Despite Mexico approaching 600,000 Covid-19 infections and having the fourth-highest death toll, President López Obrador claims his country weathered the pandemic better than most countries. He resisted pressures to spike debt and offer bailouts to struggling businesses, a move favored by the US and duplicated by developed economies. It adds support to the Mexican Peso, keeping the well-established bearish chart pattern in the USD/MXN intact. Price action faces renewed breakdown pressures, magnified by a weak US Dollar, enhanced by US monetary policy.

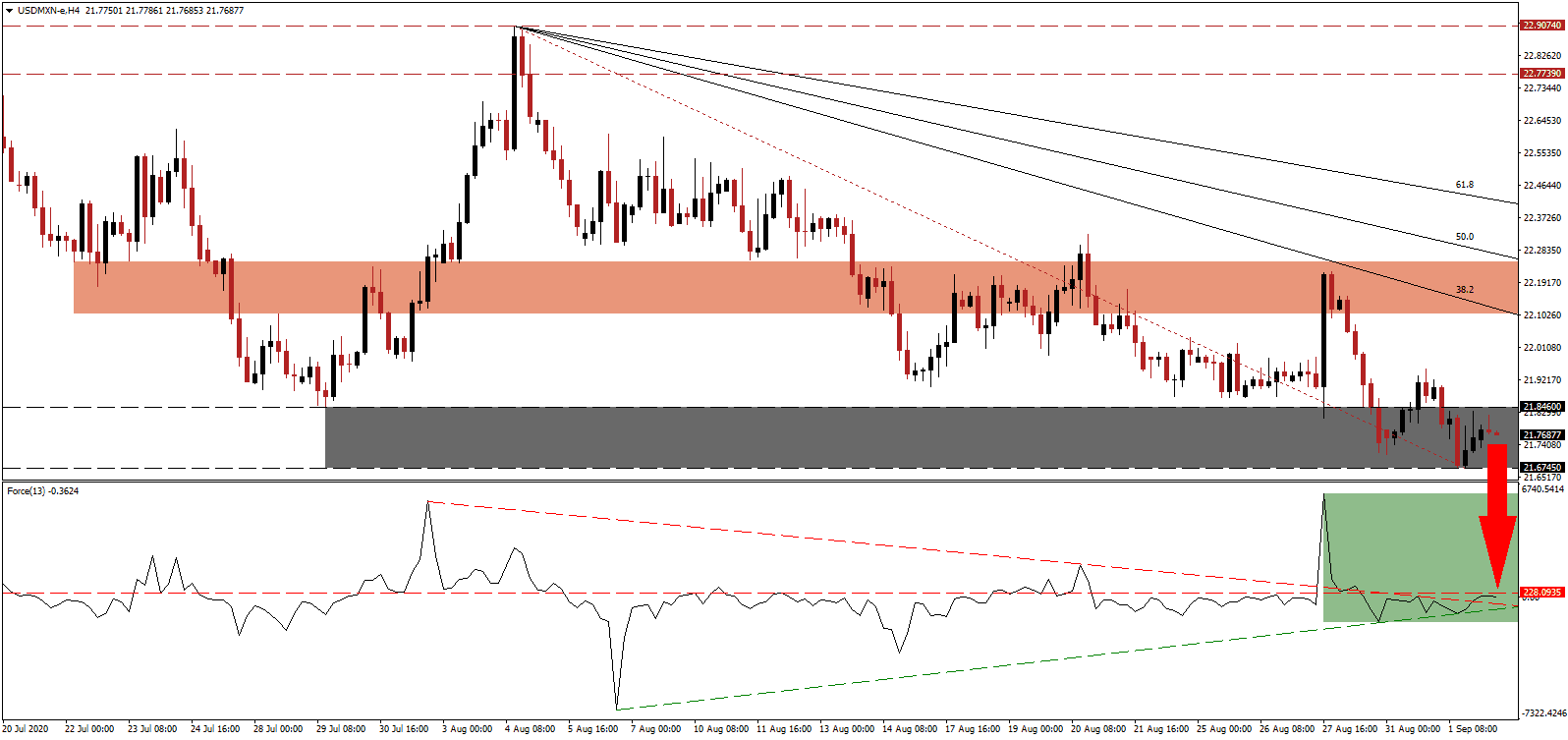

The Force Index, a next-generation technical indicator, remains below its horizontal resistance level, as marked by the green rectangle. While it was able to eclipse its descending resistance level, aided by its ascending support level, bullish momentum is weak and vulnerable to a swift reversal. Bears wait for this technical indicator to slide deeper into negative territory and retrace its most recent advance, to regain control over the USD/MXN.

Hundreds of protesters gathered outside the National Palace, angered over the lack of support for the millions of workers who lost their jobs in the informal economy. President López Obrador focused on the positive trend in the formal sector, where companies started to add positions after steep losses. After the descending 38.2 Fibonacci Retracement Fan Resistance Level rejected a brief price spike inside of its short-term resistance zone located between 22.1039 and 22.2497, as marked by the red rectangle, bearish pressures expanded.

A silver lining during the record second-quarter GDP collapse of 18.7% is remittances, which increased amid the pandemic. They helped to keep many families afloat and expected to remain a lifeline as the Mexican economy may embark on a slow and uneven recovery, mirroring the forecast for the global one. The USD/MXN is challenging its downward revised support zone located between 21.6745 and 21.8460, as identified by the grey rectangle. Price action will face its next support zone between 21.0833 and 21.3602.

USD/MXN Technical Trading Set-Up - Breakdown Scenario

Short Entry @ 21.7700

Take Profit @ 21.0850

Stop Loss @ 21.9350

Downside Potential: 6,850 pips

Upside Risk: 1,650 pips

Risk/Reward Ratio: 4.15

Should the ascending support level guide the Force Index farther to the upside, the USD/MXN may attempt a breakout. The upside potential is confined to its 50.0 Fibonacci Retracement Fan Resistance Level, which will grant Forex Traders a secondary short-selling opportunity. With the US Federal Reserve poised to enforce a weak US Dollar policy, and labor sub-components of economic reports suggesting more job losses, this currency pair is positioned to extend its breakdown sequence.

USD/MXN Technical Trading Set-Up - Confined Breakout Scenario

Long Entry @ 22.0350

Take Profit @ 22.1850

Stop Loss @ 21.9350

Upside Potential: 1,500 pips

Downside Risk: 1,000 pips

Risk/Reward Ratio: 1.50