The market is likely to continue to see a lot of noise, and perhaps a lot of “risk aversion.” If that is going to be the case, the Mexican peso is going to get hammered because nobody buys a Mexican peso unless they either have to, or they are speculating on Latin American growth. It is used as an oil proxy by some traders, but that is not going to help anything either with oil getting absolutely hammered during the trading session as well.

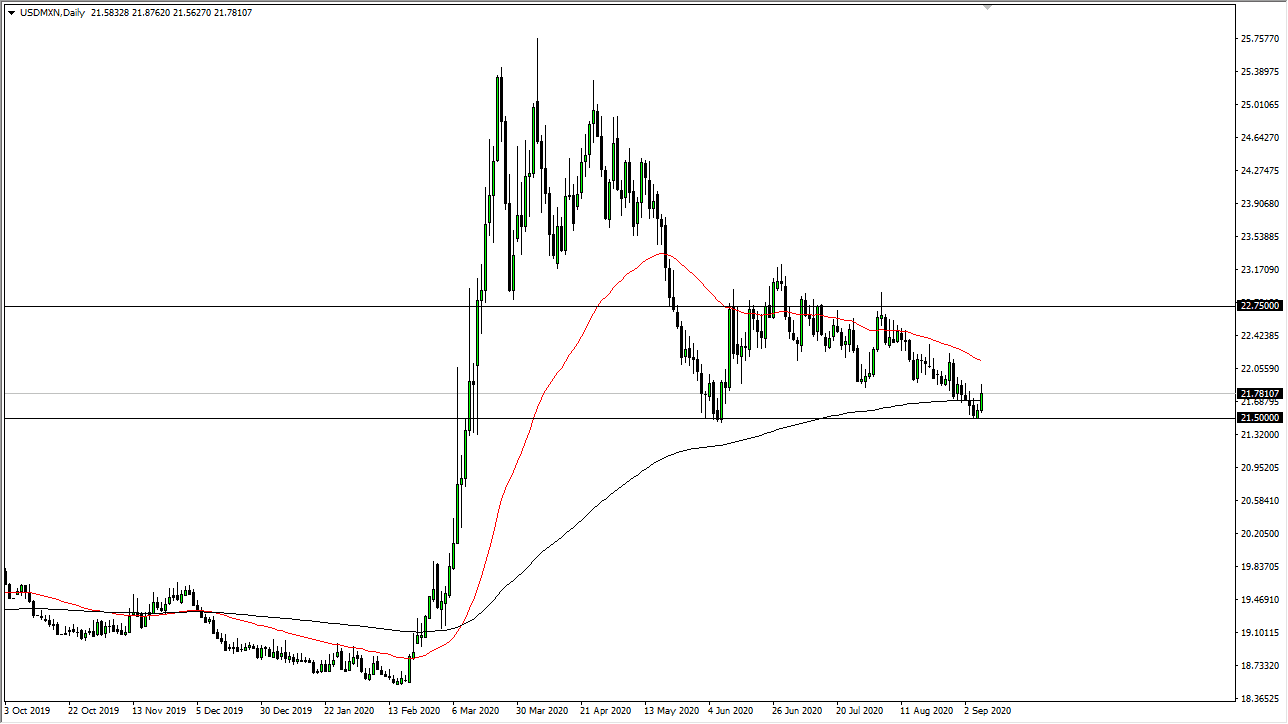

When you look at the structure of the chart, you can make a strong argument for the idea of the 200 day EMA coming in and affecting how the market traded, but you can also start to look at the 21.50 pesos level as a potential support level as well. If we do bounce from here it will technically be a “double bottom.” We have a long way to go before we can call it that, but clearly the last couple of days have favored the US dollar overall, and that is not going to be any different here. Because of this, I am looking to buy short-term pullbacks and perhaps aim for the red 50 day EMA, maybe even as high as 22.75 pesos. Keep in mind that this pair tends to trade during North American hours more than anything else, so if you put a position on, you might be kind of bored watching it during European hours and even more so during Asian hours. Because of this, you need to keep your position size somewhat light, as spreads will widen. This is not necessarily anything that is particularly unique about this pair, as it is that way with all exotic pairs.

The alternate scenario is that we turn right back around a break down below the 21.50 pesos level, which would open the floodgates to a much bigger move lower. The nice thing about this set up is that there is an obvious stop-loss area that if it gets violated, everything is wrong and it is time to reverse the position, something that is not always present in an FX trade.