While new Covid-19 cases continue to close the gap between Mexico and South Africa, currently the eight and seventh-most infected countries with the virus, ten out of thirty-two Mexican states are classified as yellow states under the government’s traffic-light Covid-19 designation system. Yellow resembles the least restricted measures and is one step from green, translating in no restrictions. The remaining 22 states remain orange, where crippling economic limitations are in place. US Dollar weakness continues to fuel the breakdown sequence in the USD/MXN, favored expanding.

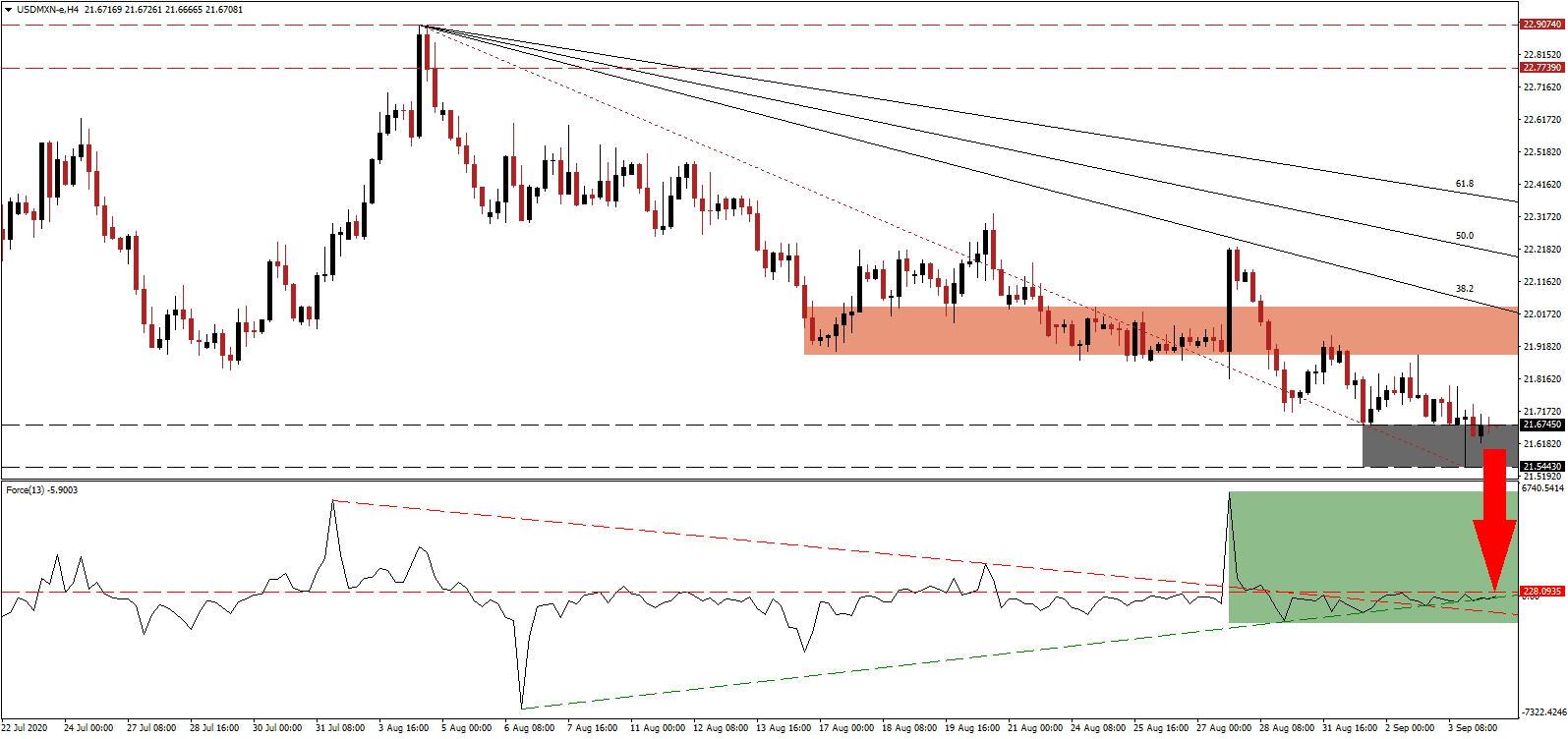

The Force Index, a next-generation technical indicator, entered a sideways trend below its horizontal resistance level, confirming dominant bearish momentum. While it was able to slide above its ascending support level, as marked by the green rectangle, a renewed collapse below its descending resistance level is expected. Once this technical indicator corrects deeper into negative territory, bears will regain full control over the USD/MXN.

Signs of economic recovery are evident in the agricultural and automotive sectors. Per data from the United States Department of Agriculture (USDA), the agricultural trade surplus with the US recorded a record high for the period ending June 2020. July automotive production exceeded the previous year’s level by 0.7%. It continues to fuel the bearish chart pattern in the USD/MXN, evident by the continued downward revisions to the short-term resistance zone, presently located between 21.8897 and 22.0398, as marked by the red rectangle.

Remittances in the first six months of 2020 are up by 10.6% compared to the same period in 2019, supporting millions of Mexicans. The government of President López Obrador announced more infrastructure investments, planning a new railroad connecting the Atlantic and Pacific coasts between Veracruz to Oaxaca. The descending Fibonacci Retracement Fan sequence is positioned to force a breakdown in the USD/MXN below its support zone located between 21.5443 and 21.6745, as identified by the grey rectangle. The next support zone awaits between 21.0833 and 21.3602.

USD/MXN Technical Trading Set-Up - Breakdown Scenario

- Short Entry @ 21.6700

- Take Profit @ 21.0850

- Stop Loss @ 21.8200

- Downside Potential: 5,850 pips

- Upside Risk: 1,500 pips

- Risk/Reward Ratio: 3.90

An extended advance in the Force Index, driven higher by its ascending support level, may initiate a brief price spike. Today’s US NFP report will provide a short-term catalyst, following conflicting data on the state of the labor market. The upside potential is reduced to its 38.2 Fibonacci Retracement Fan Resistance Level. Forex traders should take advantage of any advance with new short positions.

USD/MXN Technical Trading Set-Up - Reduced Breakout Scenario

- Long Entry @ 21.9000

- Take Profit @ 22.0200

- Stop Loss @ 21.8200

- Upside Potential: 1,200 pips

- Downside Risk: 800 pips

- Risk/Reward Ratio: 1.50