Mexico breached the 700,000 level in confirmed Covid-19 infections with the death toll approaching 75,000. The Secretary of Foreign Affairs of Mexico, Marcelo Ebrard, confirmed that his government is finalizing plans to join the global COVAX plan of the World Health Organization (WHO). It aims to deliver two billion doses of a yet-unavailable Covid-19 vaccine by the end of 2021. He added that Phase 3 trials would commence shortly. José Luis Alomía, the Mexican Director-General of Epidemiology, noted that Mexico would buy as many doses as possible, secured by advanced payments. The USD/MXN reached its short-term resistance zone, from where a new breakdown sequence is pending.

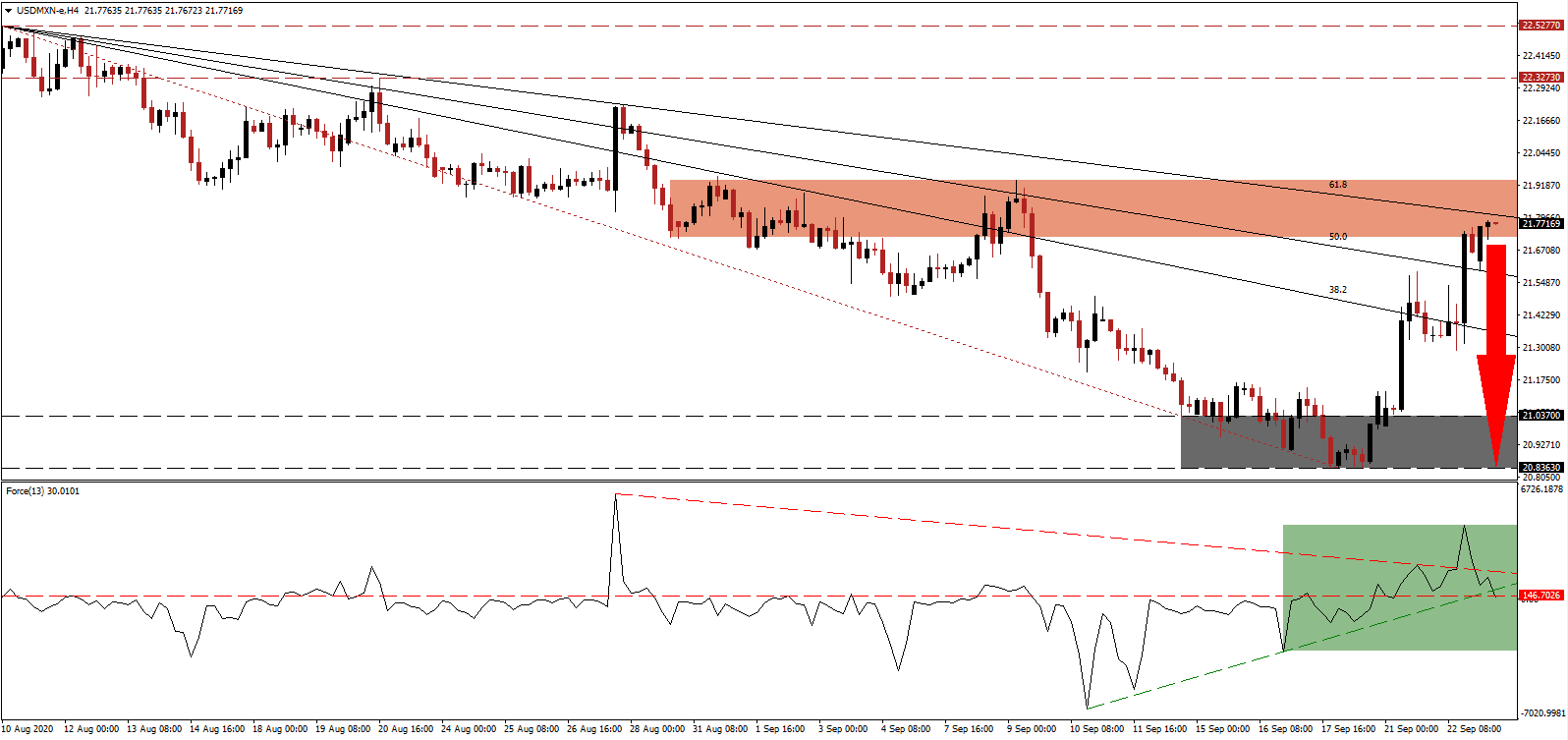

The Force Index, a next-generation technical indicator, initially spiked above its descending resistance level before reversing. It has now collapsed below its ascending support level, adding to bearish pressures. It sufficed to convert its horizontal support level into resistance, as marked by the green rectangle. This technical indicator is on course to move into negative territory, granting bears complete control over the USD/MXN.

Given the severity of the impact of Covid-19, with a rise in new confirmed infections globally, the Organization for Economic Cooperation and Development (OECD) lowered its GDP forecast for Mexico to a drop of 10.2% for 2020. The Secretary of Finance and Public Credit, Arturo Herrera Gutiérrez, presented the 2021 Economic Package to Congress, outlining a GDP contraction of 8.0% with a 2021 growth rate of 4.6%. The USD/MXN faces rejection by its descending 61.8 Fibonacci Retracement Fan Resistance Level after reaching its short-term resistance zone located between 21.7182 and 21.9387, as marked by the red rectangle.

Mexican President López Obrador asked regulators to use existing laws to strengthen state-oil firm Petróleos Mexicanos (Pemex) and utility Comisión Federal de Electricidad (CFE). He has a preference for the government controlling the energy market, and suggested energy reforms next year to achieve his goals. With bullish momentum fading, partially due to a weak US Dollar, the USD/MXN is well-positioned to accelerate into its support zone located between 20.8363 and 21.0370, as identified by the grey rectangle.

USD/MXN Technical Trading Set-Up - Breakdown Scenario

Short Entry @ 21.7700

Take Profit @ 20.8400

Stop Loss @ 21.9600

Downside Potential: 9,300 pips

Upside Risk: 1,900 pips

Risk/Reward Ratio: 4.90

Should the Force Index push through its descending resistance level, the USD/MXN could attempt to extend its advance. The upside potential remains limited to its downward revised resistance zone located between 22.3273 and 22.5277. With US Dollar weakness, a rise in initial jobless claims, and depressing debt levels, any advance will grant Forex traders a secondary selling opportunity to consider.

USD/MXN Technical Trading Set-Up - Limited Breakout Scenario

Long Entry @ 22.1600

Take Profit @ 22.4600

Stop Loss @ 21.9600

Upside Potential: 3,000 pips

Downside Risk: 2,000 pips

Risk/Reward Ratio: 1.50