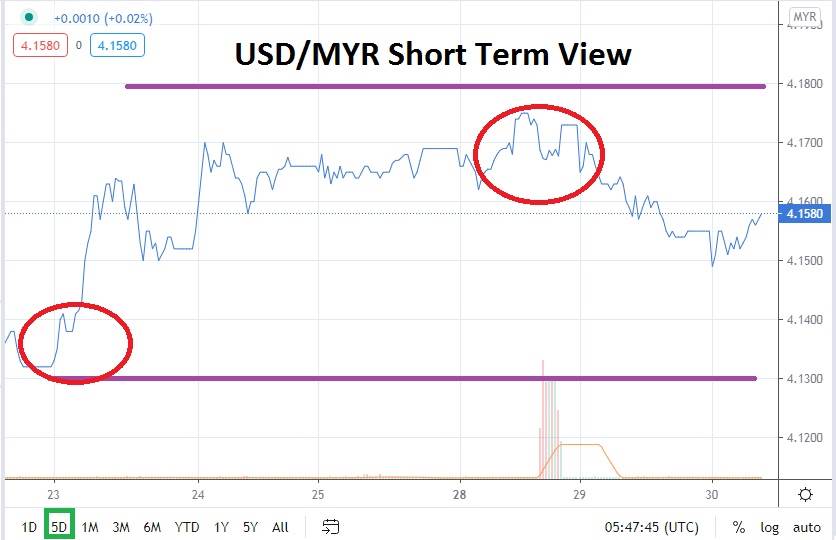

The USD/MYR is trading within the middle values of its five-day technical chart. The forex pair has experienced a bullish trend the past week and a half of trading since testing critical support levels near the 4.1050 ratio on the 21st of September. So while the bullish trend may look strong, it is all about perspective and the length of timeframes you are using within your technical approach.

This opens the door to short term speculators who may feel there is a potential to take advantage of the sudden decline in global risk appetite. They may look to buy the USD/MYR with the notion the forex pair has the capability to trade higher. A challenge of short term resistance only made two days ago is not farfetched. While the USD/MYR has shown an ability to create a short reversal lower it has not exactly proven that the selling of the US Dollar against the Malaysian Ringgit is going to be sustained near term.

This isn’t to say the mid-term bearish trend of the USD/MYR is over, it will likely continue. However, experienced traders know that having a difference of opinion regarding mid-term and short term outcomes is a normal and often profitable way to view forex trends. The USD/MYR has not shown a true capability to break through short term support since late last week.

Early this morning the USD/MYR tested the 4.1500 juncture below but then produced a solid reversal higher. The USD/MYR is a respected forex pair among speculators with a taste for exotics currencies that offers transparency. Volatility can certainly be displayed, but its characteristic trading is often more comfortable than many minor forex pairs. The reversal higher this morning may prove to be a short term catalyst and signal that a test of resistance near the 4.1640 mark is possible.

Buying the USD/MYR on pullbacks with limit order below the current market rates may be the best opportunity for speculators near term. Traders should keep their eyes on global equity indices and pay attention to existing sentiment in the markets. If risk-adverse behavior continues to be displayed the USD/MYR could traverse higher as cautious investors prove conservative and cause more bullish activity and a buying trend to be demonstrated.

Malaysian Ringgit Short Term Outlook:

Current Resistance: 4.1640

Current Support: 4.1500

High Target: 4.1755

Low Target: 4.1480