most economists had expected, although it was still far from the levels that were the norm before the outbreak. The US Consumer Confidence Index rose sharply to a reading of 101.8, up from 86.3 in August, largely due to a more positive view of current business and labor market conditions.

Commenting on the results, Lynn Franco, Senior Indicators Manager at Consumer Confidence said: “Consumers also expressed greater optimism about their short-term financial outlook, which may help prevent spending from slowing further in the coming months”. Consumer confidence is closely watched for signals about consumer spending, which accounts for 70% of economic activity in the US, as the country is heading into a crucial economic period, ahead of the holiday season.

In general, the big spike in September is a strong 16.1 points jump from the low of 85.7 recorded in April, as large strips of the country were closed. However, in the months leading up to April, that number had crossed 100 and the index reached 132.6 in February before the severity of the COVID-19 infection became clear. September's positivity reflects improved consumer optimism about current conditions, which jumped to 98.5 from 85.8. It also shows rising consumer expectations, which were boosted to 104.0 from 86.6 in August.

The percentage of respondents who saw jobs as elusive decreased to 20%, from 23.6%, while the percentage of those who saw jobs as plentiful increased slightly to 22.9%, up from 21.4%.

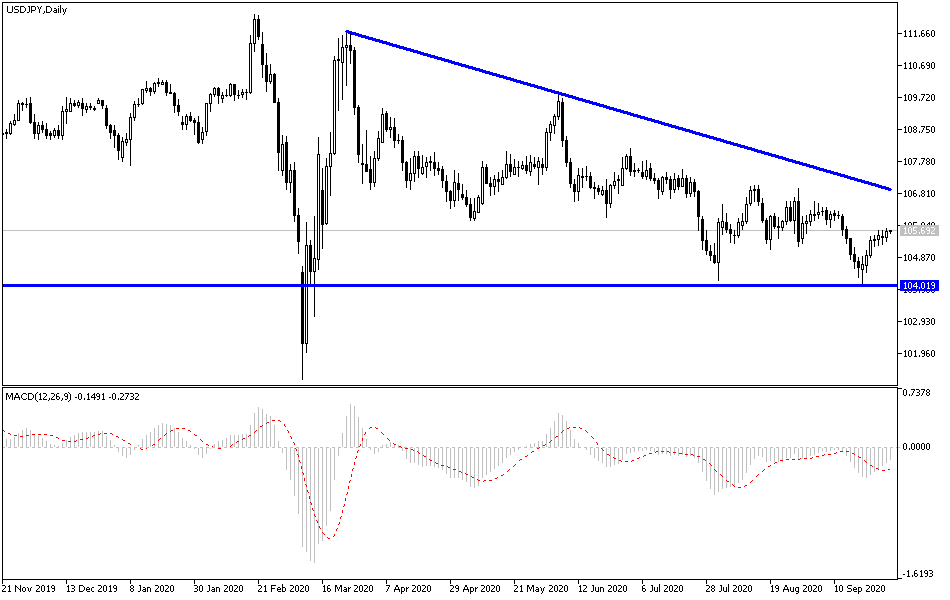

According to the technical analysis of the pair: According to the performance on the daily chart below, there is no change in my technical outlook for the USD/JPY. Recent performance and its continuation means a strong movement coming in one of the two directions and it will be closer to the downside if the pair stabilizes below the 105.00 support, and as I mentioned before, there will be no real chance of a correction to the upside without the pair surpassing the 108.00 resistance. The pair will interact a lot with whether investors’ risk appetite, along with the announcement of the ADP survey of the change in nonfarm payroll numbers, then the rate of GDP growth for the United States, the Chicago PMI reading, and the pending home sales.