Despite claims by Mexican President López Obrador that the country and economy weathered the depth of the Covid-19 induced recession better than many global counterparts, Mexico remains under significant short-term stress. It is evident in the role reversal between Latin America’s two largest economies, Brazil and Mexico. The former has overtaken the latter after Brazilian President Jair Bolsonaro unveiled a massive spending package. It follows the short-term approach of developed countries, at the cost of long-term sustainability, a trap President López Obrador has avoided to date. While the USD/MXN may temporarily spike above its support zone, the sell-off is favored to resume.

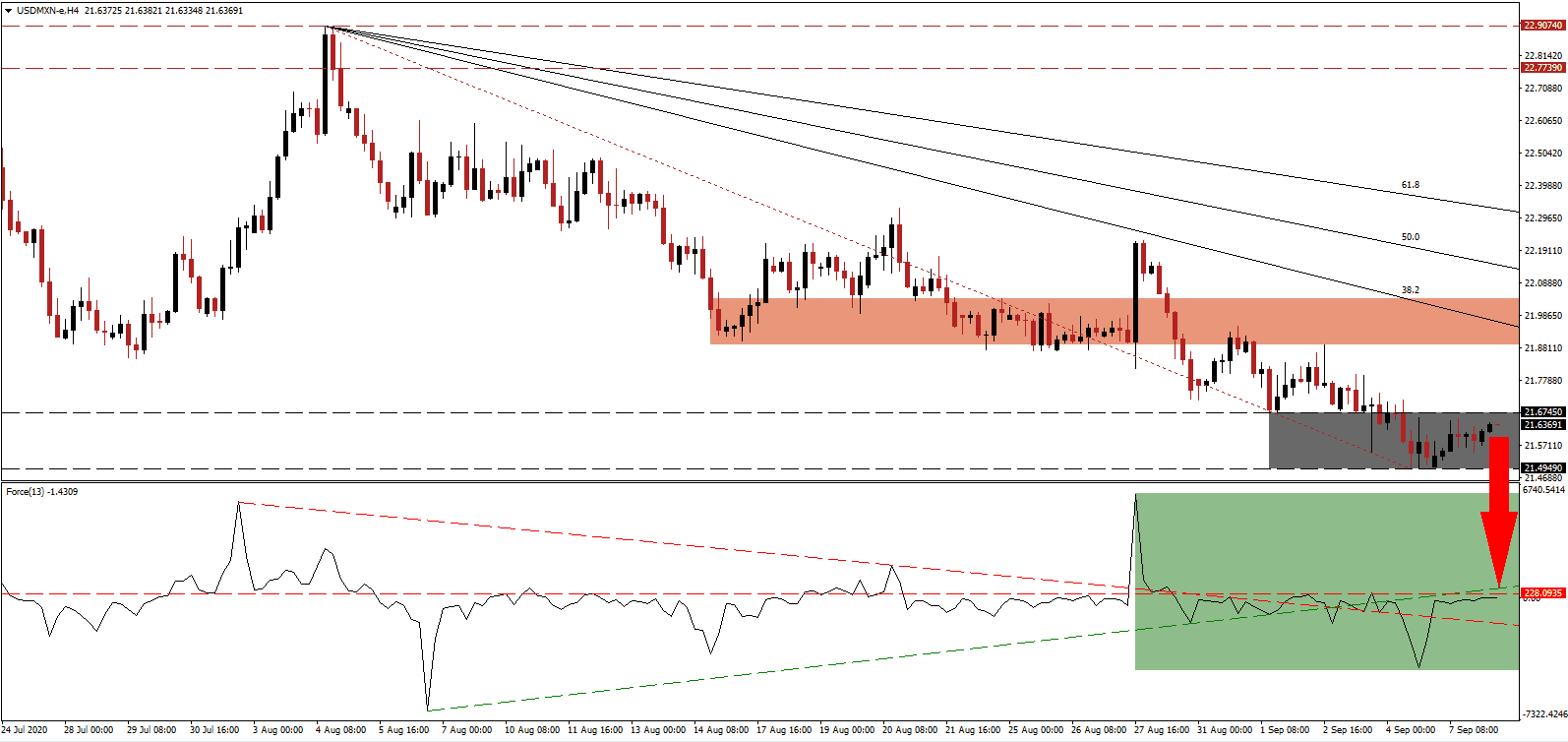

The Force Index, a next-generation technical indicator, recovered from its most recent low while remaining below its horizontal resistance level. It is also exposed to a short-term role reversal in the ascending support level and descending resistance level, as marked by the green rectangle. Bears have the upper hand on price action in the USD/MXN with this technical indicator in negative territory.

With many economies loading up on debt, President López Obrador reiterated his belief that the current approach his government has taken will lead to positive long-term results. He predicts Mexico will serve as an example to the world, and presently, despite being a leftist president, his policies are the most capitalistic among Covid-19 responses. While Brazil and Mexico reversed roles, so have Mexico and the US. The USD/MXN may embark on a healthy counter-trend advance into its short-term resistance zone located between 21.8897 and 22.0398, as marked by the red rectangle, before resuming its breakdown sequence.

Countering criticism of miscalculations, the government of President López Obrador does resort to a primary fundamental leftist crisis response, massive infrastructure projects. Mexico is in need to modernize, and the Covid-19 pandemic resulted in additions to railway projects. Over 2,000,000 job additions are expected, per a government assessment. In the meantime, many Mexican families survive via remittances, which have reached record highs. The USD/MXN, partially driven by ongoing US Dollar weakness, is forecast to collapse below its support zone located between 21.4949 and 21.6745, as identified by the grey rectangle. Price action will challenge its next support zone between 21.0833 and 21.3602. The descending Fibonacci Retracement Fan sequence enforces the bearish trend.

USD/MXN Technical Trading Set-Up - Breakdown Scenario

Short Entry @ 21.6350

Take Profit @ 21.0850

Stop Loss @ 21.8050

Downside Potential: 5,500 pips

Upside Risk: 1,700 pips

Risk/Reward Ratio: 3.24

Should the Force Index reclaim its ascending support level, serving as resistance, the USD/MXN may spike higher temporarily. The upside potential is limited to its 38.2 Fibonacci Retracement Fan Resistance Level. With US Dollar weakness positioned to intensify, and the risk of a double-dip recession heightened, Forex traders should consider any breakout as a secondary short-selling opportunity.

USD/MXN Technical Trading Set-Up - Limited Breakout Scenario

Long Entry @ 21.9550

Take Profit @ 22.1550

Stop Loss @ 21.8050

Upside Potential: 2,000 pips

Downside Risk: 1,500 pips

Risk/Reward Ratio: 1.33