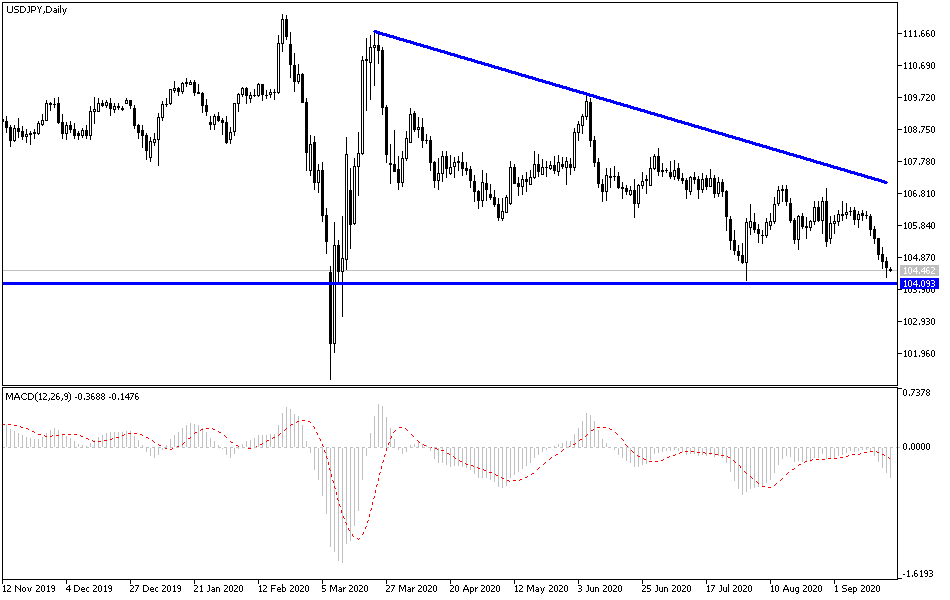

The sharp selling of the USD/JPY pushed the technical indicators to strong oversold areas, as the pair retreated to the 104.27 support, its lowest level in more than a month and a half. It then stabilized around 104.55 at the beginning of this important week’s trading, in which Jerome Powell comments will be the most-watched for by Forex currency traders. Investors' appetite for the Japanese yen as a safe haven increased more than that for the dollar, in light of a sharp wave of the Corona pandemic, which threatens to shut down the global economy again. This is in addition to the escalation of tensions between the United States of America and China. This situation is less than six weeks before the US presidential elections. “President Donald Trump has made gains in opinion polls and we expect this to support the US currency in the coming weeks,” said Valentin Marinov, head of foreign exchange strategy at Credit Agricole CIB.

First, the analyst predicted that the disputed election could closely affect risk sentiment, feed volatility in the forex currency market, and boost the dollar, similar to the year 2000. Second, Trump's victory could revive fears of new trade tariffs and thus weigh on currencies of the main trading partners of the United States.

The US dollar was affected a lot during last week’s trading, influenced by the Federal Reserve’s statement that interest rates will likely remain near zero for another three years. Although the dollar recorded gains against some currencies, largely due to covering short positions after the recent weakness, it failed to hold at higher levels. The latest batch of economic data also played a role in its decline.

Last Wednesday, the US central bank kept interest rates unchanged, suggesting that the low-interest rates will continue into 2023, and maintained the asset purchase program. In his post-meeting press conference, Fed Chairman Jerome Powell warned that the pace of the economic recovery is expected to slow and urged fiscal stimulus from Congress to maintain the recovery.

On the economic side, data released by the US Labour Department showed that initial jobless claims fell to 860,000 in the week ending September 12, a drop of 33,000 from the previous week’s revised level of 893,000. Economists had expected unemployment claims to drop to 850,000 from the 884,000 that were reported the previous week. On the other hand, according to a report issued by the Ministry of Commerce, housing starts fell by 5.1% to an annual rate of 1.416 million in August after rising by 17.9% to a revised rate of 1.492 million in July. Economists had expected home construction to decline 1.2% to 1.478 million from the 1.496 million originally reported in the previous month.

The department also reported that US building permits also fell 0.9% to an annual rate of 1.470 million in August after rising 17.9% to a revised rate of 1.483 million in July. Building permits, an indicator of future housing demand, were expected to increase by 1.7% in August. A separate report from the Federal Reserve Bank of Philadelphia showed a modest slowdown in the pace of growth in regional manufacturing activity.

According to the technical analysis of the pair: According to USD/JPY performance on the daily chart, the general trend is still downward, and the recent selling operations have pushed the technical indicators into strong oversold areas, and from here, forex traders will consider making purchases to gain from the bounce. As I mentioned earlier, support levels at 104.40, 103.90, and 103.00 will remain the best suited to do so. To the upside, there will be no opportunity for a trend reversal without moving above the 108.00 resistance, and this will not happen without improved investors' risk appetite and the return of confidence in the US currency. Today the dollar will be influenced by Fed Governor Jerome Powell's comments.